TCF Bank 2004 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72 TCF Financial Corporation and Subsidiaries

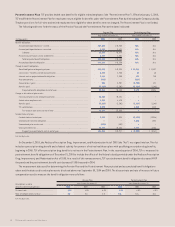

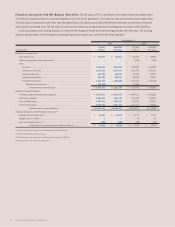

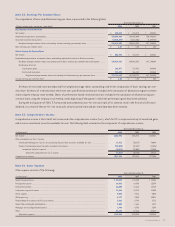

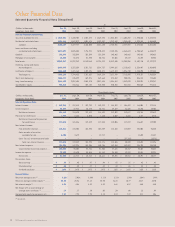

Financial Instruments with Off-Balance-Sheet Risk The fair values of TCF’s commitments to extend credit and standby letters

of credit are estimated using fees currently charged to enter into similar agreements. For fixed-rate loan commitments and standby letters

of credit issued in conjunction with fixed-rate loan agreements, fair value also considers the difference between current levels of interest

rates and the committed rates. The fair value of loans serviced with recourse approximates the carrying value recorded in other liabilities.

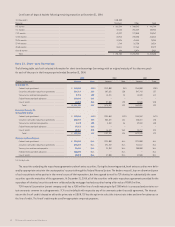

As discussed above, the carrying amounts of certain of the Company’s financial instruments approximate their fair value. The carrying

amounts and fair values of the Company’s remaining financial instruments are set forth in the following table:

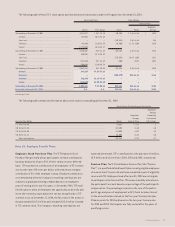

At December 31,

2004 2003

Carrying Estimated Carrying Estimated

(In thousands) Amount Fair Value Amount Fair Value

Financial instrument assets:

Loans held for sale . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 154,279 $ 155,611 $ 335,372 $ 340,189

Forward mortgage loan sales commitments (1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ––(1,105) (1,105)

Loans:

Consumer . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4,418,588 4,415,340 3,630,341 3,649,810

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,154,396 2,171,409 1,916,701 1,947,267

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 424,135 424,354 427,696 429,727

Equipment finance loans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 334,352 332,734 309,740 312,948

Residential real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,014,166 1,022,328 1,212,643 1,247,610

Allowance for loan losses(2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (58,966) – (67,654) –

Total financial instrument assets . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,440,950 $ 8,521,776 $ 7,763,734 $ 7,926,446

Financial instrument liabilities:

Checking, savings and money market deposits . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 6,493,545 $ 6,493,545 $ 5,999,626 $ 5,999,626

Certificates of deposit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,468,650 1,483,190 1,612,123 1,630,511

Short-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,056,111 1,056,111 878,412 878,412

Long-term borrowings . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2,048,492 2,091,412 1,536,413 1,627,253

Total financial instrument liabilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $11,066,798 $11,124,258 $10,026,574 $10,135,802

Financial instruments with off-balance-sheet risk:(3)

Commitments to extend credit(4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 28,551 $ 28,551 $ 22,773 $ 22,773

Standby letters of credit(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8843 43

Loans serviced with recourse(1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (100) (100) (100) (100)

Total financial instruments with off-balance-sheet risk . . . . . . . . . . . . . . $ 28,459 $ 28,459 $ 22,716 $ 22,716

(1) Carrying amounts are included in accrued expenses and other liabilities.

(2) Excludes the allowance for lease losses.

(3) Positive amounts represent assets, negative amounts represent liabilities.

(4) Carrying amounts are included in other assets.