XM Radio 2014 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2014 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

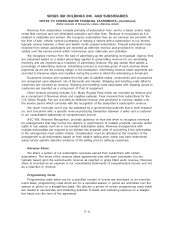

value then goodwill is not impaired; otherwise, an impairment loss will be recorded by the amount the

carrying value exceeds the implied fair value. At the date of our annual assessment for 2014 and

2013, the fair value of our single reporting unit substantially exceeded its carrying value and therefore

was not at risk of failing step one of ASC 350-20, Goodwill.

As of December 31, 2014, there were no indicators of impairment and no impairment loss was

recorded for goodwill during the years ended December 31, 2014, 2013 and 2012. During the year

ended December 31, 2014, the purchase price allocation and working capital calculation associated

with the connected vehicle business we purchased from Agero were adjusted. These adjustments

resulted in a net increase to Goodwill of $554. As of December 31, 2014, the cumulative balance of

goodwill impairments recorded since the July 2008 merger (the “Merger”) between our wholly owned

subsidiary, Vernon Merger Corporation, and XM Satellite Radio Holdings Inc. (“XM”), was

$4,766,190, which was recognized during the year ended December 31, 2008.

During the years ended December 31, 2014 and 2013, we reduced goodwill by $0 and $274,

respectively. The goodwill reduction during the year ended December 31, 2013, related to the

subsequent exercise of certain stock options and vesting of certain restricted stock units that were

recorded at fair value in connection with the Merger.

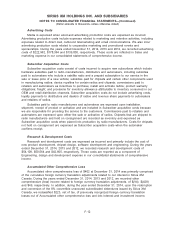

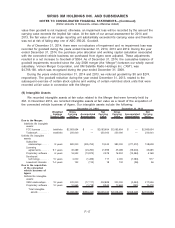

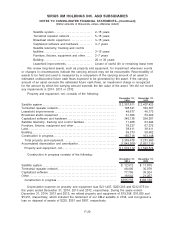

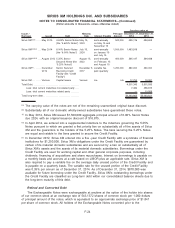

(9) Intangible Assets

We recorded intangible assets at fair value related to the Merger that were formerly held by

XM. In November 2013, we recorded intangible assets at fair value as a result of the acquisition of

the connected vehicle business of Agero. Our intangible assets include the following:

Weighted

Average

Useful Lives

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

Gross

Carrying

Value

Accumulated

Amortization

Net

Carrying

Value

December 31, 2014 December 31, 2013

Due to the Merger:

Indefinite life intangible

assets:

FCC licenses ....... Indefinite $2,083,654 $ — $2,083,654 $2,083,654 $ — $2,083,654

Trademark .......... Indefinite 250,000 — 250,000 250,000 — 250,000

Definite life intangible

assets:

Subscriber

relationships ...... 9 years 380,000 (305,755) 74,245 380,000 (271,372) 108,628

Licensing

agreements ....... 9.1 years 45,289 (23,290) 21,999 45,289 (19,604) 25,685

Proprietary software . 6 years 16,552 (13,973) 2,579 16,552 (13,384) 3,168

Developed

technology ........ 10 years 2,000 (1,283) 717 2,000 (1,083) 917

Leasehold interests. . 7.4 years 132 (114) 18 132 (96) 36

Due to the acquisition

of the connected

vehicle business of

Agero:

Definite life intangible

assets:

OEM relationships. . . 15 years 220,000 (17,111) 202,889 220,000 (2,444) 217,556

Proprietary software . 10 years 10,663 (1,718) 8,945 10,663 (245) 10,418

Total intangible

assets .......... $3,008,290 $(363,244) $2,645,046 $3,008,290 $(308,228) $2,700,062

F-17

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

(Dollar amounts in thousands, unless otherwise stated)