TCF Bank 2004 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 73

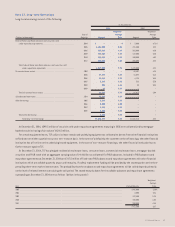

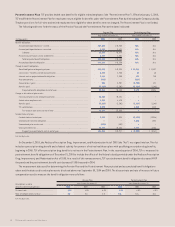

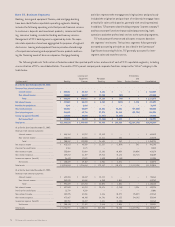

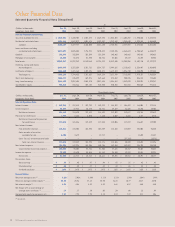

Note 22. Earnings Per Common Share

The computation of basic and diluted earnings per share is presented in the following table:

Year Ended December 31,

(Dollars in thousands, except per-share data) 2004 2003 2002

Basic Earnings Per Common Share

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 254,993 $ 215,878 $ 232,931

Weighted average shares outstanding . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 139,656,829 144,028,040 150,480,642

Unvested restricted stock grants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (3,040,397) (3,041,506) (3,289,758)

Weighted average common shares outstanding for basic earnings per common share . . . . . . . . . . . . . . . . . . 136,616,432 140,986,534 147,190,884

Basic earnings per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.87 $ 1.53 $ 1.58

Diluted Earnings Per Common Share

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 254,993 $ 215,878 $ 232,931

Weighted average number of common shares outstanding adjusted for effect of dilutive securities:

Weighted average common shares outstanding used in basic earnings per common share calculation . . . . . 136,616,432 140,986,534 147,190,884

Net dilutive effect of:

Stock option plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 182,577 187,346 248,444

Restricted stock plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 375,631 366,848 442,560

Weighted average common shares outstanding for diluted earnings per common share . . . . . . . . . . 137,174,640 141,540,728 147,881,888

Diluted earnings per common share . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 1.86 $ 1.53 $ 1.58

All shares of restricted stock are deducted from weighted average shares outstanding used for the computation of basic earnings per com-

mon share. All shares of restricted stock which vest over specified time periods are included in the calculation of diluted earnings per common

share using the treasury stock method. Shares of performance-based restricted stock are included in the calculation of diluted earnings per

common share, using the treasury stock method, at the beginning of the quarter in which the performance goals have been achieved.

During the third quarter of 2004, TCF announced and completed a two-for-one stock split of its common stock in the form of a 100% stock

dividend. As a result of the two-for-one stock split, all prior period share and per share data have been restated.

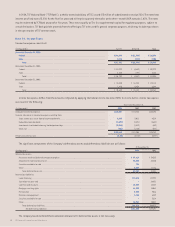

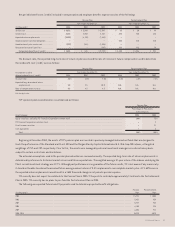

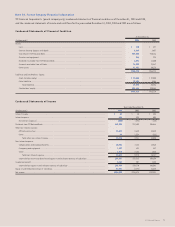

Note 23. Comprehensive Income

Comprehensive income is the total of net income and other comprehensive income (loss), which for TCF is comprised entirely of unrealized gains

and losses on investment securities available for sale. The following table summarizes the components of comprehensive income:

Year Ended December 31,

(In thousands) 2004 2003 2002

Net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $254,993 $215,878 $232,931

Other comprehensive (loss) income:

Unrealized holding gains (losses) arising during the period on securities available for sale . . . . . . . . . . . . . 11,522 (30,619) 74,044

Reclassification adjustment for gains included in net income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (22,600) (32,832) (11,536)

Income tax (benefit) expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (4,011) (23,001) 22,635

Total other comprehensive (loss) income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (7,067) (40,450) 39,873

Comprehensive income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $247,926 $175,428 $272,804

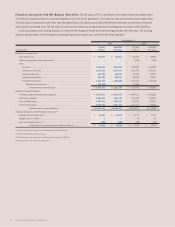

Note 24. Other Expense

Other expense consists of the following:

Year Ended December 31,

(In thousands) 2004 2003 2002

Deposit account losses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 22,624 $ 18,820 $ 19,206

Postage and courier . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14,002 14,358 13,579

Telecommunication . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,459 12,634 12,738

Card processing and issuance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12,446 12,213 11,095

Office supplies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,891 9,316 9,023

ATM processing . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9,171 9,545 10,071

Federal deposit insurance and OCC assessments . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,682 2,796 2,761

Deposit base intangible amortization . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,662 1,666 1,671

Mortgage servicing liquidation expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,460 4,352 2,394

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 55,743 57,646 57,431

Total other expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $142,140 $143,346 $139,969