TCF Bank 2004 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 71

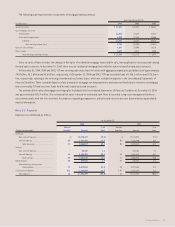

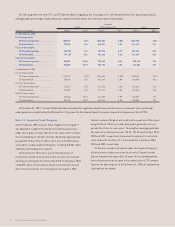

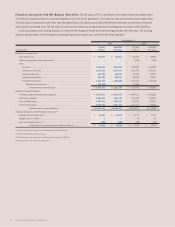

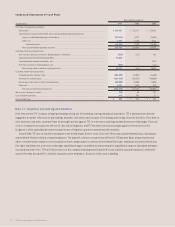

Commitments to Extend Credit Commitments to extend credit

are agreements to lend to a customer provided there is no violation

of any condition in the contract. These commitments generally have

fixed expiration dates or other termination clauses and may require

payment of a fee. Since certain of the commitments are expected

to expire without being drawn upon, the total commitment amounts

do not necessarily represent future cash requirements. Collateral

predominantly consists of residential and commercial real estate.

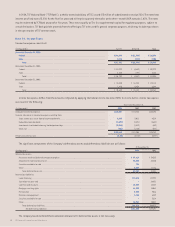

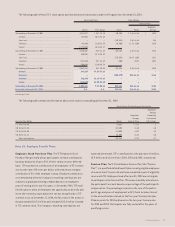

Loans Serviced with Recourse Loans serviced with recourse

represent a contingent guarantee based upon failure to perform

by another party. These loans consist of $94.9 million of Veterans

Administration (“VA”) loans and $2.7 million of loans sold with

recourse to the Federal National Mortgage Association (“FNMA”).

As is typical of a servicer of VA loans, TCF must cover any principal

loss in excess of the VA’s guarantee if the VA elects its “no-bid”

option upon the foreclosure of a loan. TCF has established a liability

of $100 thousand relating to this VA “no-bid” exposure on VA loans

serviced with partial recourse at December 31, 2004 and 2003,

respectively, which was recorded in other liabilities. No significant

claims have been made under the “no-bid” option during 2004 or

2003. Loans sold with recourse to FNMA represent residential real

estate loans sold to FNMA prior to 1982. The contingent guarantee

related to both types of recourse remains in effect for the duration

of the loans and thus expires in various years through the year 2034.

All loans sold with recourse are collateralized by residential real

estate. Since conditions under which TCF would be required to cover

any principal loss in excess of the VA’s guarantee or repurchase the

loan sold to FNMA may not materialize, the actual cash requirements

are expected to be less than the outstanding commitments.

Standby Letters of Credit Standby letters of credit

and guarantees on industrial revenue bonds are conditional

commitments issued by TCF guaranteeing the performance of a

customer to a third party. These conditional commitments expire

in various years through the year 2009. Collateral held primarily

consists of commercial real estate mortgages. Since the conditions

under which TCF is required to fund these commitments may not

materialize, the cash requirements are expected to be less than

the total outstanding commitments.

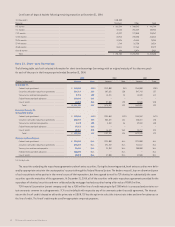

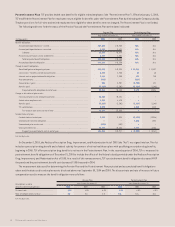

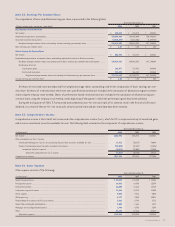

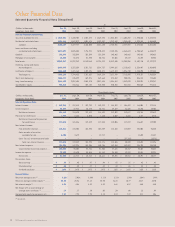

Note 21. Fair Values of Financial Instruments

TCF is required to disclose the estimated fair value of financial

instruments, both assets and liabilities on and off the balance sheet,

for which it is practicable to estimate fair value. Fair value estimates

are made at a specific point in time, based on relevant market infor-

mation and information about the financial instruments. Fair value

estimates are subjective in nature, involving uncertainties and mat-

ters of significant judgment, and therefore cannot be determined

with precision. Changes in assumptions could significantly affect

the estimates.

The carrying amounts of cash and due from banks, investments

and accrued interest payable and receivable approximate their fair

values due to the short period of time until their expected realiza-

tion. Securities available for sale are carried at fair value, which

is based on quoted market prices. Certain financial instruments,

including lease financings and discounted lease rentals, and all

non-financial instruments are excluded from fair value of financial

instrument disclosure requirements.

The following methods and assumptions are used by the Company

in estimating fair value disclosures for its remaining financial instru-

ments, all of which are issued or held for purposes other than trading.

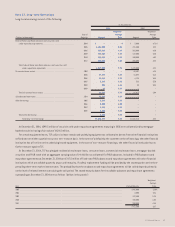

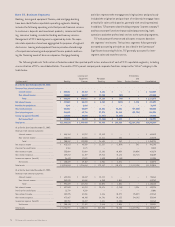

Loans The fair value of residential loans is estimated based on

quoted market prices of loans with similar characteristics. For certain

variable-rate loans that reprice frequently and that have experienced

no significant change in credit risk, fair values are based on carrying

values. The fair values of other loans are estimated by discounting

contractual cash flows adjusted for prepayment estimates, using

interest rates currently being offered for loans with similar terms to

borrowers with similar credit risk characteristics.

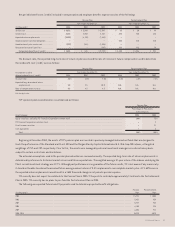

Deposits The fair value of checking, savings and money market

deposits is deemed equal to the amount payable on demand.

The fair value of certificates of deposit is estimated based on

discounted cash flow analyses using interest rates offered by TCF

for certificates of deposit with similar remaining maturities. The

intangible value of long-term relationships with depositors is not

taken into account in the fair values disclosed.

Borrowings The carrying amounts of short-term borrowings

approximate their fair values. The fair values of TCF’s long-term

borrowings are estimated based on quoted market prices or

discounted cash flow analyses using interest rates for borrowings

of similar remaining maturities.