XM Radio 2014 Annual Report Download - page 35

Download and view the complete annual report

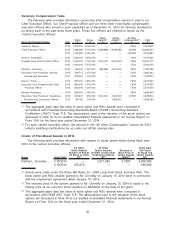

Please find page 35 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Fiscal Year 2014 Performance Summary

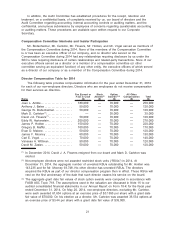

We believe that our compensation program for the named executive officers was instrumental

in helping us achieve strong financial and operating performance in 2014. In the face of intense

competition for our services, our financial results exceeded our public guidance and our internal

budget and business plan. The following highlights our financial and operating results for 2014:

•achieving adjusted EBITDA growth of 26% to $1.47 billion in 2014;

•increasing our revenues by 10% to $4.18 billion;

•increasing our free cash flow by 25% to $1.16 billion;

•managing the integration of our connected vehicle services business and establishing Sirius

XM as a leading provider of telematics services; and

•increasing our stock buyback program from $4 billion to $6 billion.

In addition, 2014 was marked by key subscriber and content-based achievements and other

measures that contributed to our growth and success, including:

•adding approximately 1.75 million net new subscribers, resulting in a total of approximately

27.3 million subscribers, an increase of almost 7% as compared to 2013;

•expanding our relationships with independent resellers, including surpassing 15,000 franchise

and independent auto dealers nationwide that provide trial subscriptions to purchasers and

lessees of pre-owned vehicles; and

•entering into agreements with Ford and Volvo to provide purchasers of new vehicles with

multi-year subscriptions to our premium traffic, weather, data and information services, and

with Subaru to provide enhancements to its in-vehicle connectivity system.

In this CD&A, we use certain financial performance measures that are not calculated and

presented in accordance with generally accepted accounting principles in the United States of

America (“Non-GAAP”). These Non-GAAP financial measures include adjusted EBITDA and free

cash flow. We use these Non-GAAP financial measures and other performance metrics to manage

our business, set operational goals and, in certain cases, as a basis for determining compensation

for our employees. Please refer to the glossary contained in our annual report for the fiscal year

ended December 31, 2014 which accompanies this proxy statement for a discussion of such Non-

GAAP financial measures and reconciliations to the most directly comparable GAAP measure and a

discussion of these other performance metrics.

Overall Program Objectives and Processes

Program Objectives

We strive to attract, motivate, reward and retain highly qualified executives with the skills and

experience necessary to provide leadership for our success in dynamic and competitive markets

and enhance stockholder value by providing compensation that is largely performance-based and

competitive with the various markets and industries in which we compete for talent. We also

endeavor to develop executive compensation programs that are consistent with, explicitly linked to,

and support our strategic objectives—growing our business while enhancing stockholder value.

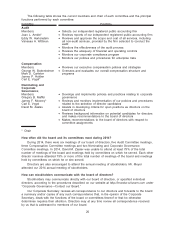

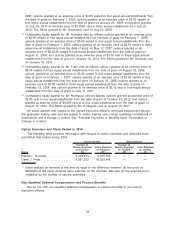

We achieve these objectives through three primary compensation elements:

•a base salary;

•a performance-based discretionary annual bonus that constitutes the short-term incentive

element of our program; and

•equity-based awards that constitute the long-term incentive element of our program.

The Compensation Committee believes that a program comprised principally of the above-

described three elements is consistent with programs adopted by companies with which we

compete for executive talent. The program is structured to meet the requirements of the intensely

competitive and rapidly changing environment in which we operate, while ensuring that we maintain

28