TCF Bank 2004 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report 29

Mortgage servicing revenues can be significantly impacted by the

amount of amortization and provision for impairment of mortgage

servicing rights. The valuation of mortgage servicing rights is a criti-

cal accounting estimate for TCF. This estimate is based upon loan

types, note rates and prepayment assumptions. Changes in the mix

of loans, interest rates, defaults or prepayment speeds may have a

material effect on the amortization amount and possible impairment

in valuation. In a declining interest rate environment, prepayment

speed assumptions will increase and result in an acceleration in

the amortization of the mortgage servicing rights as the assumed

underlying portfolio declines and also may result in impairment as

the value of the mortgage servicing rights decline. TCF periodically

evaluates its capitalized mortgage servicing rights for impairment.

A key component in determining the fair value of mortgage servicing

rights is the projected cash flows of the underlying loan portfolio.

TCF uses projected cash flows and related prepayment assumptions

based on management’s best estimates. See Notes 1 and 10 of Notes

to Consolidated Financial Statements for additional information

concerning TCF’s mortgage servicing rights.

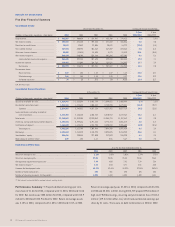

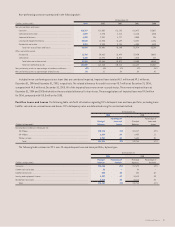

The following tables summarize the servicing portfolio by interest rate tranche, the prepayment speed assumptions and the weighted average

remaining life of the loans by interest rate tranche used in the determination of the value and amortization of mortgage servicing rights as of

December 31, 2004 and 2003:

At December 31,

(Dollars in thousands) 2004 2003

Prepayment Weighted Prepayment Weighted

Unpaid Speed Average Life Unpaid Speed Average Life

Interest Rate Tranche Balance Assumption (in Years) Balance Assumption (in Years)

0 to 5.50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $1,707,934 11.3% 7.5 $1,648,918 13.3% 7.2

5.51 to 6.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1,409,983 16.1 5.8 1,407,315 17.9 5.6

6.01 to 6.50% . . . . . . . . . . . . . . . . . . . . . . . . . . . . 691,148 23.2 4.0 830,161 25.4 3.8

6.51 to 7.00% . . . . . . . . . . . . . . . . . . . . . . . . . . . . 453,017 25.6 3.4 740,675 31.8 2.7

7.01% and higher . . . . . . . . . . . . . . . . . . . . . . . . . 241,482 27.6 3.0 495,672 35.5 2.3

