XM Radio 2014 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

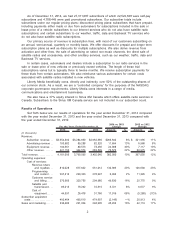

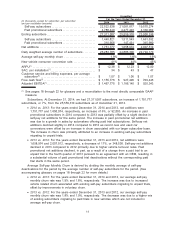

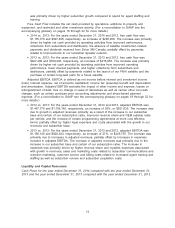

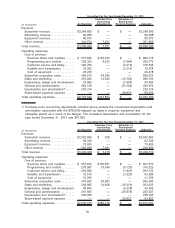

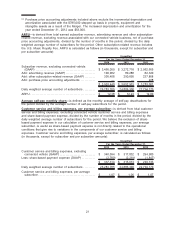

(in thousands, except for subscriber, per subscriber

and per installation amounts) 2014 2013 2012

For the Years Ended December 31,

Unaudited

Self-pay subscribers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22,522,638 21,081,817 19,570,274

Paid promotional subscribers . . . . . . . . . . . . . . . . . . . . . . . . 4,788,449 4,477,493 4,330,062

Ending subscribers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 27,311,087 25,559,310 23,900,336

Self-pay subscribers . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,440,821 1,511,543 1,661,532

Paid promotional subscribers . . . . . . . . . . . . . . . . . . . . . . . . 310,956 147,431 345,980

Net additions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,751,777 1,658,974 2,007,512

Daily weighted average number of subscribers . . . . . . . . . 26,283,785 24,886,300 22,794,170

Average self-pay monthly churn . . . . . . . . . . . . . . . . . . . . . . . 1.9% 1.8% 1.9%

New vehicle consumer conversion rate. . . . . . . . . . . . . . . . . 41% 44% 45%

ARPU(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12.38 $ 12.23 $ 12.00

SAC, per installation(1)................................. $ 34 $ 43 $ 47

Customer service and billing expenses, per average

subscriber(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.07 $ 1.06 $ 1.07

Free cash flow(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,155,776 $ 927,496 $ 709,446

Adjusted EBITDA(1). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,467,775 $ 1,166,140 $ 920,343

(1) See pages 18 through 22 for glossary and a reconciliation to the most directly comparable GAAP

measure.

Subscribers. At December 31, 2014, we had 27,311,087 subscribers, an increase of 1,751,777

subscribers, or 7%, from the 25,559,310 subscribers as of December 31, 2013.

•2014 vs. 2013: For the years ended December 31, 2014 and 2013, net additions were

1,751,777 and 1,658,974, respectively, an increase of 6%, or 92,803. An increase in paid

promotional subscribers in 2014 compared to 2013 was partially offset by a slight decline in

self-pay net additions for the same period. The increase in paid promotional net additions

was due to a growth in sales by automakers offering paid trial subscriptions. Self-pay net

additions declined slightly in 2014 compared to 2013 as record new and used car

conversions were offset by an increase in churn associated with our larger subscriber base.

The increase in churn was primarily attributed to an increase in existing self-pay subscribers

migrating to unpaid trials.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, net additions were

1,658,974 and 2,007,512, respectively, a decrease of 17%, or 348,538. Self-pay net additions

declined in 2013 compared to 2012 primarily due to higher vehicle turnover rates. Paid

promotional net additions declined, in part, as a result of a change from a paid trial to an

unpaid trial in the fourth quarter of 2013 pursuant to an agreement with an OEM, resulting in

a substantial volume of paid promotional trial deactivations without the corresponding paid

trial starts in the same period.

Average Self-pay Monthly Churn is derived by dividing the monthly average of self-pay

deactivations for the period by the average number of self-pay subscribers for the period. (See

accompanying glossary on pages 18 through 22 for more details.)

•2014 vs. 2013: For the years ended December 31, 2014 and 2013, our average self-pay

monthly churn rate was 1.9% and 1.8%, respectively. The increase was due to increased

vehicle related churn associated with existing self-pay subscribers migrating to unpaid trials,

offset by improvements in voluntary churn.

•2013 vs. 2012: For the years ended December 31, 2013 and 2012, our average self-pay

monthly churn rate was 1.8% and 1.9%, respectively. The decrease was due to a higher mix

of existing subscribers migrating to paid trials in new vehicles which are not included in

average self-pay churn.

11