XM Radio 2014 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

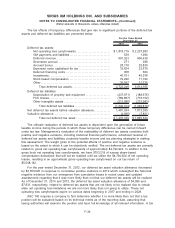

position that meets this more likely than not threshold is then measured and recognized at the

largest amount of benefit that is greater than fifty percent likely to be realized upon effective

settlement with a taxing authority. Changes in recognition or measurement are reflected in the

period in which the change in judgment occurs. We record interest and penalties related to

uncertain tax positions in Income tax (expense) benefit in our consolidated statements of

comprehensive income.

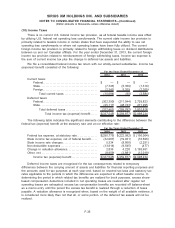

As of December 31, 2014 and 2013, the gross liability for income taxes associated with

uncertain state tax positions was $1,432. If recognized, $1,432 of unrecognized tax benefits would

affect our effective tax rate. This liability is recorded in Other long-term liabilities. No penalties have

been accrued for. We do not currently anticipate that our existing reserves related to uncertain tax

positions as of December 31, 2014 will significantly increase or decrease during the twelve-month

period ending December 31, 2015; however, various events could cause our current expectations to

change in the future. Should our position with respect to the majority of these uncertain tax

positions be upheld, the effect would be recorded in our consolidated statements of comprehensive

income as part of the income tax provision. Our policy is to recognize interest and penalties

accrued on uncertain tax positions as part of income tax expense. We recorded interest expense of

$55 and $40 for the years ended December 31, 2014 and 2013, respectively, related to our

unrecognized tax benefits presented below.

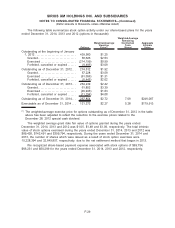

Changes in our uncertain income tax positions, from January 1 through December 31 are

presented below:

2014 2013

Balance, beginning of year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,432 $1,432

Additions for tax positions from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . — —

Balance, end of year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,432 $1,432

We have federal and certain state income tax audits pending. We do not expect the ultimate

disposition of these audits to have a material adverse effect on our financial position or results of

operations.

(19) Subsequent Events

Stock Repurchase Program

For the period from January 1, 2015 to February 3, 2015, we repurchased 65,425,873 shares

of our common stock for an aggregate purchase price of $231,026, including fees and

commissions, on the open market.

F-37

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)