2K Sports 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 2K Sports annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

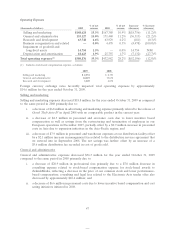

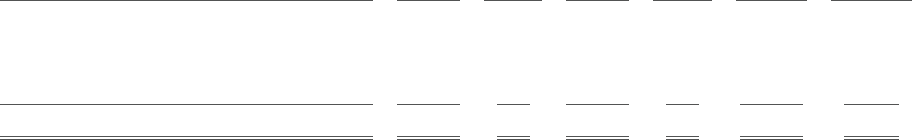

Interest and other expense, net

% of net % of net Increase/ % Increase/

(thousands of dollars) 2008 revenue 2007 revenue (decrease) (decrease)

Interest income (expense), net $ 695 0.0% $ 2,274 0.2% $(1,579) (69.4)%

Gain (loss) on sale and deconsolidation 277 0.0% (4,469) (0.5)% 4,746 (106.2)%

Foreign exchange gain (loss) (5,097) (0.3)% 1,644 0.2% (6,741) (410.0)%

Other 415 0.0% 34 0.0% 381 1120.6%

Interest and other expense, net $(3,710) (0.2)% $ (517) (0.1)% $(3,193) 617.6%

In 2007, we sold substantially all of the assets, primarily inventory and accounts receivable, of our wholly-

owned Joytech video game accessories subsidiary, formerly a component of our publishing business, to

Mad Catz Interactive, Inc. for approximately $3.6 million in cash and notes receivable, resulting in a

recognized loss on the sale of $3.1 million. The disposition of Joytech did not involve a significant amount

of assets or materially impact our operating results.

Also, in 2007, we recognized a loss of $1.4 million when we deconsolidated the net assets of Blue Castle

Games, Inc. (‘‘Blue Castle’’), which was previously accounted for, in accordance with the Variable Interest

Entity guidance, as a wholly-owned subsidiary and considered to be a variable interest entity. We are no

longer considered to be the primary beneficiary of Blue Castle’s profits or losses.

In 2008, we incurred a foreign exchange transaction loss of $5.1 million for the year ended October 31,

2008, reflecting a strengthening United States dollar in the fourth quarter of 2008, compared to a foreign

exchange transaction gain of $1.6 million for the year ended October 31, 2007.

Provision for income taxes. Income tax expense was $15.0 million for the year ended October 31, 2008, as

compared to $10.2 million for the year ended October 31, 2007. Our effective tax rate differed from the

federal statutory rate due to foreign earnings taxed at lower rates and the application of net operating

losses carried forward to 2008 taxable income. The use of the net operating losses enabled the reversal of

valuation allowances of $19.3 million in 2008, while the 2007 taxable loss required an increase to the

valuation allowance of $40.6 million.

We are regularly audited by domestic and foreign taxing authorities. Audits may result in tax assessments

in excess of amounts claimed and the payment of additional taxes. We believe that our tax positions comply

with applicable tax law, and that we have adequately provided for reasonably foreseeable tax assessments.

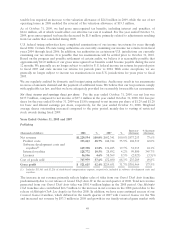

Net income (loss) and earnings (loss) per share. For the year ended October 31, 2008, net income was

$97.1 million, compared to a net loss of $138.4 million for the year ended October 31, 2007. Basic and

diluted earnings per share for the year ended October 31, 2008 was $1.29 and $1.28, respectively,

compared to a loss per share of $1.93 for the year ended October 31, 2007. Weighted average shares

outstanding increased compared to the prior period, mainly due to an increase in the exercise of stock

options as a result of a higher average stock price in the 2008 period and the issuance of 1,496,647 shares

of restricted stock in connection with our acquisition of 2K Czech, formerly known as Illusion Softworks.

Liquidity and Capital Resources

Our primary cash requirements have been to fund (i) the development, manufacturing and marketing of

our published products, (ii) working capital, (iii) acquisitions and (iv) capital expenditures. We expect to

rely on funds provided by our operating activities, our credit agreement and our recently issued

Convertible Notes to satisfy our working capital needs.

In June 2009, we issued $138.0 million aggregate principal amount of 4.375% convertible senior notes due

2014 (‘‘Convertible Notes’’). The issuance of the Convertible Notes included $18.0 million related to the

exercise of an over-allotment option by the underwriters. Interest on the Convertible Notes is payable

53