XM Radio 2014 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

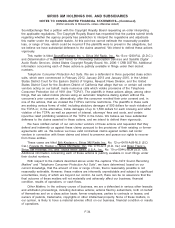

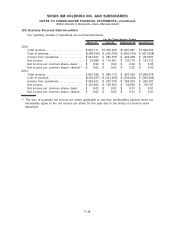

(18) Income Taxes

There is no current U.S. federal income tax provision, as all federal taxable income was offset

by utilizing U.S. federal net operating loss carryforwards. The current state income tax provision is

primarily related to taxable income in certain states that have suspended the ability to use net

operating loss carryforwards or where net operating losses have been fully utilized. The current

foreign income tax provision is primarily related to foreign withholding taxes on dividend distributions

between us and our Canadian affiliate. For the year ended December 31, 2013, the current foreign

income tax provision related to reimbursement of foreign withholding taxes. Income tax expense is

the sum of current income tax plus the change in deferred tax assets and liabilities.

We file a consolidated federal income tax return with our wholly-owned subsidiaries. Income tax

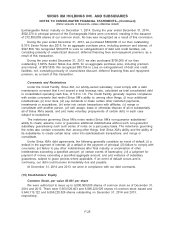

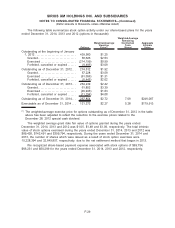

(expense) benefit consisted of the following:

2014 2013 2012

For the Years Ended December 31,

Current taxes:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ — $ — $ —

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,743) (5,359) (1,319)

Foreign. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (2,341) 5,269 (2,265)

Total current taxes. . . . . . . . . . . . . . . . . . . . . . . . . (10,084) (90) (3,584)

Deferred taxes:

Federal. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (302,350) (211,044) 2,729,823

State . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (25,111) (48,743) 271,995

Total deferred taxes . . . . . . . . . . . . . . . . . . . . . . . (327,461) (259,787) 3,001,818

Total income tax (expense) benefit . . . . . $(337,545) $(259,877) $2,998,234

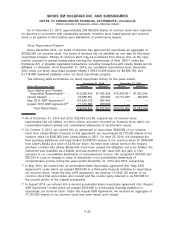

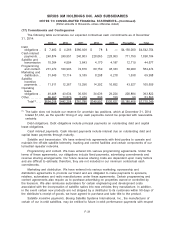

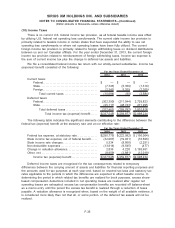

The following table indicates the significant elements contributing to the difference between the

federal tax (expense) benefit at the statutory rate and at our effective rate:

2014 2013 2012

For the Years Ended December 31,

Federal tax expense, at statutory rate . . . . . . . . . . . . . . . $(290,775) $(222,982) $ (166,064)

State income tax expense, net of federal benefit. . . . . (32,067) (19,031) (16,606)

State income rate changes . . . . . . . . . . . . . . . . . . . . . . . . . 5,334 (8,666) (2,251)

Non-deductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . (13,914) (9,545) (477)

Change in valuation allowance. . . . . . . . . . . . . . . . . . . . . . 2,836 4,228 3,195,651

Other, net . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (8,959) (3,881) (12,019)

Income tax (expense) benefit . . . . . . . . . . . . . . . . . . . $(337,545) $(259,877) $2,998,234

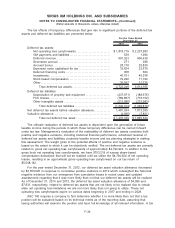

Deferred income taxes are recognized for the tax consequences related to temporary

differences between the carrying amount of assets and liabilities for financial reporting purposes and

the amounts used for tax purposes at each year-end, based on enacted tax laws and statutory tax

rates applicable to the periods in which the differences are expected to affect taxable income. In

determining the period in which related tax benefits are realized for book purposes, excess share-

based compensation deductions included in net operating losses are realized after regular net

operating losses are exhausted; excess tax compensation benefits are recorded off balance-sheet

as a memo entry until the period the excess tax benefit is realized through a reduction of taxes

payable. A valuation allowance is recognized when, based on the weight of all available evidence, it

is considered more likely than not that all, or some portion, of the deferred tax assets will not be

realized.

F-35

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)