TCF Bank 2004 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 19

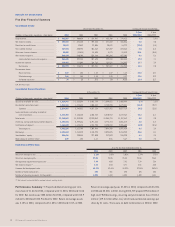

Net interest income, the difference between interest income

earned on loans and leases and on investments, and interest expense

paid on deposits and short-term and long-term borrowings, repre-

sents 50.1% of TCF’s total revenue. Net interest income can change

significantly from period to period based on general levels of inter-

est rates, customer prepayment patterns, the mix of interest earning

assets and the mix of interest bearing and non-interest bearing

deposits and borrowings. TCF manages the risk of changes in interest

rates on its net interest income through an Asset/Liability Committee

and through related interest rate risk monitoring and management

policies. See “Market Risk – Interest-Rate Risk” for further discus-

sion of TCF’s interest rate risk position.

The historically low interest rates in 2003 and 2004 were a

significant challenge to asset/liability risk and management made

several key decisions that impacted TCF’s results. These very low

interest rates caused a high level of prepayment in the residential

loan and mortgage-backed securities portfolio, which declined a

combined $111.8 million during 2004 and $1.5 billion during 2003.

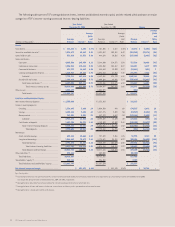

The Company’s Visa debit card program has grown significantly

since its inception in 1996. TCF is one of the largest issuers of Visa

Classic debit cards in the United States. TCF earns interchange rev-

enue from customer debit card transactions. During 2004, 88.7% of

TCF’s debit card sales volume was generated from off-line (signature-

based) transactions. The average interchange rate on these off-line

transactions was 1.40% in 2004 compared with 1.43% in 2003. The

decrease in the average off-line interchange rate was the result of

Visa establishing new interchange rates, as part of the settlement

of its class action lawsuits, which took effect in August 2003 and

were revised in February 2004. Class action litigation against Visa

brought by certain merchants who chose not to participate in the

2003 settlements remains pending. In October 2004, the United

States Supreme Court decided not to hear an appeal of a ruling

that Visa and MasterCard may not bar member banks from issuing

cards on rival networks. Rival card networks, such as Discover and

American Express, have brought or are considering bringing private

legal action against Visa and MasterCard. Visa is a defendant in

several other legal actions. The ultimate impact of any such litiga-

tion cannot be predicted at this time. The continued success of

TCF’s debit card program is dependent on the success and viability

of Visa and the continued use by customers and acceptance by

merchants of its debit cards.

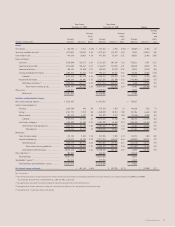

TCF’s mortgage banking business originated residential mortgage

loans and sold them to investors, primarily retaining the servicing

rights and related servicing revenue. During 2004, TCF restructured

its mortgage banking business by eliminating the wholesale loan

origination activities and downsizing and integrating its retail loan

origination function with TCF’s consumer lending business. TCF’s

mortgage banking business no longer originates any new loans and

continues to service the remaining $4.5 billion portfolio of mortgage

loans for third party investors. Generally accepted accounting prin-

ciples require TCF to record the value of the servicing rights on the

balance sheet at the time the loans are sold. Capitalized mortgage

servicing rights are amortized in proportion to, and over the period

of, estimated related servicing revenues and are also evaluated

quarterly for impairment. As interest rates fall, there is a higher

probability of prepayment as the customer can generally refinance

the loan with relative ease. In addition, as property values increase,

customers’ home equity increases, enabling customers to engage in

“cash-out” refinance transactions where the customer refinances

an existing mortgage into a higher balance loan in order to draw out

the increased home equity. TCF does not utilize derivatives to man-

age the impairment risk in its capitalized mortgage servicing rights.

The following portions of the Management’s Discussion and

Analysis focus in more detail on the results of operations for 2004,

2003 and 2002 and on information about TCF’s balance sheet, credit

quality, liquidity and funding resources, capital, critical accounting

estimates and other matters.