2K Sports 2009 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

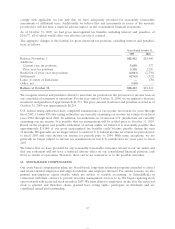

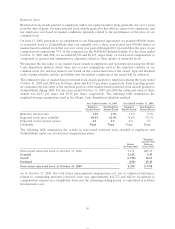

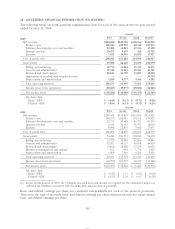

As of October 31, 2009, there was no aggregate intrinsic value related to options outstanding or exercisable

and the total future unrecognized compensation cost, net of estimated forfeitures, related to outstanding

unvested options was approximately $3,430, which will be recognized as compensation expense on a

straight-line basis over the remaining vesting periods, or capitalized as software development costs. At

October 31, 2009, the weighted average exercise price of stock options expected to vest was $15.53.

The fair value of our stock options is estimated using the Black-Scholes option-pricing model. This model

requires the input of assumptions regarding a number of complex and subjective variables that will usually

have a significant impact on the fair value estimate. These variables include, but are not limited to, the

volatility of our stock price, the current market price, the risk free rate and expected exercise term. The

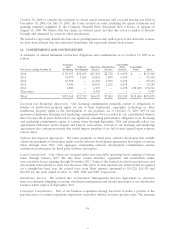

following table summarizes the weighted average assumptions used in the Black-Scholes option-pricing

model to value outstanding stock options awarded to ZelnickMedia in 2007 and employee stock options,

which were last granted in 2007:

Years Ended October 31,

2009 2008 2007

Risk-free interest rate 3.2% 3.9% 4.7%

Expected stock price volatility 67.4% 58.8% 50.7%

Expected term until exercise (years) 8.4 9.4 3.5

Dividends None None None

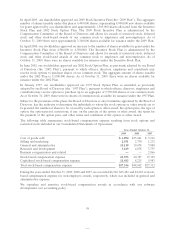

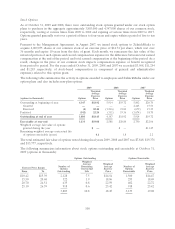

For the years ended October 31, 2009, 2008 and 2007, we estimated stock price volatility of all stock-based

compensation awards using a combination of historical volatility and implied volatility for publicly traded

options on our common stock. In addition, stock-based compensation expense is calculated based on the

number of awards that are ultimately expected to vest, and therefore has been reduced for estimated

forfeitures. Our estimate of expected forfeitures is based on our historical annual forfeiture rate of 5%.

The estimated forfeiture rate, which is evaluated at each balance sheet date throughout the life of the

award, provides a time-based adjustment of forfeited shares. The estimated forfeiture rate is reassessed at

each balance sheet date and may change based on new facts and circumstances.

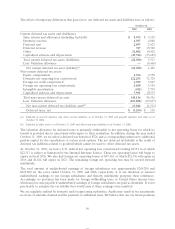

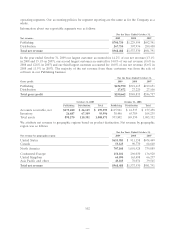

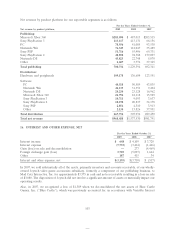

15. SEGMENT AND GEOGRAPHIC INFORMATION

We are a publisher and distributor of interactive software games designed for personal computers, video

game consoles and handheld platforms. Revenue earned by our publishing business segment is primarily

derived from the sale of internally developed software titles and software titles developed on our behalf by

third parties. Revenue earned by our distribution business segment is derived from the sale of third party

software titles, accessories and hardware.

Our Chief Executive Officer is our chief operating decision maker (‘‘CODM’’). We are centrally managed

and our CODM assesses performance, allocates resources and reviews results on the basis of our

publishing and distribution segments supplemented by sales information by product category, major

product title and platform.

Our CODM is presented with financial information that contains information that separately identifies our

publishing and distribution operations, including gross margin information. Accordingly, we consider our

publishing and distribution businesses to be distinct reportable segments. Our publishing business consists

of our Rockstar Games and 2K labels which have been aggregated into a reportable segment (the

‘‘publishing segment’’) based on their similar economic characteristics, products and distribution methods.

Our distribution business distributes our publishing products as well as third party software, hardware and

accessories to retail outlets in North America and on the basis of its economic characteristics, products and

distribution methods is considered a reportable segment (the ‘‘distribution segment’’).

Our operating segments do not record inter-segment revenue and therefore none has been reported. We

do not allocate operating expenses, interest and other income, interest expense or income taxes to

101