XM Radio 2014 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We have evaluated events subsequent to the balance sheet date and prior to the filing of this

Annual Report for the year ended December 31, 2014 and have determined that no events have

occurred that would require adjustment to our consolidated financial statements. For a discussion of

subsequent events that do not require adjustment to our consolidated financial statements refer to

Note 19.

Use of Estimates

The preparation of financial statements in conformity with U.S. GAAP requires management to

make certain estimates, judgments and assumptions that affect the amounts reported in the

financial statements and footnotes. Estimates, by their nature, are based on judgments and

available information. Actual results could differ materially from those estimates. Significant

estimates inherent in the preparation of the accompanying consolidated financial statements include

asset impairment, depreciable lives of our satellites, share-based payment expense, and income

taxes.

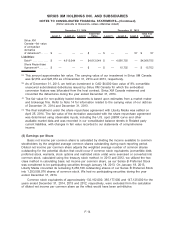

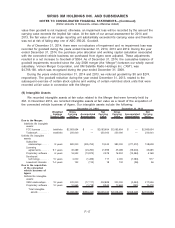

(2) Acquisitions

On November 4, 2013, we purchased all of the outstanding shares of the capital stock of the

connected vehicle business of Agero, Inc. (“Agero”). The transaction was accounted for using the

acquisition method of accounting. During the year ended December 31, 2014, the purchase price

allocation associated with the connected vehicle business of Agero was finalized resulting in a net

increase to Goodwill of $554, of which $1,144 related to the finalization of the working capital

calculation.

As of December 31, 2014, our Goodwill balance associated with this acquisition was $390,016.

No other assets or liabilities have been adjusted as a result of the final working capital calculation

and adjusted purchase price allocation.

(3) Summary of Significant Accounting Policies

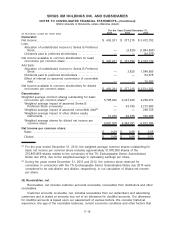

In addition to the significant accounting policies discussed in this Note 3, the following table

includes our significant accounting policies that are described in other notes to our consolidated

financial statements, including the number and page of the note:

Significant Accounting Policy Note # Page #

Fair Value Measurements . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4 F-13

Goodwill. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8 F-16

Intangible Assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9 F-17

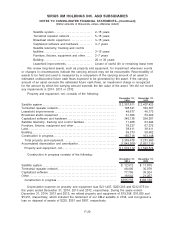

Property and Equipment . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 F-19

Equity Method Investments. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12 F-21

Share-Based Compensation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16 F-27

Legal Costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17 F-31

Income Taxes . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18 F-35

Cash and Cash Equivalents

Our cash and cash equivalents consist of cash on hand, money market funds, certificates of

deposit, in-transit credit card receipts and highly liquid investments purchased with an original

maturity of three months or less.

Revenue Recognition

We derive revenue primarily from subscribers, advertising and direct sales of merchandise.

F-10

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)