Seagate 2011 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Restricted Cash and Investments.

Restricted cash and investments represents cash and cash equivalents and investments that are restricted

as to withdrawal or use for other than current operations.

Allowances for Doubtful Accounts. The Company maintains an allowance for uncollectible accounts receivable based upon expected

collectability. This reserve is established based upon historical trends, global macroeconomic conditions and an analysis of specific exposures.

The provision for doubtful accounts is recorded as a charge to general and administrative expense.

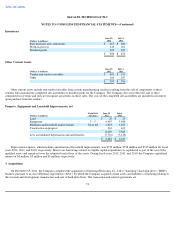

Inventory. Inventories are valued at the lower of cost (which approximates actual cost using the first-in, first-out method) or market.

Market value is based upon an estimated average selling price reduced by estimated cost of completion and disposal.

Property, Equipment and Leasehold Improvements. Property, equipment and leasehold improvements are stated at cost. Equipment and

buildings are depreciated using the straight-line method over the estimated useful lives of the assets. Leasehold improvements are amortized

using the straight-line method over the shorter of the estimated life of the asset or the remaining term of the lease. The costs of additions and

substantial improvements to property, equipment and leasehold improvements, which extend the economic life of the underlying assets, are

capitalized. The cost of maintenance and repairs to property, equipment and leasehold improvements is expensed as incurred.

Assessment of Goodwill and Other Long-lived Assets for Impairment. The Company accounts for goodwill in accordance with

Accounting Standards Codification (ASC) Topic 350 (ASC 350), Intangibles—Goodwill and Other . Effective first quarter of fiscal year 2012,

the Company adopted ASU No. 2011-08, Intangibles—Goodwill and Other (ASC Topic 350)—

Testing Goodwill for Impairment. The Company

performs a qualitative assessment at the end of each reporting period to determine if any events or circumstances exist, such as an adverse

change in business climate or a decline in the overall industry that would indicate that it would more likely than not reduce the fair value of a

reporting unit below its carrying amount, including goodwill.

The Company tests other long-lived assets, including property, equipment and leasehold improvements and other intangible assets subject

to amortization, for recoverability whenever events or changes in circumstances indicate that the carrying value of those assets may not be

recoverable. The Company performs a recoverability test to assess the recoverability of an asset group. If the recoverability test indicates that the

carrying value of the asset group is not recoverable, the Company will estimate the fair value of the asset group and the excess of the carrying

value over the fair value is allocated pro rata to derive the adjusted carrying value of assets in the asset group. The adjusted carrying value of

each asset in the asset group is not reduced below its fair value.

The Company also tests other intangible assets not subject to amortization annually or more frequently if events or changes in circumstance

indicate that the asset might be impaired. If the carrying amount of an intangible asset exceeds its fair value, an impairment loss is recognized in

an amount equal to that excess.

Derivative Financial Instruments. The Company applies the requirements of ASC Topic 815 (ASC 815), Derivatives and Hedging .

ASC 815 requires that all derivatives be recorded on the balance sheet at fair value and establishes criteria for designation and effectiveness of

hedging relationships.

Establishment of Warranty Accruals. The Company estimates probable product warranty costs at the time revenue is recognized. The

Company generally warrants its products for a period of 1 to 5 years. The Company's warranty provision considers estimated product failure

rates and trends (including the timing of product returns during the warranty periods), and estimated repair or replacement costs related to

68