TCF Bank 2004 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40 TCF Financial Corporation and Subsidiaries

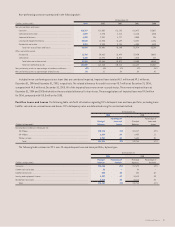

Liquidity Management TCF manages its liquidity position to

ensure that the funding needs of depositors and borrowers are met

promptly and in a cost-effective manner. Asset liquidity arises from

the ability to convert assets to cash as well as from the maturity of

assets. Liability liquidity results from the ability of TCF to attract a

diversity of funding sources to promptly meet funding requirements.

Deposits are the primary source of TCF’s funds for use in lending

and for other general business purposes. In addition to deposits,

TCF derives funds primarily from loan and lease repayments, proceeds

from the discounting of leases and borrowings. Deposit inflows and

outflows are significantly influenced by general interest rates, money

market conditions, competition for funds, customer service and other

factors. TCF’s deposit inflows and outflows have been and will con-

tinue to be affected by these factors. Borrowings may be used to

compensate for reductions in normal sources of funds, such as

deposit inflows at less than projected levels, net deposit outflows

or to support expanded activities. Historically, TCF has borrowed

primarily from the FHLB, from institutional sources under

repurchase agreements and, to a lesser extent, from other sources.

At December 31, 2004, TCF had over $2.2 billion in unused capacity

under these funding sources, which could be used to meet future

liquidity needs. See “Borrowings.”

Potential sources of liquidity for TCF Financial Corporation (par-

ent company only) include cash dividends from TCF’s wholly owned

bank subsidiary, issuance of equity securities and borrowings under

a $105 million line of credit. TCF’s National Bank’s ability to pay divi-

dends or make other capital distributions to TCF is restricted by reg-

ulation and may require regulatory approval. Undistributed earnings

and profits at December 31, 2004 includes approximately $134.4

million for which no provision for federal income tax has been made.

This amount represents earnings appropriated to bad debt reserves

and deducted for federal income tax purposes, and is generally not

available for payment of cash dividends or other distributions to

shareholders without incurring an income tax liability based on the

amount of earnings removed and current tax rates.

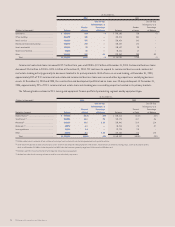

Potential Problem Loans and Leases In addition to non-

performing assets, there were $71.1 million of loans and leases at

December 31, 2004, for which management has concerns regarding

the ability of the borrowers to meet existing repayment terms, com-

pared with $48.1 million at December 31, 2003. These loans and

leases are primarily classified for regulatory purposes as substandard

and reflect the distinct possibility, but not the probability, that the

Company will not be able to collect all amounts due according to the

contractual terms of the loan or lease agreement. Although these

loans and leases have been identified as potential problem loans

and leases, they may never become non-performing. Additionally,

these loans and leases are generally secured by commercial real

estate or assets, thus reducing the potential for loss should they

become non-performing. Potential problem loans and leases are

considered in the determination of the adequacy of the allowance

for loan and lease losses. At December 31, 2004, commercial busi-

ness potential problem loans were up $5.4 million from December

31, 2003. Commercial real estate potential problem loans totaled

$34.1 million at December 31, 2004, and were up $13.9 million from

December 31, 2003, primarily due to the addition of two large proper-

ties. Leasing and equipment finance potential problem loans include

$1.2 million and $1.1 million funded on a non-recourse basis at

December 31, 2004 and 2003, respectively.

Potential problem loans and leases are summarized as follows:

At December 31, Change

(Dollars in thousands) 2004 2003 $%

Commercial real estate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $34,138 $20,279 $13,859 68.3%

Commercial business . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,112 12,721 5,391 42.4

Leasing and equipment finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18,816 15,094 3,722 24.7

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $71,066 $48,094 $22,972 47.8