XM Radio 2014 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Share Lending Arrangements

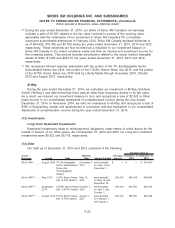

To facilitate the offering of the Exchangeable Notes, we entered into share lending agreements

with Morgan Stanley Capital Services Inc. and UBS AG London Branch in July 2008. All loaned

shares were returned to us as of October 2011, and the share lending agreements were

terminated.

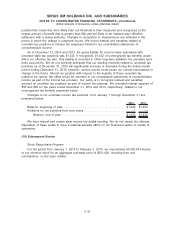

We recorded interest expense related to the amortization of the costs associated with the share

lending arrangement and other issuance costs for our Exchangeable Notes of $12,701, $12,745 and

$12,402 for the years ended December 31, 2014, 2013 and 2012, respectively. As of December 31,

2013, the unamortized balance of the debt issuance costs was $12,701, with $12,423 recorded in

Other current assets, and $278 recorded in Related party current assets. These costs were fully

amortized as of December 31, 2014 as the Exchangeable Notes matured on December 1, 2014.

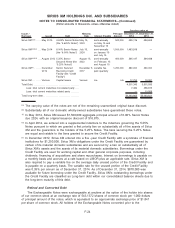

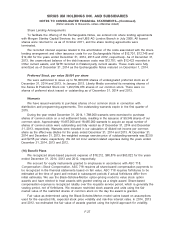

Preferred Stock, par value $0.001 per share

We were authorized to issue up to 50,000,000 shares of undesignated preferred stock as of

December 31, 2014 and 2013. In January 2013, Liberty Media converted its remaining shares of

the Series B Preferred Stock into 1,293,509,076 shares of our common stock. There were no

shares of preferred stock issued or outstanding as of December 31, 2014 and 2013.

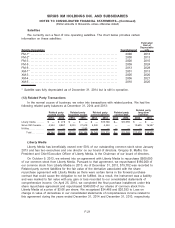

Warrants

We have issued warrants to purchase shares of our common stock in connection with

distribution and programming agreements. The outstanding warrants expire in the first quarter of

2015.

During the year ended December 31, 2014, 1,788,000 warrants were exercised to purchase

shares of common stock on a net settlement basis, resulting in the issuance of 99,349 shares of our

common stock. Approximately 16,667,000 and 18,455,000 warrants to acquire an equal number of

shares of common stock were outstanding and fully vested as of December 31, 2014 and December

31, 2013, respectively. Warrants were included in our calculation of diluted net income per common

share as the effect was dilutive for the years ended December 31, 2014 and 2013. At December 31,

2014 and December 31, 2013, the weighted average exercise price of outstanding warrants was $2.50

and $2.55 per share, respectively. We did not incur warrant related expenses during the years ended

December 31, 2014, 2013 and 2012.

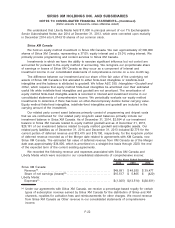

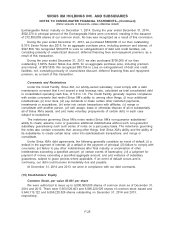

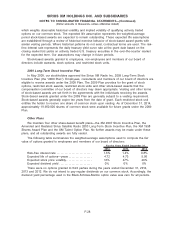

(16) Benefit Plans

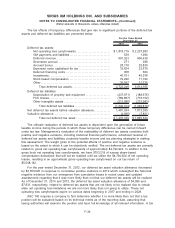

We recognized share-based payment expense of $78,212, $68,876 and $63,822 for the years

ended December 31, 2014, 2013 and 2012, respectively.

We account for equity instruments granted to employees in accordance with ASC 718,

Compensation—Stock Compensation. ASC 718 requires all share-based compensation payments to

be recognized in the financial statements based on fair value. ASC 718 requires forfeitures to be

estimated at the time of grant and revised in subsequent periods if actual forfeitures differ from

initial estimates. We use the Black-Scholes-Merton option-pricing model to value stock option

awards and have elected to treat awards with graded vesting as a single award. Share-based

compensation expense is recognized ratably over the requisite service period, which is generally the

vesting period, net of forfeitures. We measure restricted stock awards and units using the fair

market value of the restricted shares of common stock on the day the award is granted.

Fair value as determined using the Black-Scholes-Merton model varies based on assumptions

used for the expected life, expected stock price volatility and risk-free interest rates. In 2014, 2013

and 2012, we estimated the fair value of awards granted using the hybrid approach for volatility,

F-27

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)