XM Radio 2014 Annual Report Download - page 131

Download and view the complete annual report

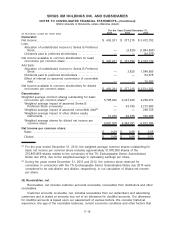

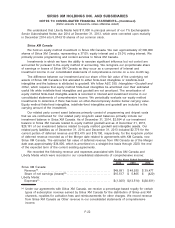

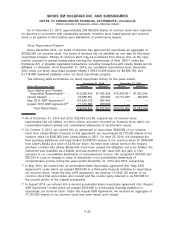

Please find page 131 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Exchangeable Notes’ maturity on December 1, 2014. During the year ended December 31, 2014,

$502,370 in principal amount of the Exchangeable Notes were converted, resulting in the issuance

of 272,855,859 shares of our common stock. No loss was recognized as a result of this conversion.

During the year ended December 31, 2013, we purchased $800,000 of our then outstanding

8.75% Senior Notes due 2015, for an aggregate purchase price, including premium and interest, of

$927,860. We recognized $104,818 to Loss on extinguishment of debt and credit facilities, net,

consisting primarily of unamortized discount, deferred financing fees and repayment premium, as a

result of this transaction.

During the year ended December 31, 2013, we also purchased $700,000 of our then

outstanding 7.625% Senior Notes due 2018, for an aggregate purchase price, including premium

and interest, of $797,830. We recognized $85,759 to Loss on extinguishment of debt and credit

facilities, net, consisting primarily of unamortized discount, deferred financing fees and repayment

premium, as a result of this transaction.

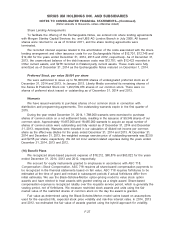

Covenants and Restrictions

Under the Credit Facility, Sirius XM, our wholly-owned subsidiary, must comply with a debt

maintenance covenant that it not exceed a total leverage ratio, calculated as total consolidated debt

to consolidated operating cash flow, of 5.0 to 1.0. The Credit Facility generally requires compliance

with certain covenants that restrict Sirius XM’s ability to, among other things, (i) incur additional

indebtedness, (ii) incur liens, (iii) pay dividends or make certain other restricted payments,

investments or acquisitions, (iv) enter into certain transactions with affiliates, (v) merge or

consolidate with another person, (vi) sell, assign, lease or otherwise dispose of all or substantially

all of Sirius XM’s assets, and (vii) make voluntary prepayments of certain debt, in each case

subject to exceptions.

The indentures governing Sirius XM’s notes restrict Sirius XM’s non-guarantor subsidiaries’

ability to create, assume, incur or guarantee additional indebtedness without such non-guarantor

subsidiary guaranteeing each such series of notes on a pari passu basis. The indentures governing

the notes also contain covenants that, among other things, limit Sirius XM’s ability and the ability of

its subsidiaries to create certain liens; enter into sale/leaseback transactions; and merge or

consolidate.

Under Sirius XM’s debt agreements, the following generally constitute an event of default: (i) a

default in the payment of interest; (ii) a default in the payment of principal; (iii) failure to comply with

covenants; (iv) failure to pay other indebtedness after final maturity or acceleration of other

indebtedness exceeding a specified amount; (v) certain events of bankruptcy; (vi) a judgment for

payment of money exceeding a specified aggregate amount; and (vii) voidance of subsidiary

guarantees, subject to grace periods where applicable. If an event of default occurs and is

continuing, our debt could become immediately due and payable.

At December 31, 2014 and 2013, we were in compliance with our debt covenants.

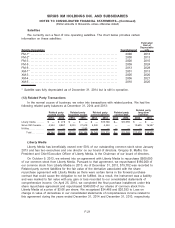

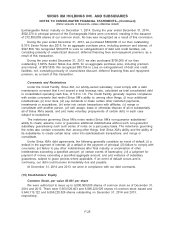

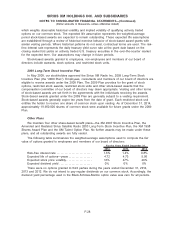

(15) Stockholders’ Equity

Common Stock, par value $0.001 per share

We were authorized to issue up to 9,000,000,000 shares of common stock as of December 31,

2014 and 2013. There were 5,653,529,403 and 6,096,220,526 shares of common stock issued and

5,646,119,122 and 6,096,220,526 shares outstanding on December 31, 2014 and 2013,

respectively.

F-25

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)