2K Sports 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.entity. The guidance also now requires ongoing reassessments of whether an enterprise is the primary

beneficiary of a variable interest entity. The guidance is effective at the start of a Company’s first fiscal year

beginning after November 15, 2009 (November 1, 2010 for the Company). We are still evaluating the

impact that the adoption of this new guidance will have on our consolidated financial position, cash flows

and results of operations.

Measuring Liabilities at Fair Value

In August 2009, new guidance was issued related to the fair value measurement of liabilities. This update

provides clarification that in circumstances in which quoted prices in an active market for the identical

liability are not available, a reporting entity is required to measure fair value using a valuation technique

that uses quoted prices for the identical liability when traded as an asset, quoted prices for similar liabilities

when traded as an asset or another technique that is consistent with the Fair Value principles. The

guidance is effective for the first reporting period (including interim periods) beginning after issuance

which for the Company is November 1, 2009. We do not expect that the adoption of this new guidance will

have a material effect on our consolidated financial position, cash flows and results of operations.

Multiple-Deliverable Revenue Arrangements

In October 2009, new guidance was issued related to the accounting for multiple-deliverable revenue

arrangements. This guidance amends the existing guidance for separating consideration in multiple-

deliverable arrangements and establish a selling price hierarchy for determining the selling price of a

deliverable. This guidance will become effective, on a prospective basis, for the Company on November 1,

2011. We are still evaluating the impact that the adoption of this new guidance will have on our

consolidated financial position, cash flows and results of operations.

Certain Revenue Arrangements That Include Software Elements

In October 2009, new guidance was issued that changes the accounting model for revenue arrangements by

excluding tangible products containing both software and non-software components that function together

to deliver the product’s essential functionality and instead have these types of transactions be accounted

for under other accounting literature in order to determine whether the software and non-software

components function together to deliver the product’s essential functionality. This guidance will become

effective, on a prospective basis, for the Company on November 1, 2011. We are still evaluating the impact

that the adoption of this new guidance will have on our consolidated financial position, cash flows and

results of operations.

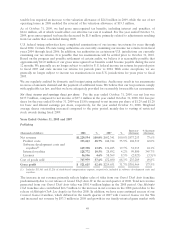

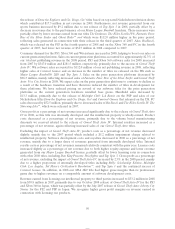

Fluctuations in Operating Results and Seasonality

We have experienced fluctuations in quarterly and annual operating results as a result of: the timing of the

introduction of new titles; variations in sales of titles developed for particular platforms; market

acceptance of our titles; development and promotional expenses relating to the introduction of new titles,

sequels or enhancements of existing titles; projected and actual changes in platforms; the timing and

success of title introductions by our competitors; product returns; changes in pricing policies by us and our

competitors; the size and timing of acquisitions; the timing of orders from major customers; order

cancellations; and delays in product shipment. Sales of our products are also seasonal, with peak shipments

typically occurring in the fourth calendar quarter (our fourth and first fiscal quarters) as a result of

increased demand for titles during the holiday season. Quarterly and annual comparisons of operating

results are not necessarily indicative of future operating results.

43