XM Radio 2014 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

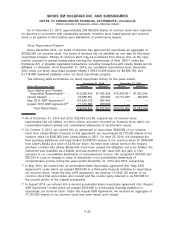

As of December 31, 2014, approximately 296,096,000 shares of common stock were reserved

for issuance in connection with outstanding warrants, incentive stock based awards and common

stock to be granted to third parties upon satisfaction of performance targets.

Stock Repurchase Program

Since December 2012, our board of directors has approved for repurchase an aggregate of

$6,000,000 our common stock. Our board of directors did not establish an end date for this stock

repurchase program. Shares of common stock may be purchased from time to time on the open

market, pursuant to pre-set trading plans meeting the requirements of Rule 10b5-1 under the

Exchange Act, in privately negotiated transactions, including transactions with Liberty Media and its

affiliates, or otherwise. As of December 31, 2014, our cumulative repurchases since December

2012 under our stock repurchase program totaled 1,259,274,498 shares for $4,285,192, and

$1,714,808 remained available under our stock repurchase program.

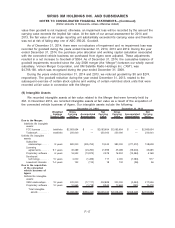

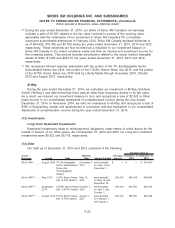

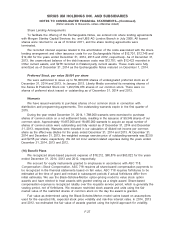

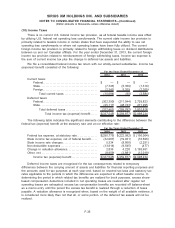

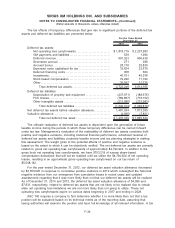

The following table summarizes our share repurchase activity for the years ended:

Share Repurchase Type Shares Amount Shares Amount

December 31, 2014 December 31, 2013

Open Market and Privately

Negotiated Repurchases(a) . . . . . . 422,965,443 $1,426,428 476,545,601 $1,602,360

Liberty Media(b) . . . . . . . . . . . . . . . . . . . 92,888,561 340,000 43,712,265 160,000

May 2014 ASR Agreement(c) . . . . . . 151,846,125 506,404 — —

August 2014 ASR Agreement(d) . . . 71,316,503 250,000 — —

Total Repurchases . . . . . . . . . . . 739,016,632 $2,522,832 520,257,866 $1,762,360

(a) As of December 31, 2014 and 2013, $26,034 and $0, respectively, of common stock

repurchases had not settled, nor been retired, and were recorded as Treasury stock within our

consolidated balance sheets and consolidated statements of stockholders’ equity.

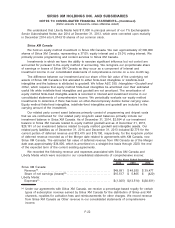

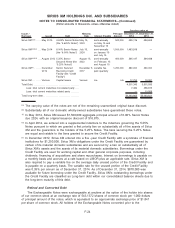

(b) On October 9, 2013, we entered into an agreement to repurchase $500,000 of our common

stock from Liberty Media. Pursuant to this agreement, we repurchased 43,712,265 shares of our

common stock for $160,000 from Liberty Media in 2013. On April 25, 2014, we completed the

final purchase installment and repurchased 92,888,561 shares of our common stock for $340,000

from Liberty Media at a price of $3.66 per share. As there were certain terms in the forward

purchase contract with Liberty Media that could have caused the obligation not to be fulfilled, the

instrument was classified as a liability and was marked to fair value with any gain or loss

recorded to our consolidated statements of comprehensive income. We recognized $34,485 and

$20,393 to Loss on change in value of derivatives in our consolidated statements of

comprehensive income during the years ended December 31, 2014 and 2013, respectively.

(c) In May 2014, we entered into an accelerated share repurchase agreement (the “May ASR

Agreement”) under which we prepaid $600,000 to a third-party financial institution to repurchase

our common stock. Under the May ASR Agreement, we received 151,846,125 shares of our

common stock that were retired upon receipt and the counter party returned to us $93,596 for

the unused portion of the original prepayment.

(d) In August 2014, we entered into a second accelerated share repurchase agreement (the “August

ASR Agreement”) under which we prepaid $250,000 to a third-party financial institution to

repurchase our common stock. Under the August ASR Agreement, we received an aggregate of

71,316,503 shares of our common stock that were retired upon receipt.

F-26

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)