$4,503,564 15.8 5.8 $5,122,741 19.0 5.1

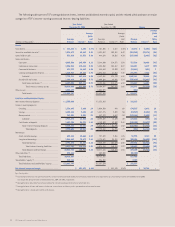

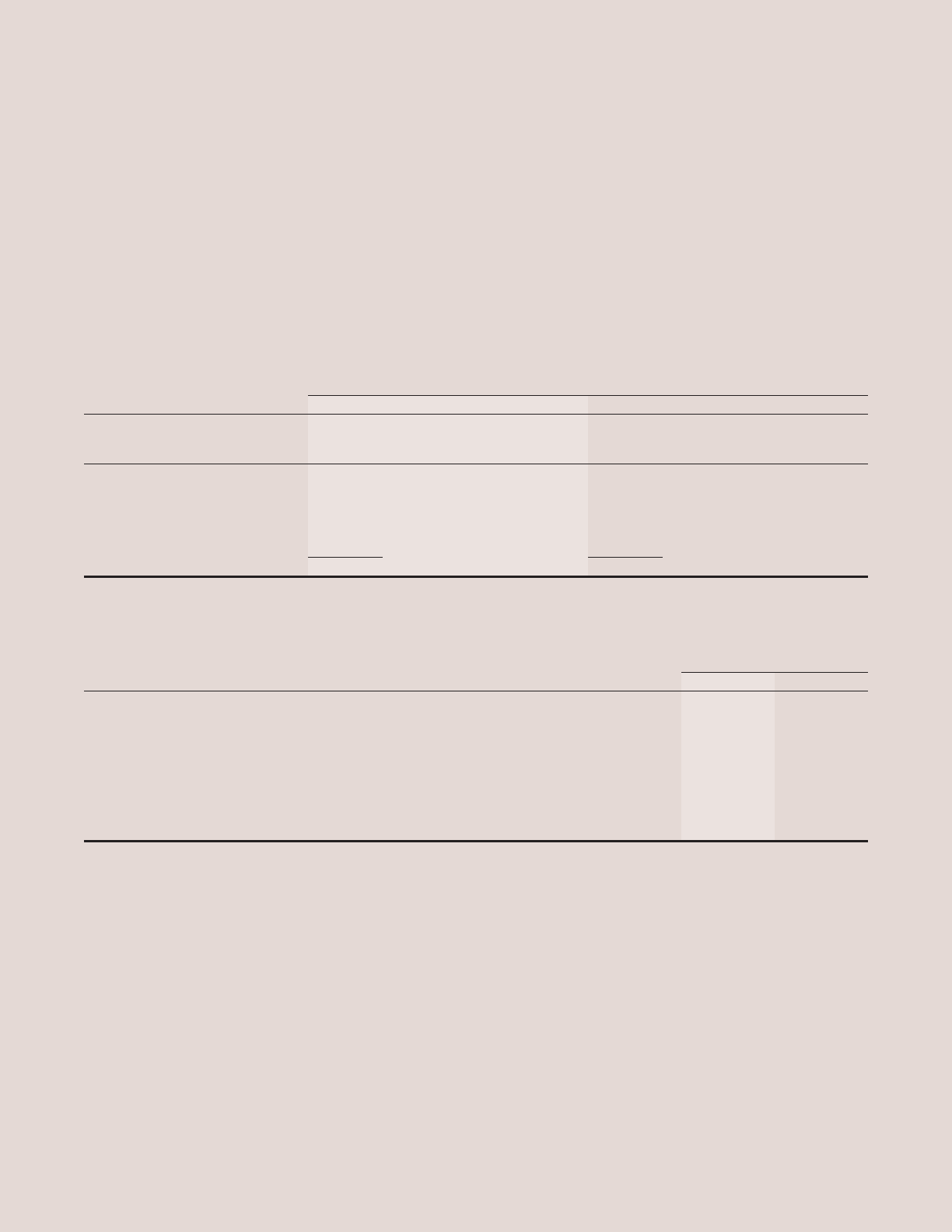

At December 31, 2004 and 2003, the sensitivities of the current fair value of mortgage servicing rights to a hypothetical immediate 10% and

25% adverse change in prepayment speed assumptions and discount rate are as follows:

At December 31,

(Dollars in millions) 2004 2003

Fair value of mortgage servicing rights . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $55.9 $58.0

Weighted-average life (in years) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5.8 5.1

Weighted average prepayment speed assumption . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.8% 19.0%

Weighted average discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7.5% 7.5%

Impact on fair value of 10% adverse change in prepayment speed assumptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(3.1) $(3.2)

Impact on fair value of 25% adverse change in prepayment speed assumptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(7.1) $(7.4)

Impact on fair value of 10% adverse change in discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(1.5) $(1.3)

Impact on fair value of 25% adverse change in discount rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $(3.4) $(3.3)

These sensitivities are theoretical and should be used with cau-

tion. As the figures indicate, changes in fair value based on a given

variation in assumptions generally cannot be extrapolated because

the relationship of the change in assumption to the change in fair

value may not be linear. Also, in the above table, the effect of a

variation in a particular assumption on the fair value of the mortgage

servicing rights is calculated independently without changing any

other assumptions. In reality, changes in one factor may result in

changes in another (for example, changes in prepayment speed

estimates could result in changes in discount rates or market

interest rates), which might either magnify or counteract the

sensitivities. TCF does not use derivatives to hedge its mortgage

servicing rights asset.