2K Sports 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

General and administrative expenses for the year ended October 31, 2009 and 2008 also include occupancy

expense (primarily rent, utilities and office expenses) of $14.1 million and $13.6 million, respectively,

related to our development studios.

Research and development

Research and development expenses decreased slightly for the year ended October 31, 2009 compared to

the same period in 2008. Personnel costs decreased primarily due to lower bonus expense and higher

capitalization rates. The capitalization rates for payroll related costs for 2008 were lower than usual as

certain development studios refocused their efforts to new projects following the release of Grand Theft

Auto IV. This decrease was offset by higher production expenses and increased headcount, primarily from

the prior year acquisitions of Rockstar New England (formerly known as Mad Doc Software LLC) and 2K

Czech (formerly known as Illusion Softworks, a.s.) as well as expansion initiatives in Asia-Pacific markets.

Impairment of goodwill and long-lived assets

During our annual goodwill impairment test we determined that goodwill attributed to our distribution

reporting unit was impaired due to a decline in the retail environment in 2009 and its impact on our

outlook for our distribution reporting unit. For the fiscal year ended October 31, 2009, we recorded a

goodwill and intangible impairment charge of $14.8 million related to our distribution segment. No

impairments were recorded in fiscal 2008.

Depreciation and amortization

For the year ended October 31, 2009, depreciation and amortization expense decreased by $7.1 million

compared to 2008 mainly due to lower depreciation and amortization expense associated with the

September 2008 sale of certain assets to a third party as part of entering into a distribution services

agreement.

Interest and other expense, net

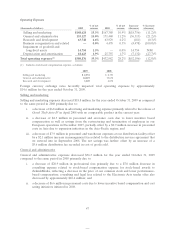

% of net % of net Increase/ % Increase/

(thousands of dollars) 2009 revenue 2008 revenue (decrease) (decrease)

Interest income (expense), net $(7,087) (0.7)% $ 695 0.0% $(7,782) (1119.7)%

Gain (loss) on sale and deconsolidation — 0.0% 277 0.0% (277) (100.0)%

Foreign exchange gain (loss) 3,705 0.4% (5,097) (0.3)% 8,802 (172.7)%

Other 187 0.0% 415 0.0% (228) (54.9)%

Interest and other expense, net $(3,195) (0.3)% $(3,710) (0.2)% $ 515 (13.9)%

For the year ended October 31, 2009, interest and other expense, net decreased $0.5 million due to

favorable exchange gains in our foreign subsidiaries, partially offset by higher interest expense associated

with the issuance of the June 2009 Convertible Notes and the line of credit as well as lower interest income

in 2009 due to lower average cash balances and lower interest rates.

Provision for income taxes. Income tax expense was $4.5 million for the year ended October 31, 2009,

compared to income tax expense of $15.0 million for the year ended October 31, 2008. The change in

income taxes is primarily attributable to pre-tax losses without tax benefit in 2009, a reduction in our

liability for gross unrecognized tax benefits following the conclusion of certain tax audits, and a cumulative

charge to increase our valuation allowance as a result of deferred tax liabilities related to goodwill which

cannot be used to offset deferred tax assets, compared to worldwide pre-tax income in 2008 with a related

tax charge. We did not record an income tax benefit on our pre-tax losses in 2009 due to uncertainty

regarding the realization of our deferred tax assets, and recorded income tax expense on income generated

in several foreign jurisdictions. Our effective tax rate differed from the federal statutory rate due to losses

without tax benefit in 2009 and changes in gross unrecognized tax benefits during 2008 and 2009. The 2009

48