2K Sports 2009 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15DEC200902125737

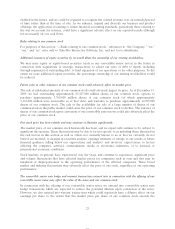

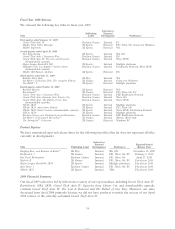

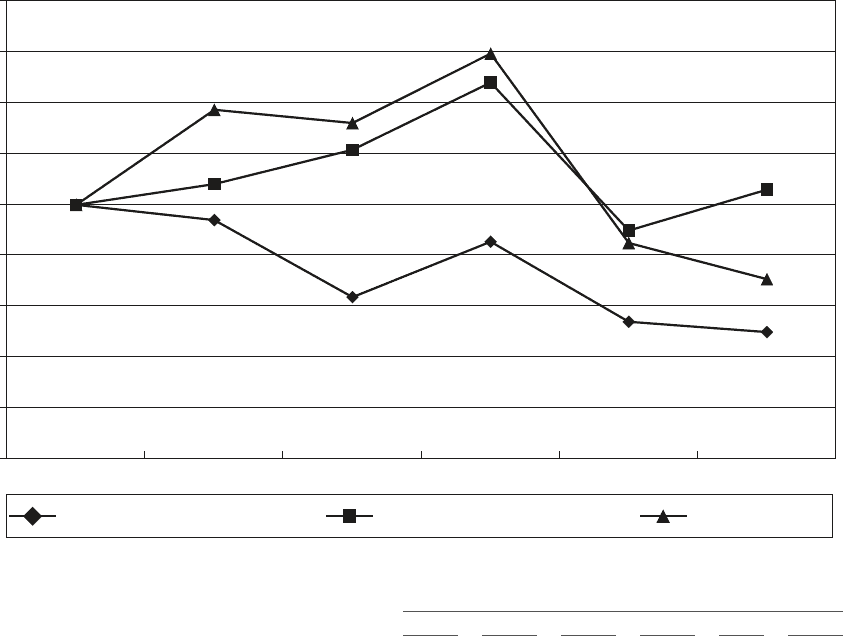

Stock Performance Graph

The following line graph compares, from October 31, 2004 through October 31, 2009, the cumulative total

stockholder return on our common stock with the cumulative total return on the stocks comprising the

NASDAQ Composite Index and the stocks comprising a peer group index consisting of Activision

Blizzard, Inc., Electronic Arts, Inc. and THQ Inc. The comparison assumes $100 was invested on

October 31, 2004 in our common stock and in each of the following indices and assumes reinvestment of all

cash dividends, if any, paid on such securities. We have not paid any cash dividends and, therefore, our

cumulative total return calculation is based solely upon stock price appreciation and not upon

reinvestment of cash dividends. Historical stock price is not necessarily indicative of future stock price

performance.

COMPARISON OF 5 YEAR CUMULATIVE TOTAL RETURN*

Among Take-Two Interactive Software, Inc., The NASDAQ Composite Index and a Peer Group

Comparison of 5 Year Cumulative Total Return

Assumes Initial Investment of $100

October 2009

0.00

20.00

40.00

60.00

80.00

140.00

180.00

160.00

2005 2006 2007 20092008

2004

120.00

100.00

NASDAQ Composite-Total Returns TTWO Peer GroupTake-Two Interactive Software, Inc.

* $100 invested on October 31, 2004 in stock or index-including reinvestment of dividends.

October 31,

2004 2005 2006 2007 2008 2009

Take-Two Interactive Software, Inc 100.00 93.99 63.69 85.49 54.00 49.94

NASDAQ Composite-Total Returns 100.00 108.15 121.64 148.10 89.88 107.94

Peer Group 100.00 137.41 132.17 159.45 84.93 70.74

29