XM Radio 2014 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.As part of the transactions with Liberty Media, in February 2009, we entered into an investment

agreement (the “Investment Agreement”) with Liberty Radio, LLC, an indirect wholly-owned

subsidiary of Liberty Media. Pursuant to the Investment Agreement, we issued to Liberty Radio,

LLC 12,500,000 shares of convertible preferred stock with a liquidation preference of $0.001 per

share in partial consideration for the loan investments. The preferred stock was convertible into

approximately 40% of our outstanding shares of common stock (after giving effect to such

conversion).

In September 2012, Liberty Radio, LLC converted 6,249,900 shares of its preferred stock into

1,293,467,684 shares of our common stock. In January 2013, the Federal Communications

Commission granted Liberty Media approval to acquire de jure control of us and Liberty Radio, LLC

converted its remaining preferred stock into 1,293,509,076 shares of our common stock. As a result

of these conversions of preferred stock and additional purchases of our common stock, Liberty

Media beneficially owns, directly and indirectly, over 50% of our outstanding common stock.

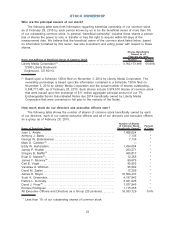

Three individuals who are affiliated with Liberty Media, either as executives or members of the

board of directors of Liberty Media, are members of our board of directors. Gregory B. Maffei, the

President and Chief Executive Officer of Liberty Media, is the Chairman of our board of directors.

As a result, Liberty Media has the ability to control our affairs, policies and operations, such as

the appointment of management, future issuances of our common stock or other securities, the

payment of dividends, if any, on our common stock, the incurrence of debt by us, amendments to

our certificate of incorporation and bylaws and the entering into of extraordinary transactions, and

their interests may not in all cases be aligned with the interests of other stockholders. In addition,

Liberty Media can determine the outcome of all matters requiring general stockholder approval and

has the ability to cause or prevent a change of control of our Company or a change in the

composition of our board of directors and could preclude any unsolicited acquisition of our

Company. The concentration of ownership could deprive stockholders of an opportunity to receive a

premium for their common stock as part of a sale of our Company and might ultimately affect the

market price of our common stock.

On October 9, 2013, we entered into an agreement with Liberty Media to repurchase

$500 million of our common stock from Liberty Media at a price of $3.66 per share. Pursuant to

that agreement, we repurchased $160 million of our common stock from Liberty Media as of

December 31, 2013. On January 23, 2014, we entered into an amendment to that agreement to

defer the previously scheduled $240 million repurchase of shares of our common stock from Liberty

Media from January 27, 2014 to April 25, 2014, the date of the final purchase installment under the

agreement. On April 25, 2014, we repurchased $340 million of our shares of common stock from

Liberty Media. We entered into this amendment at the request of the Special Committee of our

board of directors that was formed to review and evaluate the Liberty Media proposal described

below. That Special Committee is comprised of independent directors.

On January 3, 2014, our board of directors received a non-binding letter from Liberty Media

proposing a transaction pursuant to which all outstanding shares of our common stock not owned

by Liberty Media would be converted into the right to receive 0.0760 of a new share of Liberty

Series C common stock, which would have no voting rights. Our board of directors formed a

Special Committee of independent directors, consisting of Joan L. Amble, Eddy W. Hartenstein and

James P. Holden, to consider the proposal. On March 13, 2014, Liberty Media announced that its

proposal was no longer applicable.

In November 2014, Liberty Media exchanged $11 million in aggregate principal amount of our

7% Exchangeable Senior Subordinated Notes due 2014 for 5,974,510 shares of common stock.

This exchange was in accordance with the indenture governing such Notes and was consummated

prior to the December 1, 2014 maturity of the Notes.

Does Sirius XM have corporate governance guidelines and a code of ethics?

Our board of directors adopted the Guidelines which set forth a flexible framework within which

the board, assisted by its committees, directs our affairs. The Guidelines cover, among other things,

26