XM Radio 2014 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

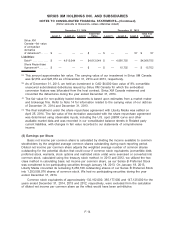

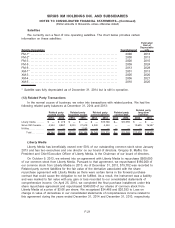

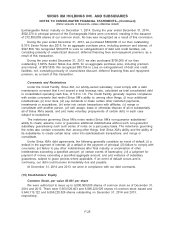

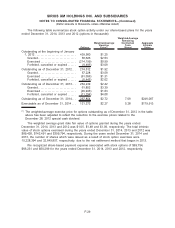

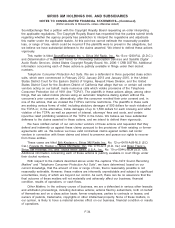

Issuer /

Borrower Issued Debt

Maturity

Date Interest Payable

Principal

Amount

December 31,

2014

December 31,

2013

Carrying value at

Sirius XM(a)(b) ..... May 2013 4.625% Senior Notes

(the “4.625% Notes”)

May 15,

2023

semi-annually

on May 15 and

November 15

500,000 495,116 494,653

Sirius XM(a)(b)(c) . . . May 2014 6.00% Senior Notes

(the “6.00% Notes”)

July 15,

2024

semi-annually

on January 15

and July 15

1,500,000 1,483,918 —

Sirius XM(a)(b)(d) . . . August 2012 5.25% Senior

Secured Notes (the

“5.25% Notes”)

August 15,

2022

semi-annually

on February 15

and August 15

400,000 395,147 394,648

Sirius XM(e) ...... December

2012

Senior Secured

Revolving Credit

Facility (the “Credit

Facility”)

December 5,

2017

variable fee

paid quarterly

1,250,000 380,000 460,000

Sirius XM ........ Various Capital leases Various n/a n/a 12,754 19,591

Total Debt........................................... 4,501,345 3,601,595

Less: total current maturities non-related party .... 7,482 496,815

Less: total current maturities related party ........ — 10,959

Total long-term debt ................................. $4,493,863 $3,093,821

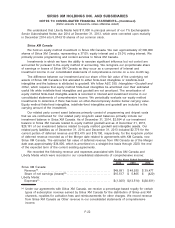

(a) The carrying value of the notes are net of the remaining unamortized original issue discount.

(b) Substantially all of our domestic wholly-owned subsidiaries have guaranteed these notes.

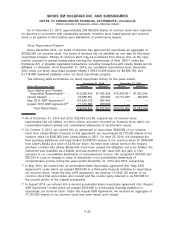

(c) In May 2014, Sirius XM issued $1,500,000 aggregate principal amount of 6.00% Senior Notes

due 2024, with an original issuance discount of $16,875.

(d) In April 2014, we entered into a supplemental indenture to the indenture governing the 5.25%

Notes pursuant to which we granted a first priority lien on substantially all of the assets of Sirius

XM and the guarantors to the holders of the 5.25% Notes. The liens securing the 5.25% Notes

are equal and ratable to the liens granted to secure the Credit Facility.

(e) In December 2012, Sirius XM entered into a five -year Credit Facility with a syndicate of financial

institutions for $1,250,000. Sirius XM’s obligations under the Credit Facility are guaranteed by

certain of its material domestic subsidiaries and are secured by a lien on substantially all of

Sirius XM’s assets and the assets of its material domestic subsidiaries. Borrowings under the

Credit Facility are used for working capital and other general corporate purposes, including

dividends, financing of acquisitions and share repurchases. Interest on borrowings is payable on

a monthly basis and accrues at a rate based on LIBOR plus an applicable rate. Sirius XM is

also required to pay a variable fee on the average daily unused portion of the Credit Facility and

is payable on a quarterly basis. The variable rate for the unused portion of the Credit Facility

was 0.35% per annum as of December 31, 2014. As of December 31, 2014, $870,000 was

available for future borrowing under the Credit Facility. Sirius XM’s outstanding borrowings under

the Credit Facility are classified as Long-term debt within our consolidated balance sheets due to

the long-term maturity of this debt.

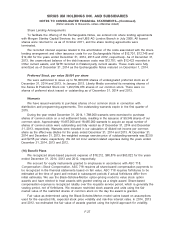

Retired and Converted Debt

The Exchangeable Notes were exchangeable at anytime at the option of the holder into shares

of our common stock at an exchange rate of 543.1372 shares of common stock per 1,000 dollars

of principal amount of the notes, which is equivalent to an approximate exchange price of $1.841

per share of common stock. All holders of the Exchangeable Notes converted prior to the

F-24

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)