XM Radio 2014 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

may affect the counterparty’s ability to pay. Bad debt expense is included in Customer service and

billing expense in our consolidated statements of comprehensive income.

Receivables from distributors primarily include billed and unbilled amounts due from OEMs for

services included in the sale or lease price of vehicles, as well as billed amounts due from

wholesale distributors of our satellite radios. Other receivables primarily include amounts due from

manufacturers of our radios, modules and chipsets where we are entitled to a subsidy based on the

number of units produced. We have not established an allowance for doubtful accounts for our

receivables from distributors or other receivables as we have historically not experienced any

significant collection issues with OEMs or other third parties.

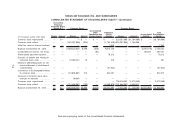

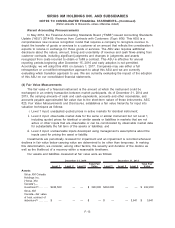

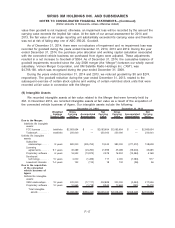

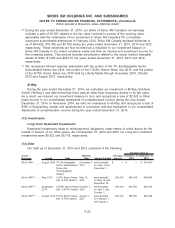

Receivables, net consists of the following:

December 31,

2014

December 31,

2013

Gross customer accounts receivable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $101,634 $ 95,562

Allowance for doubtful accounts. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,815) (9,078)

Customer accounts receivable, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 93,819 $ 86,484

Receivables from distributors . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 105,731 88,975

Other receivables . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 21,029 17,453

Total Receivables, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $220,579 $192,912

(7) Inventory, net

Inventory consists of finished goods, refurbished goods, chipsets and other raw material

components used in manufacturing radios. Inventory is stated at the lower of cost or market. We

record an estimated allowance for inventory that is considered slow moving or obsolete or whose

carrying value is in excess of net realizable value. The provision related to products purchased for

resale in our direct to consumer distribution channel and components held for resale by us is

reported as a component of Cost of equipment in our consolidated statements of comprehensive

income. The provision related to inventory consumed in our OEM and retail distribution channel is

reported as a component of Subscriber acquisition costs in our consolidated statements of

comprehensive income.

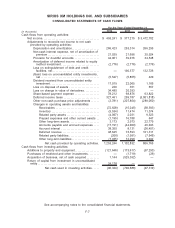

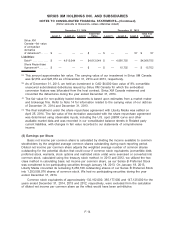

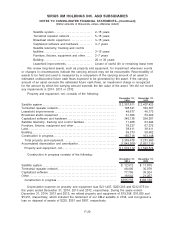

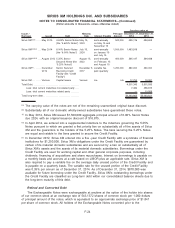

Inventory, net, consists of the following:

December 31,

2014

December 31,

2013

Raw materials . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 12,150 $ 12,358

Finished goods. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17,971 15,723

Allowance for obsolescence. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (10,724) (14,218)

Total inventory, net. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 19,397 $ 13,863

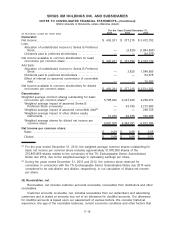

(8) Goodwill

Goodwill represents the excess of the purchase price over the estimated fair value of the net

tangible and identifiable intangible assets acquired in business combinations. Our annual impairment

assessment of our single reporting unit is performed as of the fourth quarter of each year, and an

assessment is performed at other times if an event occurs or circumstances change that would more

likely than not reduce the fair value of the asset below its carrying value. Step one of the impairment

assessment compares the fair value to its carrying value and if the fair value exceeds its carrying

value, goodwill is not impaired. If the carrying value exceeds the fair value, the implied fair value of

goodwill is compared to the carrying value of goodwill. If the implied fair value exceeds the carrying

F-16

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)