XM Radio 2014 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.participant for such restricted stock) at such time as the shares are no longer subject to forfeiture

or restrictions on transfer for purposes of Section 83 of the Code (“Restrictions”). However, a

recipient who so elects under Section 83(b) of the Code within 30 days of the date of transfer of

the shares will have taxable ordinary income on the date of transfer of the shares equal to the

excess of the fair market value of such shares (determined without regard to the Restrictions) over

the purchase price, if any, of such restricted stock. If a Section 83(b) election has not been made,

any dividends received with respect to restricted stock that is subject to the Restrictions generally

will be treated as compensation that is taxable as ordinary income to the participant.

RSUs. No income generally will be recognized upon the award of RSUs. The recipient of a

RSU award generally will be subject to tax at ordinary income rates on the fair market value of

shares of our common stock on the date that such shares are transferred to the participant under

the award (reduced by any amount paid by the participant for such RSUs), and the capital

gains/loss holding period for such shares will also commence on such date.

Performance Awards/Other Stock based Awards. No income generally will be recognized upon

the grant of performance awards or other stock based awards. Upon payment in respect of the

performance awards or other stock based awards, the recipient generally will be required to include

as taxable ordinary income in the year of receipt an amount equal to the amount of cash received

and the fair market value of any of our common stock received.

Tax Consequences to Us or Our Subsidiaries

To the extent that a participant recognizes ordinary income in the circumstances described

above, we or the subsidiary for which the participant performs services will be entitled to a

corresponding deduction provided that, among other things, the income meets the test of

reasonableness, is an ordinary and necessary business expense, is not an “excess parachute

payment” within the meaning of Section 280G of the Code and is not disallowed by the $1 million

limitation on certain executive compensation under Section 162(m) of the Code.

Compliance with Section 162(m) of the Code

The 2015 Plan is designed to enable us to provide certain forms of performance-based

compensation to executive officers that may be able to meet the requirements for tax deductibility

under Section 162(m) of the Code.

Compliance with Section 409A of the Code

To the extent applicable, the 2015 Plan and any grants made thereunder is intended to comply

with the provisions of Section 409A of the Code, so that the income inclusion provisions of Section

409A(a)(1) of the Code do not apply to the participants. The 2015 Plan and any grants made under

the 2015 Plan will be administered in a manner consistent with this intent. Any reference in the

2015 Plan to Section 409A of the Code will also include any regulations or any other formal

guidance promulgated with respect to such Section by the U.S. Department of the Treasury or the

Internal Revenue Service.

Registration with the SEC

We intend to file a Registration Statement on Form S-8 relating to the issuance of shares of

our common stock under the 2015 Plan with the Securities and Exchange Commission pursuant to

the Securities Act of 1933, as amended, as soon as is practicable after approval of the 2015 Plan

by our stockholders.

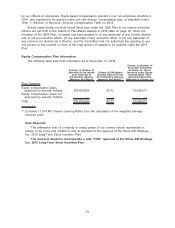

New Plan Benefits

Because awards to be granted in the future under the 2015 Plan are at the discretion of the

Committee, it is not possible to determine the benefits or the amounts to be received (or that would

have been received had the 2015 Plan been in effect for the last fiscal year) under the 2015 Plan

50