2K Sports 2009 Annual Report Download - page 86

Download and view the complete annual report

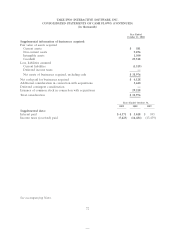

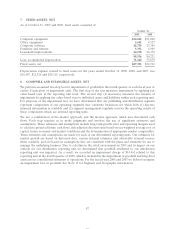

Please find page 86 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.For the year ended October 31, 2008, the Company excluded from its diluted EPS calculation

approximately 3,651,000 of common stock equivalents which were antidilutive because the common stock

equivalents’ exercise prices exceeded the average fair market value of the Company’s common stock.

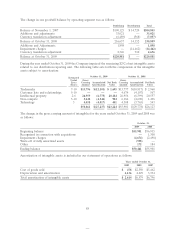

Stock-based Compensation

We have issued stock-based compensation to employees and non-employee consultants, such as

ZelnickMedia.

We calculate the fair value of our employee and non-employee stock option awards using the Black-

Scholes pricing model. Employee stock option awards are amortized as stock-based compensation expense

on a straight-line basis over the expected vesting period, which is generally three years, and reduced for

estimated forfeitures. We apply variable accounting to our non-employee based stock option awards,

whereby we re-measure the fair value of the unvested portion of the awards at each vest date, and record

stock-based compensation expense for the difference between total earned compensation at the end of the

period and total earned compensation at the beginning of the period.

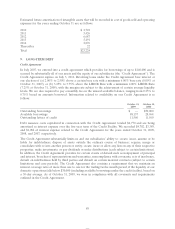

We value time-based restricted stock awards to employees using our closing stock price on the date of

grant. Time-based restricted stock awards are amortized and recorded as expense on a straight-line basis

over their expected vesting period, which is typically three years, and reduced for estimated forfeitures. We

apply variable accounting to our non-employee time-based restricted stock awards, whereby we re-measure

the value of such awards at each balance sheet date and adjust the value of the awards based on the closing

price of our common stock at the end of the reporting period. Changes in the value of the awards from

period to period are recorded as stock-based compensation expense over the vesting period, which is

typically three years.

Estimated forfeitures are adjusted, if necessary, in subsequent periods if actual forfeitures differ from our

estimates.

Market-based restricted stock is typically awarded to executives and non-employee consultants. We

estimate the fair value of market-based awards using the Monte Carlo Simulation method which takes into

account the probability that the market conditions of the awards will be achieved. We apply variable

accounting to our non-employee market-based awards. We have issued market-based awards that vest

based on a variety of conditions: (1) the correlation of the return of our common stock price relative to

companies in the NASDAQ Industrial Index and (2) appreciation in the price of our common stock. Our

employee and non-employee market-based awards are amortized over their estimated derived service

period, which typically ranges from three to four years.

See Note 14 for a full discussion of our stock-based compensation arrangements.

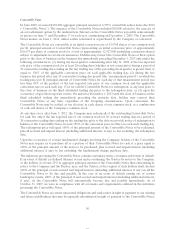

Foreign Currency

The functional currency for our foreign operations is primarily the applicable local currency. Accounts of

foreign operations are translated into U.S. dollars using exchange rates for assets and liabilities at the

balance sheet date and average prevailing exchange rates for the period for revenue and expense accounts.

Adjustments resulting from translation are included in accumulated other comprehensive income (loss).

Realized and unrealized transaction gains and losses are included in our consolidated statement of

operations in the period in which they occur, except on inter-company balances considered to be long term.

Transaction gains and losses on inter-company balances which are considered to be long term are recorded

in accumulated other comprehensive income (loss). The foreign exchange transaction gains included in net

loss for the years ended October 31, 2009 and 2007 amounted to $3,705 and $1,644, respectively, and the

foreign exchange transaction loss included in net income for the year ended October 31, 2008 amounted to

$5,097.

81