XM Radio 2014 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149

|

|

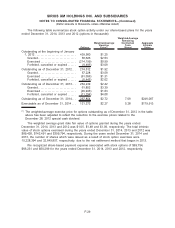

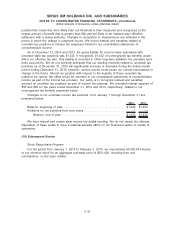

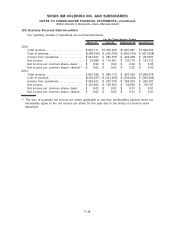

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

Schedule II - Schedule of Valuation and Qualifying Accounts

(in thousands)

Balance

January 1,

Charged to

Expenses

(Benefit)

Write-offs/

Payments/Other

Balance

December 31,

Description

2014

Allowance for doubtful accounts . . . . . . . . . . . $ 9,078 44,961 (46,224) $ 7,815

Deferred tax assets—valuation allowance . . $ 7,831 (2,836) — $ 4,995

Allowance for obsolescence . . . . . . . . . . . . . . . $ 14,218 (335) (3,159) $10,724

2013

Allowance for doubtful accounts . . . . . . . . . . . $ 11,711 39,016 (41,649) $ 9,078

Deferred tax assets—valuation allowance . . $ 9,835 (4,228) 2,224 $ 7,831

Allowance for obsolescence . . . . . . . . . . . . . . . $ 16,159 (773) (1,168) $14,218

2012

Allowance for doubtful accounts . . . . . . . . . . . $ 9,932 34,548 (32,769) $11,711

Deferred tax assets—valuation allowance . . $3,360,740 (3,195,651) (155,254) $ 9,835

Allowance for obsolescence . . . . . . . . . . . . . . . $ 15,430 4,430 (3,701) $16,159

F-39