TCF Bank 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 TCF Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46 TCF Financial Corporation and Subsidiaries

Summary of Critical Accounting Estimates Critical

accounting estimates occur in certain accounting policies and

procedures and are particularly susceptible to significant change.

Policies that contain critical accounting estimates include the

determination of the allowance for loan and lease losses, mortgage

servicing rights, income taxes, lease financings and pension liability

and expenses. See Note 1 of Notes to Consolidated Financial

Statements for further discussion of critical accounting estimates.

Recent Accounting Developments In December 2004, the

Financial Accounting Standards Board issued Statement of Financial

Accounting Standard (SFAS) No. 123R, Share-Based Payment which

revised SFAS No. 123, Accounting for Stock-Based Compensation.

This Statement supersedes APB Opinion No. 25, Accounting for Stock

Issued to Employees, and related implementation guidance and

amends SFAS No. 95, Statement of Cashflows. It requires that all

stock-based compensation now be measured at fair value and rec-

ognized as expense in the income statement. This Statement also

clarifies and expands guidance on measuring fair value, requires

estimation of forfeitures when determining expense, and requires

that excess tax benefits be shown as financing cash inflows versus

a reduction of taxes paid in the statement of cashflows. Various

other changes are also required. This statement is effective begin-

ning July 1, 2005. TCF adopted the recognition provisions of SFAS123

in January 2000. TCF expects no significant effect on TCF’s financial

statements upon adoption of this Statement.

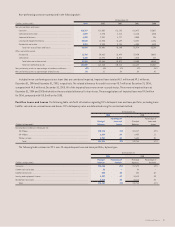

Fourth Quarter Summary In the fourth quarter of 2004, TCF

reported net income of $67.4 million, compared with $59.5 million in

the fourth quarter of 2003. Diluted earnings per common share was

50 cents for the fourth quarter of 2004, compared with 43 cents for

the fourth quarter of 2003. TCF opened 12 new branches in the fourth

quarter of 2004, of which four were supermarket branches.

Net interest income was $126.5 million and $119.1 million for the

quarter ended December 31, 2004 and 2003 respectively. The net

interest margin was 4.56% and 4.68% for the fourth quarter of 2004

and 2003, respectively. TCF’s net interest income increased by $7.4

million, or 6.2% over the fourth quarter of 2003. Of this increase in

net interest income, $10.5 million was due to volume changes, partially

offset by a decrease of $3.1 million due to interest rate changes.

TCF provided $4.1 million for credit losses in the fourth quarter of

2004, compared with $4 million in the fourth quarter of 2003. Net loan

and lease charge-offs were $3.2 million, or .14% of average loans

and leases outstanding, compared with $6.1 million, or .30% of

average loans and leases outstanding during the same 2003 period.

Non-interest income increased $17.7 million, or 15.4%, during the

fourth quarter of 2004 to $132.5 million. Banking fees and other rev-

enue increased $7.9 million, or 8.8%, over the fourth quarter of 2003.

Card revenues, included in banking fees and other revenue, totaled

$17.5 million for the fourth quarter of 2004, up $5.4 million, or

44.7% over the same quarter in 2003. The increase was attributable

to a 21.2% increase in sales volume coupled with an 18 basis point

increase in the average off-line interchange rate. Leasing and

equipment finance revenues were up $5.7 million, or 36.9%, over the

fourth quarter of 2003 due to increases in sales-type lease revenues.

Non-interest expense increased $12.2 million, or 8.5%, in the

fourth quarter of 2004 to $154.4 million. Compensation and employee

benefits increased $9.6 million, or 12.5%, from the fourth quarter of

2003, primarily driven by a $4.2 million increase in incentive compen-

sation resulting from improved performance in 2004 and a $1.9 million

increase related to new branches opened during the past 12 months.

Occupancy and equipment expenses increased $2.1 million, or 9%,

from the fourth quarter of 2003, with $1.4 million relating to costs

associated with new branch expansion.

In the fourth quarter of 2004, the effective income tax rate was

32.96% of income before tax expense compared with 32.14% for the

fourth quarter of 2003.

Earnings Teleconference and Website Information TCF

hosts quarterly conference calls to discuss its financial results.

Additional information regarding TCF’s conference calls can be

obtained from the investor relations section within TCF’s website at

www.tcfexpress.com or by contacting TCF’s Corporate Communications

Department at (952) 745-2760. The website also includes free access

to company news releases, TCF’s annual report, quarterly reports,

investor presentations and Securities and Exchange Commission

(“SEC”) filings. Replays of prior quarterly conference calls discussing

financial results may also be accessed at the investor relations sec-

tion within TCF’s website.

Legislative, Legal and Regulatory Developments

Federal and state legislation imposes numerous legal and regulatory

requirements on financial institutions. Future legislative or regula-

tory change, or changes in enforcement practices or court rulings,

may have a dramatic and potentially adverse impact on TCF and its

bank and other subsidiaries.

The Federal Deposit Insurance Corporation (“FDIC”) and members

of the United States Congress have proposed new legislation that

would reform the bank deposit insurance system. This reform could

merge the Bank Insurance Fund (“BIF”) and Savings Association

Insurance Fund (“SAIF”), increase the deposit insurance coverage

limits and index future coverage limitations, among other changes.

Most significantly, reform proposals could allow the FDIC to raise

or lower (within certain limits) the currently mandated designated

reserve ratio requiring the FDIC to maintain a 1.25% reserve ratio

($1.25 against $100 of insured deposits), and require certain changes

in the calculation methodology. Although it is too early to predict the

ultimate impact of such proposals, they could, if adopted, result in

the imposition of additional deposit insurance premium costs on TCF.