Seagate 2011 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

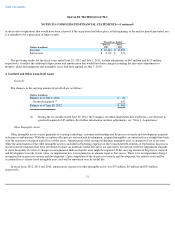

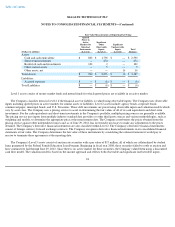

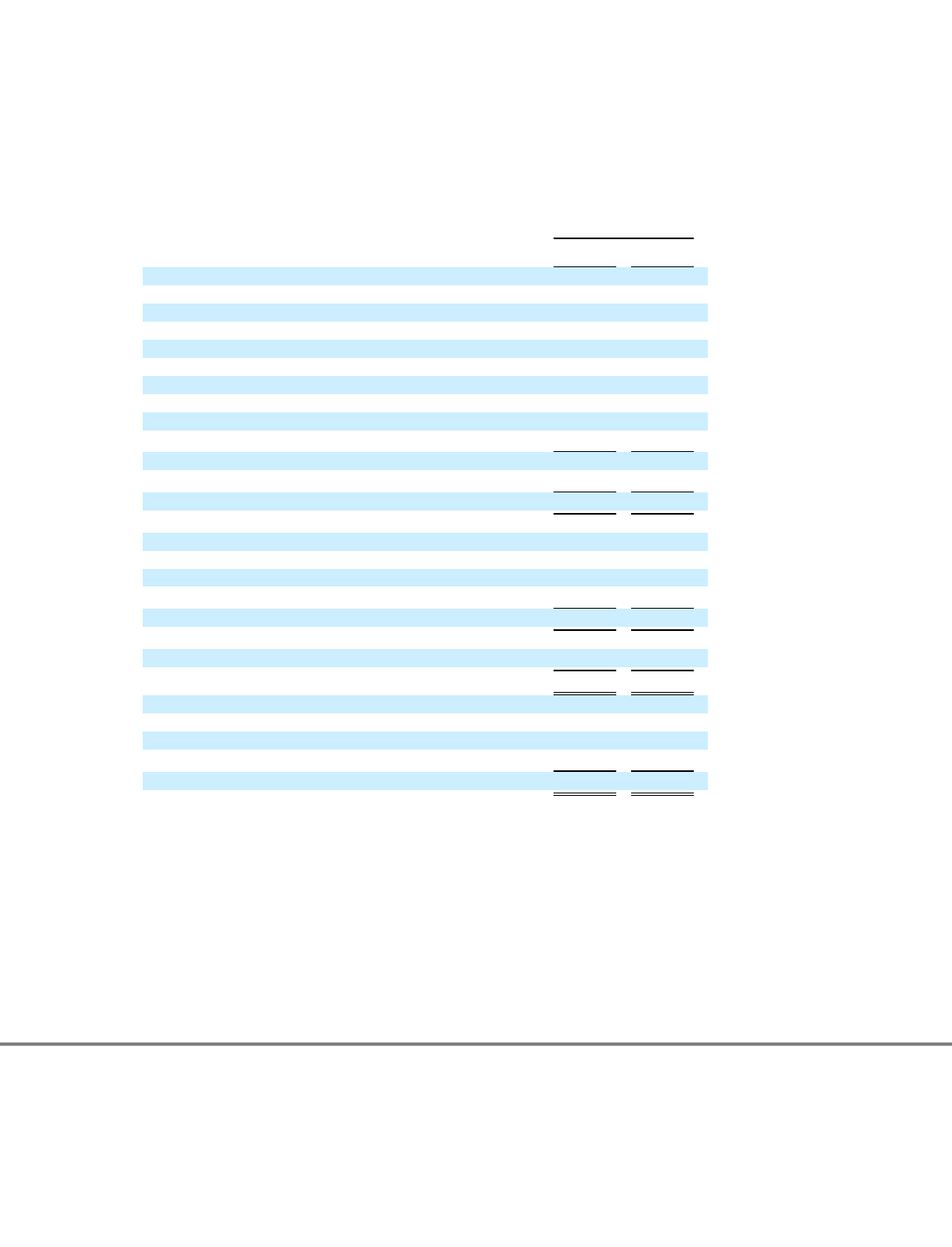

Deferred income taxes reflect the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial

reporting purposes and the amounts used for income tax purposes. The significant components of the Company's deferred tax assets and

liabilities were as follows:

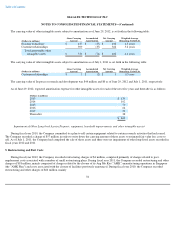

The deferred tax asset valuation allowance decreased by approximately $82 million in fiscal year 2012, decreased by approximately

$18 million in fiscal year 2011 and decreased by approximately $133 million in fiscal year 2010.

At June 29, 2012, the Company recorded $490 million of net deferred tax assets. The realization of these deferred tax assets is primarily

dependent on the Company's ability to generate sufficient U.S. and certain non-

U.S. taxable income in future periods. Although realization is not

assured, the Company's management believes that it is more likely than not that these deferred tax assets will be realized. The amount of deferred

tax assets considered realizable, however, may increase or decrease in subsequent periods when the Company reevaluates the underlying basis

for its estimates of future U.S. and certain non-U.S. taxable income.

85

Fiscal Years Ended

(Dollars in millions)

June 29,

2012

July 1,

2011

Deferred tax assets

Accrued warranty

$

116

$

130

Inventory valuation accounts

68

68

Receivable reserves

18

18

Accrued compensation and benefits

117

117

Depreciation

112

126

Restructuring accruals

8

10

Other accruals and deferred items

45

50

Net operating losses and tax credit carry

-

forwards

1,074

1,087

Other assets

8

10

Total Deferred tax assets

1,566

1,616

Valuation allowance

(1,064

)

(1,146

)

Net Deferred tax assets

502

470

Deferred tax liabilities

Unremitted earnings of certain non

-

U.S. entities

(11

)

(8

)

Trading Securities

—

Unrealized Gain

—

(

2

)

Accrued compensation

(1

)

—

Depreciation

—

(

5

)

Total Deferred tax liabilities

(12

)

(15

)

Net Deferred tax assets

490

455

Deferred taxes on inter

-

company transactions

—

7

Total Deferred tax assets

$

490

$

462

As Reported on the Balance Sheet

Current assets

—

Deferred income taxes

$

104

$

99

Non

-

current assets

—

Deferred income taxes

396

374

Other current liabilities

(10

)

(11

)

Total Deferred income taxes

$

490

$

462