XM Radio 2014 Annual Report Download - page 142

Download and view the complete annual report

Please find page 142 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

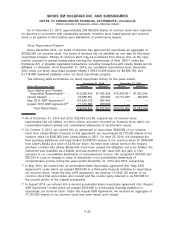

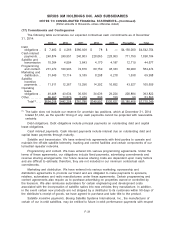

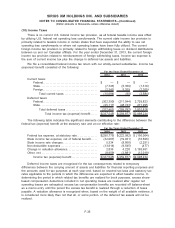

The tax effects of temporary differences that give rise to significant portions of the deferred tax

assets and deferred tax liabilities are presented below:

2014 2013

For the Years Ended

December 31,

Deferred tax assets:

Net operating loss carryforwards . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,818,719 $ 2,207,583

GM payments and liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 539 1,984

Deferred revenue. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 691,323 606,430

Severance accrual. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 271 388

Accrued bonus . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 28,170 25,830

Expensed costs capitalized for tax . . . . . . . . . . . . . . . . . . . . . . . 19,624 22,679

Deferred financing costs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 958 664

Investments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 46,751 45,078

Stock based compensation. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 79,296 71,794

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36,597 31,735

Total deferred tax assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,722,248 3,014,165

Deferred tax liabilities:

Depreciation of property and equipment . . . . . . . . . . . . . . . . . . (237,971) (188,675)

FCC license. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (789,857) (778,152)

Other intangible assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (213,086) (233,983)

Total deferred tax liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . (1,240,914) (1,200,810)

Net deferred tax assets before valuation allowance. . . . . . . . . . . . 1,481,334 1,813,355

Valuation allowance. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,995) (7,831)

Total net deferred tax asset . . . . . . . . . . . . . . . . . . . . . . . . . $ 1,476,339 $ 1,805,524

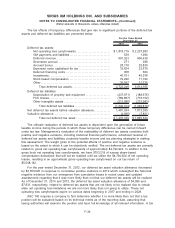

The ultimate realization of deferred tax assets is dependent upon the generation of future

taxable income during the periods in which those temporary differences can be carried forward

under tax law. Management’s evaluation of the realizability of deferred tax assets considers both

positive and negative evidence, including historical financial performance, scheduled reversal of

deferred tax assets and liabilities, projected taxable income and tax planning strategies in making

this assessment. The weight given to the potential effects of positive and negative evidence is

based on the extent to which it can be objectively verified. The net deferred tax assets are primarily

related to gross net operating loss carryforwards of approximately $4,794,924. In addition to the

gross book net operating loss carryforwards, we have $753,218 of excess share-based

compensation deductions that will not be realized until we utilize the $4,794,924 of net operating

losses, resulting in an approximate gross operating loss carryforward on our tax return of

$5,548,142.

For the year ended December 31, 2012, our deferred tax asset valuation allowance decreased

by $3,350,905 in response to cumulative positive evidence in 2012 which outweighed the historical

negative evidence from our emergence from cumulative losses in recent years and updated

assessments regarding that it was more likely than not that our deferred tax assets will be realized.

As of December 31, 2014 and 2013, the deferred tax asset valuation allowance of $4,995 and

$7,831, respectively, related to deferred tax assets that are not likely to be realized due to certain

state net operating loss limitations we are not more likely than not going to utilize. These net

operating loss carryforwards expire on various dates beginning in 2017 and ending in 2028.

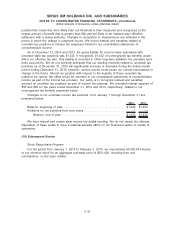

ASC 740 requires a company to first determine whether it is more likely than not that a tax

position will be sustained based on its technical merits as of the reporting date, assuming that

taxing authorities will examine the position and have full knowledge of all relevant information. A tax

F-36

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)