2K Sports 2009 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

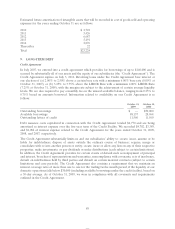

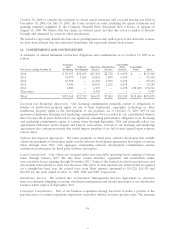

and timing of these payments are currently not fixed or determinable. See Note 4 for a discussion of our

contingent commitments related to our business acquisitions.

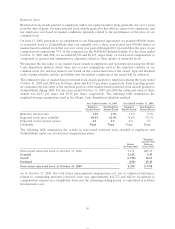

Employee savings plan: We maintain a 401(k) retirement savings plan and trust. Our 401(k) plan is

offered to all eligible employees and participants may make voluntary contributions. We began matching a

portion of the contributions in July 2002. The matching contribution expense incurred by us during the

years ended October 31, 2009, 2008 and 2007 was $2,748, $2,251 and $1,869, respectively.

Income Taxes: At October 31, 2009, the Company had recorded a liability for gross unrecognized tax

benefits of $20,915 for which we believe it is reasonably possible that approximately $11,000 could become

payable during the next 12 months. These liabilities have not been included in the contractual obligations

table.

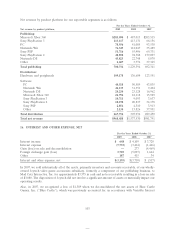

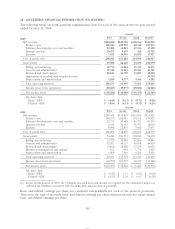

13. INCOME TAXES

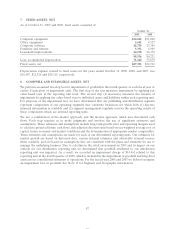

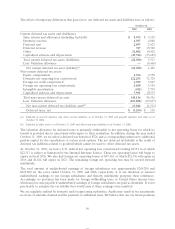

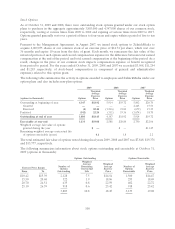

Components of income (loss) before income taxes are as follows:

Years Ended October 31,

2009 2008 2007

Domestic $ (83,427) $ 20,528 $(101,328)

Foreign (49,982) 91,615 (26,887)

Income (loss) before income taxes $(133,409) $112,143 $(128,215)

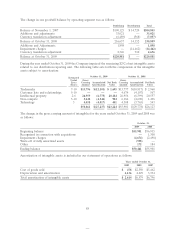

Provision for current and deferred income taxes consists of the following:

Years Ended October 31,

2009 2008 2007

Current:

U.S. federal $(3,871) $ 1,624 $ 2,390

U.S. state and local (779) 2,197 491

Foreign 6,504 11,616 9,028

Total current income taxes 1,854 15,437 11,909

Deferred:

U.S. federal 3,633 (133) (1,886)

U.S. state and local (39) (9) (161)

Foreign (927) (249) 329

Total deferred income taxes 2,667 (391) (1,718)

Income tax expense $ 4,521 $15,046 $10,191

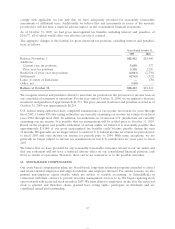

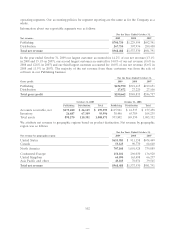

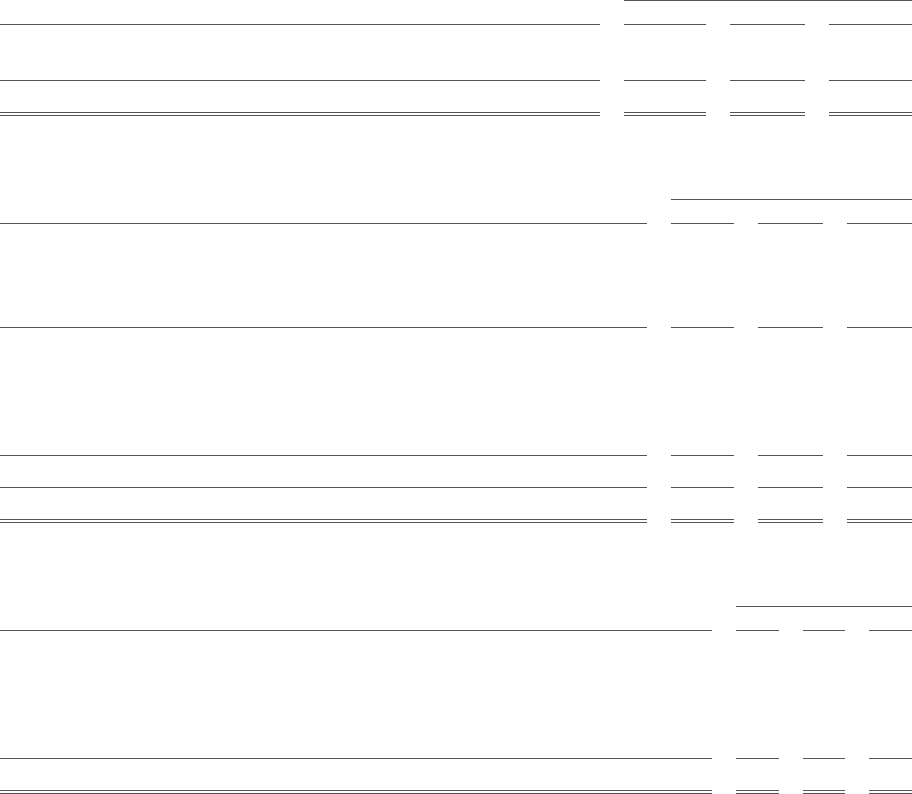

A reconciliation of our effective tax rate to the U.S. statutory federal income tax rate is as follows:

Years Ended October 31,

2009 2008 2007

U.S. federal statutory rate (35.0)% 35.0% (35.0)%

Foreign tax rate differential 20.9% (19.2)% 8.6%

State and local taxes, net of U.S. federal benefit (1.7)% 2.0% (0.5)%

Federal valuation allowance 21.4% (8.5)% 28.0%

Other (2.2)% 4.1% 6.8%

Effective tax rate 3.4% 13.4% 7.9%

95