2K Sports 2009 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

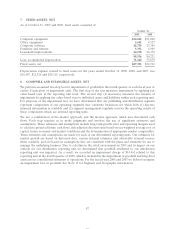

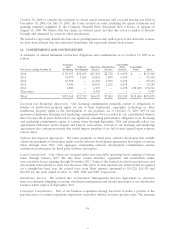

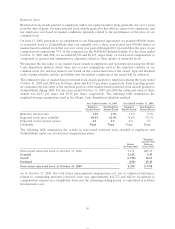

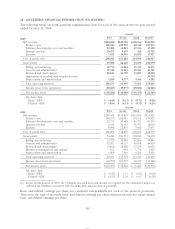

The effects of temporary differences that gave rise to our deferred tax assets and liabilities were as follows:

October 31,

2009 2008

Current deferred tax assets and (liabilities):

Sales returns and allowances (including bad debt) $ 8,473 $ 9,129

Inventory reserves 4,307 4,068

Deferred rent 2,097 2,423

Deferred revenue 747 13,520

Other 11,802 10,462

Capitalized software and depreciation (49,726) (33,685)

Total current deferred tax assets (liabilities) (22,300) 5,917

Less: Valuation allowance —(4,468)

Net current deferred tax asset (liability)(a) (22,300) 1,449

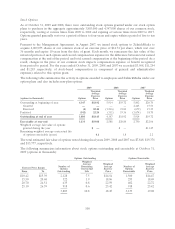

Non-current deferred tax assets:

Equity compensation 2,534 2,558

Domestic net operating loss carryforward 122,255 71,324

Foreign tax credit carryforward 6,599 5,947

Foreign net operating loss carryforwards 9,189 5,350

Intangible amortization (432) 2,774

Capitalized software and depreciation 7,991 10,573

Total non-current deferred tax asset 148,136 98,526

Less: Valuation allowance (129,090) (99,837)

Net non-current deferred tax (liability) asset(b) 19,046 (1,311)

Deferred taxes, net $ (3,254) $ 138

(a) Included in accrued expenses and other current liabilities as of October 31, 2009 and prepaid expenses and other as of

October 31, 2008.

(b) Included in other assets as of October 31, 2009 and other long-term liabilities as of October 31, 2008.

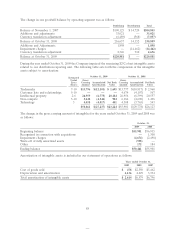

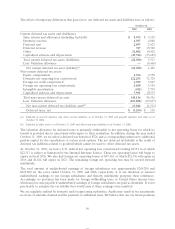

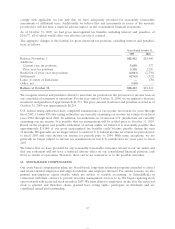

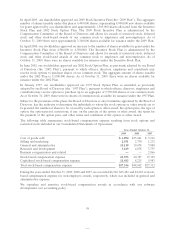

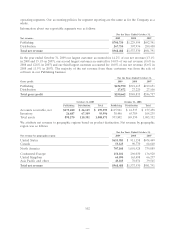

The valuation allowance for deferred taxes is primarily attributable to net operating losses for which no

benefit is provided due to uncertainty with respect to their realization. In addition, during the year ended

October 31, 2009, we recorded a deferred tax benefit of $726 and a corresponding reduction to additional

paid-in-capital for the cancellation of certain stock options. The net deferred tax liability is the result of

deferred tax liabilities related to goodwill which cannot be used to offset deferred tax assets.

At October 31, 2009, we had a U.S. federal net operating loss carryforward totaling $319,116 of which

$22,317 is subject to limitation by the Internal Revenue Service. These net operating losses will begin to

expire in fiscal 2026. We also had foreign net operating losses of $47,463, of which $32,556 will expire in

2016 and $1,614 will expire in 2023. The remaining foreign net operating loss may be carried forward

indefinitely.

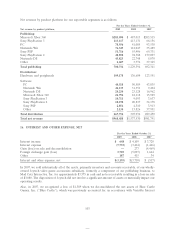

The total amount of undistributed earnings of foreign subsidiaries was approximately $209,200 and

$229,800 for the years ended October 31, 2009 and 2008, respectively. It is our intention to reinvest

undistributed earnings of our foreign subsidiaries and thereby indefinitely postpone their remittance.

Accordingly, no provision has been made for foreign withholding taxes or United States income taxes

which may become payable if undistributed earnings of foreign subsidiaries are paid as dividends. It is not

practicable to estimate the tax liability that would arise if these earnings were remitted.

We are regularly audited by domestic and foreign taxing authorities. Audits may result in tax assessments

in excess of amounts claimed and the payment of additional taxes. We believe that our tax return positions

96