TCF Bank 2004 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

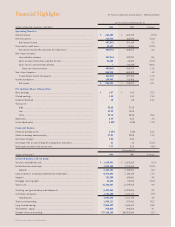

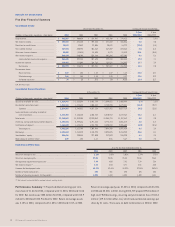

10 TCF Financial Corporation and Subsidiaries

0403020100

Retail Distribution Growth

(number of branches)

352 375 395 401

430

Traditional Branches Supermarket Branches

TCF Lakeshore’s supermarket division reached the billion-dollar mark in

total deposits early in 2004. This division has branches inside Jewel-Osco®

stores, the leading grocery chain by market share in Chicago, and in

certain Cub Foods stores. Not content to be the “most convenient bank”

with seven-day-a-week banking and long hours (84 hours a week in

the supermarkets), TCF has begun remodeling and upgrading many of

its supermarket branches. Certain branches will have a new plasma-

screen merchandising system installed, allowing TCF to combine prod-

uct messages, current promotions, news, weather, and sports

information for the consideration and enjoyment of our customers.

In Michigan, TCF has focused its expansion efforts in the Detroit metro

area with five offices opened in 2004 and eight planned for 2005.

Michigan’s consumer lending division and commercial lending group

achieved double-digit growth in 2004 and plan to expand its number of

lenders in 2005. Also, TCF Michigan recently added 11 business bankers

with plans to add several more to meet its aggressive 2005 goals.

The Colorado franchise in Denver and Colorado Springs is TCF’s fastest

growing market and continues to represent an area of great poten-

tial for future expansion. TCF Colorado now has 32 total branches:

20 traditional branches and 12 supermarket branches. By the end of

2005, TCF Colorado plans to incorporate a business banking division

and open ten new branches.

In addition to our banking franchise, we have a separate leasing and

equipment finance group headquartered in Minnetonka, Minnesota.

TCF has developed an experienced team of equipment finance pro-

fessionals that provide a variety of unique finance solutions to a

diverse group of small to large commercial customers. TCF’s leasing

and equipment finance operations is national in scope with a broad

range of equipment types financed in all 50 states. During 2004, our

leasing and equipment finance portfolio increased 19 percent and new

business volume rose more than 27 percent.

TCF’s holding company and corporate functions provide capital and

centralized management services such as data processing, bank

operations, product development and marketing, finance, treasury

services, employee benefits, legal, compliance, credit review, and

internal audit. This structure gives locally managed banks the flexi-

bility to share, compare and refine new products and services while

enjoying the economies of scale of a much larger organization.

Strategies

TCF’s banking philosophy is based on carefully planned and consistently

executed business strategies. These strategies have become the prin-

ciples by which TCF conducts its business. TCF’s long-term strategies

for growth are somewhat unique among our competitors and have

served, and will continue to serve, our customers and shareholders well.

TCF’s strategies begin with the premise that every customer is valu-

able. We bank a large and diverse customer base. We do not believe

in focusing only on one “profitable” customer segment. Every customer

is potentially profitable and may become more so over time through

cross-sell initiatives. Each of our many customers contributes incre-

mentally to our revenue.