2K Sports 2009 Annual Report Download - page 82

Download and view the complete annual report

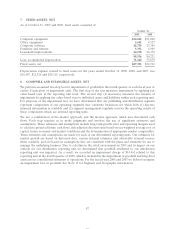

Please find page 82 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fixed Assets, net

Office equipment, furniture and fixtures are depreciated using the straight-line method over their

estimated useful life of five years. Computer equipment and software are generally depreciated using the

straight-line method over three years. Leasehold improvements are amortized over the lesser of the term

of the related lease or seven years. The cost of additions and betterments are capitalized, and repairs and

maintenance costs are charged to operations, in the periods incurred. When depreciable assets are retired

or sold, the cost and related allowances for depreciation are removed from the accounts and the gain or

loss is recognized. The carrying amounts of these assets are recorded at historical cost.

Goodwill and Intangible Assets

Goodwill is the excess of purchase price paid over identified intangible and tangible net assets of acquired

companies. Intangible assets consist of trademarks, intellectual property, non-compete agreements,

customer lists and acquired technology. Certain intangible assets acquired in a business combination are

recognized as assets apart from goodwill.

We use either the income, cost or market approach to aid in our conclusions of such fair values and asset

lives. The income approach presumes that the value of an asset can be estimated by the net economic

benefit to be received over the life of the asset, discounted to present value. The cost approach presumes

that an investor would pay no more for an asset than its replacement or reproduction cost. The market

approach estimates value based on what other participants in the market have paid for reasonably similar

assets. Although each valuation approach is considered in valuing the assets acquired, the approach

ultimately selected is based on the characteristics of the asset and the availability of information.

Identified intangibles other than goodwill are generally amortized using the straight-line method over the

period of expected benefit ranging from three to ten years, except for intellectual property, which is a

usage-based intangible asset that is amortized using the shorter of the useful life or expected revenue

stream.

We perform an annual test for impairment of goodwill in the fourth quarter of each fiscal year, or earlier if

indicators of impairment exist. We use a combination of the market approach, which uses market

capitalization and comparable companies’ data, and the income approach, which uses discounted cash

flows. Each step requires us to make judgments and involves the use of significant estimates and

assumptions. These estimates and assumptions include long-term growth rates and operating margins used

to calculate projected future cash flows, risk-adjusted discount rates based on our weighted average cost of

capital, future economic and market conditions and the determination of appropriate market comparables.

These estimates and assumptions have to be made for each reporting unit evaluated for impairment. Our

estimates for market growth are based on historical data, various internal estimates and observable

external sources when available, and are based on assumptions that are consistent with the plans and

estimates we use to manage the underlying business. Using these approaches we determined that the

goodwill and intangible assets in our Distribution segment was impaired in the fourth quarter of our fiscal

year ended October 31, 2009. As a result, we recorded an impairment charge of $14,754.

Long-lived Assets

We review all long-lived assets whenever events or changes in circumstances indicate that the carrying

amount of an asset may not be recoverable. We compare the carrying amount of the asset to the estimated

undiscounted future cash flows expected to result from the use of the asset. If the carrying amount of the

asset exceeds estimated expected undiscounted future cash flows, we record an impairment charge for the

difference between the carrying amount of the asset and its fair value. The estimated fair value is generally

measured by discounting expected future cash flows using our incremental borrowing rate or fair value, if

available.

77