2K Sports 2009 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

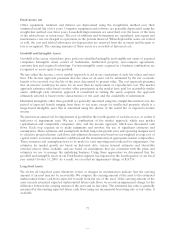

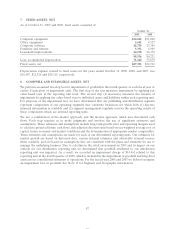

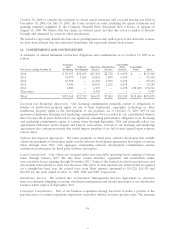

7. FIXED ASSETS, NET

As of October 31, 2009 and 2008, fixed assets consisted of:

October 31,

2009 2008

Computer equipment $34,622 $31,002

Office equipment 5,602 4,517

Computer software 28,730 23,345

Furniture and fixtures 5,392 4,989

Leasehold improvements 24,190 22,378

98,536 86,231

Less: accumulated depreciation 71,144 53,870

Fixed assets, net $27,392 $32,361

Depreciation expense related to fixed assets for the years ended October 31, 2009, 2008, and 2007, was

$16,487, $21,526 and $24,115, respectively.

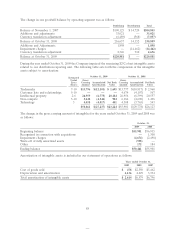

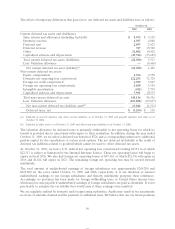

8. GOODWILL AND INTANGIBLE ASSETS, NET

We perform an annual two-step test for impairment of goodwill in the fourth quarter of each fiscal year or

earlier if indicators of impairment exist. The first step of the test measures impairment by applying fair

value-based tests at the reporting unit level. The second step (if necessary) measures the amount of

impairment by applying fair value-based tests to individual assets and liabilities within each reporting unit.

For purposes of the impairment test, we have determined that our publishing and distribution segment

represent components of our operating segments that constitute businesses for which both (1) discrete

financial information is available and (2) segment management regularly reviews the operating results of

these components which are deemed reporting units.

We use a combination of the market approach, and the income approach, which uses discounted cash

flows. Each step requires us to make judgments and involves the use of significant estimates and

assumptions. These estimates and assumptions include long-term growth rates and operating margins used

to calculate projected future cash flows, risk-adjusted discount rates based on our weighted average cost of

capital, future economic and market conditions and the determination of appropriate market comparables.

These estimates and assumptions are made for each of our determined reporting units. Our estimates for

market growth are based on historical data, various internal estimates and observable external sources

when available, and are based on assumptions that are consistent with the plans and estimates we use to

manage the underlying business. Due to a decline in the retail environment in 2009 and its impact on our

outlook for our distribution reporting unit we determined that goodwill attributed to our distribution

reporting unit was impaired. As a result, we recorded an impairment charge of $14,462 related to this

reporting unit in the fourth quarter of 2009, which is included in the impairment of goodwill and long-lived

assets in our consolidated statement of operations. For the fiscal years 2008 and 2007 we did not recognize

an impairment loss on goodwill. See Note 15 for Segment and Geographic information.

87