Seagate 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

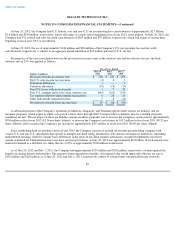

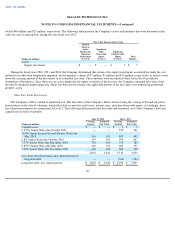

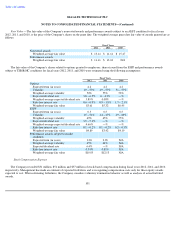

The table below presents a reconciliation of all assets and liabilities measured at fair value on a recurring basis, excluding accrued interest

components, using significant unobservable inputs (Level 3) for the fiscal years ended July 2, 2010, July 1, 2011 and June 29, 2012:

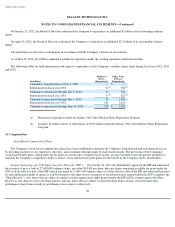

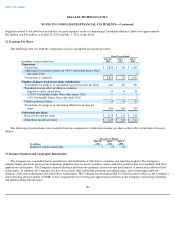

Items Measured at Fair Value on a Non-Recurring Basis

The Company enters into certain strategic investments for the promotion of business and strategic objectives. Strategic investments in

equity securities where the Company does not have the ability to exercise significant influence over the investees, included in Other assets, net in

the Consolidated Balance Sheets, are recorded at cost and are periodically analyzed to determine whether or not there are indicators of

impairment. The carrying value of the Company's strategic investments at June 29, 2012 and July 1, 2011

95

(Dollars in millions)

Auction

Rate

Securities

Balance at July 3, 2009

$

18

Total net gains (losses) (realized and unrealized):

Realized gains (losses)

(1)

(1

)

Unrealized gains (losses)

(2)

—

Sales and settlements

—

Balance at July 2, 2010

17

Total net gains (losses) (realized and unrealized):

Realized gains (losses)

(1)

—

Unrealized gains (losses)

(2)

—

Sales and settlements

(1

)

Balance at July 1, 2011

16

Total net gains (losses) (realized and unrealized):

Realized gains (losses)

(1)

—

Unrealized gains (losses)

(2)

—

Sales and settlements

(1

)

Balance at June 29, 2012

$

15

(1) Realized gains (losses) on auction rate securities are recorded in Other, net in the Consolidated Statements of

Operations.

(2) Unrealized gains (losses) on auction rate securities are recorded as a separate component of Total comprehensive

income (loss) in Accumulated other comprehensive income (loss), which is a component of Shareholders' Equity.