TCF Bank 2004 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

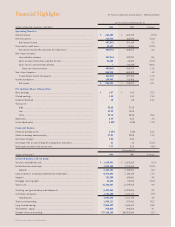

4TCF Financial Corporation and Subsidiaries

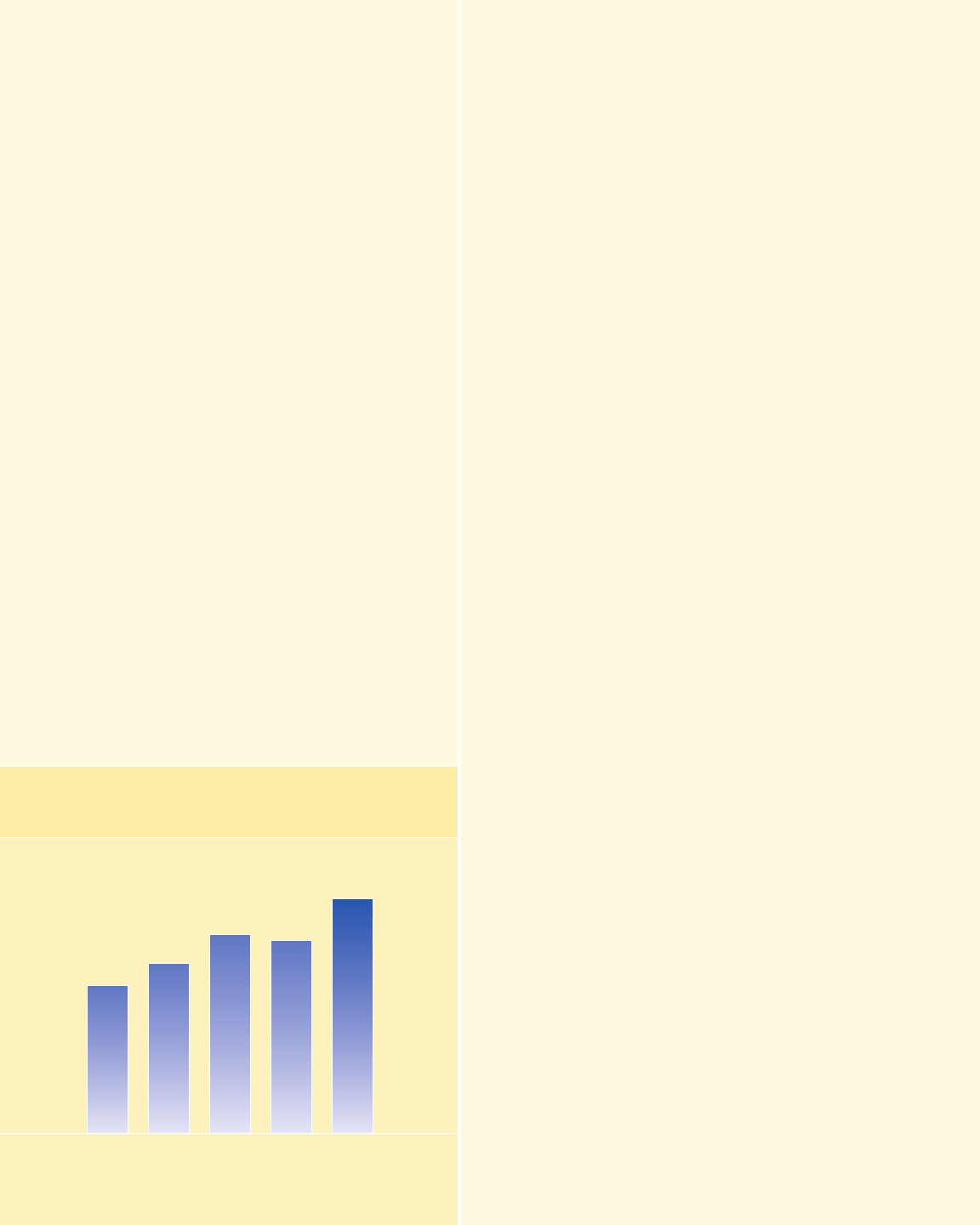

0403020100

Diluted EPS

(dollars)

$1.17

$1.35

$1.58 $1.53

$1.86

a flattening of the yield curve, which hurt our net interest margin.

TCF’s longer-term mortgage backed securities (MBSs) and fixed-rate

loans were originated or purchased at lower yields than the loans

and MBSs that were repaid or sold.

2. Credit quality improved in 2004 and remained very strong. TCF’s $18.8

million leveraged lease to Delta Airlines remains a possible dark

cloud on the horizon. This situation improved in the fourth quarter

of 2004 as Delta averted bankruptcy, but we are not yet out of

the woods.

3. TCF’s checking account growth slowed in 2004. The number of

checking accounts grew in 2004 by 91,000 accounts (up 6.3 per-

cent) compared to 106,000 (up 8 percent) in 2003. While our new

account openings were fairly close to our expectations, despite

increased competition, we were hurt by higher than anticipated

attrition. Checking account customers are changing their behavior.

Debit card transactions continue to replace checks and there are

more ACH transactions. This change in behavior impacts TCF’s fee

income. Some of our customers have abused their debit card spend-

ing privileges and, as a result, their accounts have been closed. This

has negatively impacted TCF’s fees and service charges. We are work-

ing to address this situation, but its impact will continue into 2005.

TCF’s card revenue grew 19.5 percent in 2004 to $63.3 million. The

debit card is now an integral part of the checking account with many

customers using their cards more frequently than they write checks.

4. During 2004, TCF restructured its mortgage banking business.

Wholesale loan origination activities were eliminated and the retail

loan origination function was downsized and integrated into our

consumer lending area. We believe these actions will improve future

profitability, lower TCF’s prepayment risk and lower future earn-

ings volatility from this cyclical business. We continue to evaluate

our options as it relates to the remaining $4.5 billion mortgage

servicing portfolio.

5. TCF realized $22.6 million of gains on MBS sales in 2004 versus $32.8

million of gains in 2003. In 2003, TCF incurred $44.3 million of debt

prepayment penalties to cancel high cost fixed-rate borrowings.

We sold MBSs in 2004 when longer-term interest rates hovered near

40 year lows.

Power Assets®and Power Liabilities®

TCF continued to experience strong growth in its core businesses in 2004.

Power Assets grew 17.3 percent. Consumer loans increased 21.7 per-

cent, which is an excellent performance. Commercial loans increased

10 percent, which was a good performance. Leasing and equipment

finance showed a strong increase of 18.5 percent which was aided