Seagate 2011 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

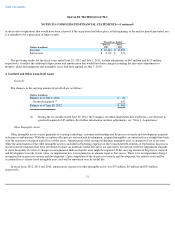

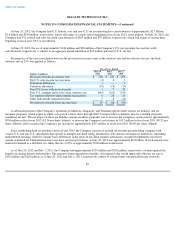

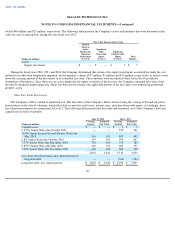

The following table summarizes the activity related to the Company's gross unrecognized tax benefits:

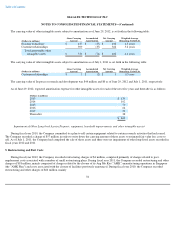

It is the Company's policy to include interest and penalties related to unrecognized tax benefits in the provision for taxes on the

Consolidated Statements of Operations. During fiscal year 2012, the Company recognized a net tax expense for interest and penalties of

$2 million as compared to a net tax expense for interest and penalties of less than $1 million and a net tax benefit of $1 million during fiscal year

2011 and fiscal year 2010, respectively. As of June 29, 2012, the Company had $17 million of accrued interest and penalties related to

unrecognized tax benefits compared to $15 million in fiscal year 2011.

During the 12 months beginning June 30, 2012, the Company expects to reduce its unrecognized tax benefits by approximately $5 million

as a result of the expiration of certain statutes of limitation. The Company does not believe it is reasonably possible that other unrecognized tax

benefits will materially change in the next 12 months.

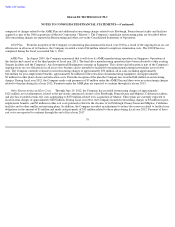

The Company is subject to taxation in many jurisdictions globally and is required to file U.S. federal, U.S. state and non-U.S. income tax

returns. In May 2011, the U.S. Internal Revenue Service (IRS) completed its field examination of the Company's U.S. federal income tax returns

for fiscal years ending in 2005 through 2007. The IRS issued a Revenue Agent's Report and proposed certain adjustments. The Company is

currently contesting one of these proposed adjustments through the IRS Appeals Office. The Company believes that the resolution of this

disputed issue will have no material impact on its financial statements.

With respect to U.S. state and non-

U.S. income tax returns, the Company is generally no longer subject to tax examinations for years ending

prior to fiscal year 2004. The Company is also no longer subject to tax examination of U.S. federal income tax returns for years prior to fiscal

year 2005.

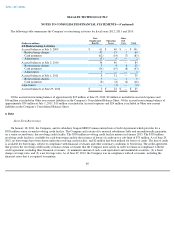

8. Derivative Financial Instruments

The Company is exposed to foreign currency exchange rate, interest rate, and to a lesser extent, equity price risks relating to its ongoing

business operations. The Company enters into foreign currency forward exchange contracts in order to manage the foreign currency exchange

rate risk on forecasted expenses denominated in foreign currencies and to mitigate the remeasurement risk of certain foreign currency

denominated liabilities. The Company's accounting policies for these instruments are based on whether the instruments are classified as

designated or non-designated hedging instruments. The Company records all derivatives in the Consolidated Balance Sheets at fair value. The

effective portions of designated cash flow

87

Fiscal Years Ended

(Dollars in millions)

June 29,

2012

July 1,

2011

July 2,

2010

Balance of unrecognized tax benefits at the

beginning of the year

$

128

$

115

$

118

Gross increase for tax positions of prior years

1

30

2

Gross decrease for tax positions of prior years

(3

)

(24

)

(5

)

Gross increase for tax positions of current year

13

13

6

Gross decrease for tax positions of current year

—

—

—

Settlements

—

—

(

4

)

Lapse of statutes of limitation

(3

)

(10

)

(3

)

Non

-

U.S. exchange (gain)/loss

(1

)

4

1

Balance of unrecognized tax benefits at the end of

the year

$

135

$

128

$

115