Seagate 2011 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

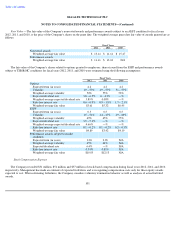

9. Fair Value

Measurement of Fair Value

Fair value is defined as the price that would be received from selling an asset or paid to transfer a liability in an orderly transaction between

market participants at the measurement date. When determining the fair value measurements for assets and liabilities required to be recorded at

fair value, the Company considers the principal or most advantageous market in which it would transact and it considers assumptions that market

participants would use when pricing the asset or liability.

Fair Value Hierarchy

A fair value hierarchy is based on whether the market participant assumptions used in determining fair value are obtained from independent

sources (observable inputs) or reflects the Company's own assumptions of market participant valuation (unobservable inputs). A financial

instrument's categorization within the fair value hierarchy is based upon the lowest level of input that is significant to the fair value

measurement. The three levels of inputs that may be used to measure fair value:

Level 1—Quoted prices in active markets that are unadjusted and accessible at the measurement date for identical, unrestricted assets or

liabilities;

Level 2—Quoted prices for identical assets and liabilities in markets that are inactive; quoted prices for similar assets and liabilities in

active markets or financial instruments for which significant inputs are observable, either directly or indirectly; or

Level 3—Prices or valuations that require inputs that are both unobservable and significant to the fair value measurement.

The Company considers an active market to be one in which transactions for the asset or liability occur with sufficient frequency and

volume to provide pricing information on an ongoing basis, and views an inactive market as one in which there are few transactions for the asset

or liability, the prices are not current, or price quotations vary substantially either over time or among market makers. Where appropriate the

Company's or the counterparty's non-performance risk is considered in determining the fair values of liabilities and assets, respectively.

91