TCF Bank 2004 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6TCF Financial Corporation and Subsidiaries

Risks

We think it is appropriate to discuss what we consider to be the major

risks to our continued success. First, as demonstrated over the last two

years, the management of interest rate risk is a major challenge. The

measurements of interest rate risk are assumption laden and results

can quickly change. Changes in interest rates may also adversely

impact the value of TCF’s mortgage servicing rights. Second, TCF, like

all banks, is subject to the effects of economic activity. In particular,

a significant decline in home values in our markets could have a neg-

ative effect on our results. A bad economy can result in increased loan

and lease charge-offs. The third risk is our ability to attract and retain

new customers. Competition has stiffened and customer behavior is

changing. Debit card transactions now outnumber checks. Other

electronic transactions (ACH, ARC, Check 21, etc.) are all changing

customer behavior in checking. Our overall growth is dependent on our

ability to grow checking accounts and related fee income, while con-

trolling fraud losses and attrition. This area became more difficult in

2004 and will continue to be a challenge in 2005. We are also relying

on the continued long-term success of branch banking. Our de novo

banking expansion is staked on this premise.

Regulatory issues and the related compliance burden continue to

increase. The Bank Secrecy Act, the Patriot Act and the Sarbanes-Oxley

Act have increased our compliance risk. We are also subject to the risks

of new regulations. Legal and tax issues are always a risk (the 2003 Visa

debit card lawsuit is a good example of this legal risk).

None of these risks are new. Our consistent results over a long period

have proven that we have prudently managed these risks in the past

and we believe we are adequately prepared to manage them in the

future. Our philosophy at TCF is to run a highly profitable bank and to

minimize risk.

In Closing

A careful reading of this annual report will tell you everything about our

company. We try to keep our financial reporting simple, but as complete

as possible. In our opinion, TCF’s accounting is conservative.

We continue to have a mutuality of interest with our shareholders. Our

senior management and board of directors own approximately 12 mil-

lion shares, or 8.8 percent of TCF stock. Seventy-nine percent of our

eligible employees participate in TCF’s Employees Stock Purchase Plan,

which at year-end held over 8.1 million shares. Our stock plans for senior

management continue to be performance-based restricted stock grants

which vest based on long-term growth in earnings per share. These

stock grants are expensed in the income statement just like all the rest

of TCF’s expenses.

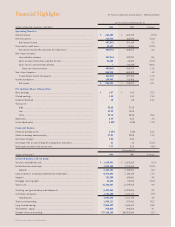

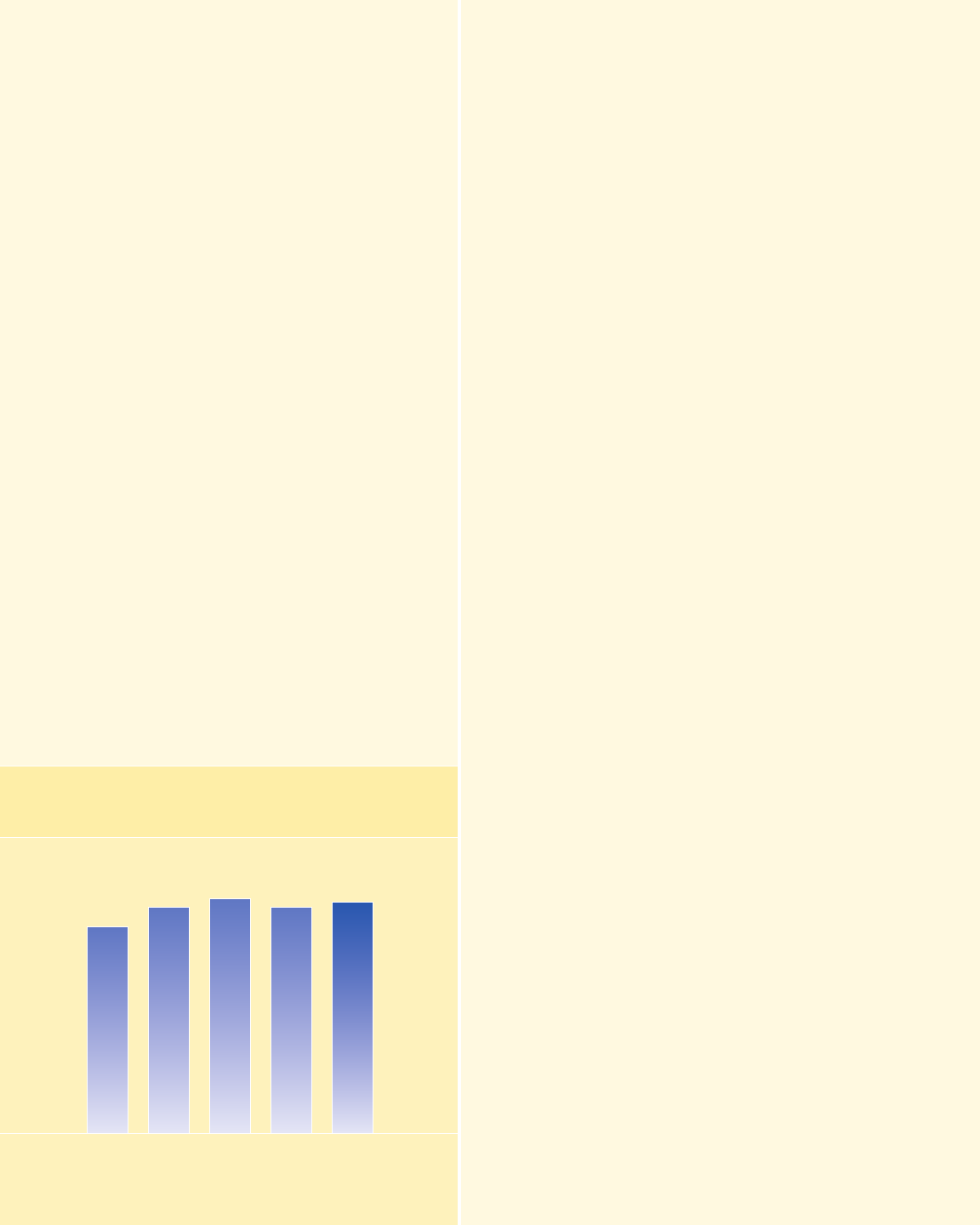

0403020100

Net Interest Income

(millions of dollars)

$439

$481 $499 $481 $492