2K Sports 2009 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Advertising

We expense advertising costs as incurred. Advertising expense for the years ended October 31, 2009, 2008

and 2007 amounted to $94,302, $101,374 and $78,004, respectively.

Earnings (Loss) per Share (‘‘EPS’’)

Basic EPS is computed by dividing the net income (loss) applicable to common stockholders for the period

by the weighted average number of shares of common stock outstanding during the same period. Diluted

EPS is computed by dividing the net income (loss) applicable to common stockholders for the period by

the weighted average number of shares of common stock and common stock equivalents outstanding.

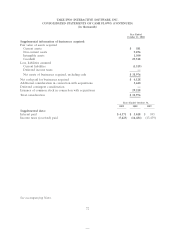

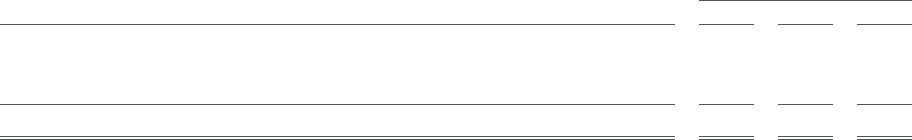

The following table sets forth a reconciliation between basic and diluted shares (in thousands):

Years ended October 31,

(thousands of shares) 2009 2008 2007

Basic shares 76,815 75,039 71,860

Dilutive effect of equity incentive plans —904 —

Dilutive effect of convertible notes and warrants ———

Diluted shares 76,815 75,943 71,860

The Company incurred a net loss for the years ended October 31, 2009 and 2007; therefore, the basic and

diluted weighted average shares outstanding exclude the impact of all common stock equivalents because

their impact would be antidilutive.

The Company defines common stock equivalents as unexercised stock options, unvested time-based and

market-based restricted stock, common stock equivalents underlying the Convertible Notes (see Note 9)

and warrants outstanding during the period. Common stock equivalents are measured using the treasury

stock method, except for the Company’s Convertible Notes, which are assessed for their impact on diluted

EPS using the more dilutive of the treasury stock method or the if-converted method. Under the provisions

of the if-converted method, the Convertible Notes are assumed to be converted and included in the

denominator of the EPS calculation and the interest expense, net of tax, recorded in connection with the

Convertible Notes is added back to the numerator. The Company applies the if-converted method to its

Convertible Notes when the dilutive impact on EPS is greater than the impact calculated using the treasury

stock method. For the year ended October 31, 2009, the if-converted method was antidilutive; therefore,

the assumed conversion of 12,927,000 shares underlying our Convertible Notes was excluded from the

computation of diluted EPS.

In connection with the issuance of our Convertible Notes in June 2009, the Company purchased

convertible note hedges (see Note 9) which were excluded from the calculation of diluted EPS because

their impact is always considered antidilutive since the call option would be exercised by the Company

when the exercise price is lower than the market price. Also in connection with the issuance of our

Convertible Notes, the Company entered into warrant transactions (see Note 9). For the year ended

October 31, 2009, the Company excluded the warrants outstanding from its diluted EPS because the

warrants’ strike price of $14.945 was greater than the average market price of our common stock

For the years ended October 31, 2009 and 2007, other common stock equivalents excluded from the

diluted EPS calculation included unexercised stock awards and unvested time-based and market-based

restricted stock because their effect would have been antidilutive due to the net loss for those periods. The

number of the antidilutive unexercised stock awards and unvested time-based and market-based restricted

stock was approximately 8,019,614 and 5,624,000 for the years ended October 31, 2009 and 2007,

respectively.

80