Seagate 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

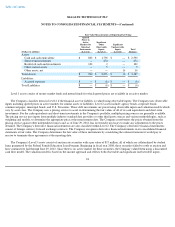

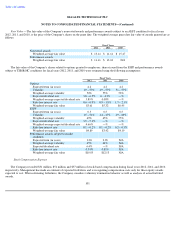

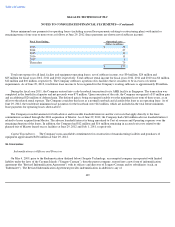

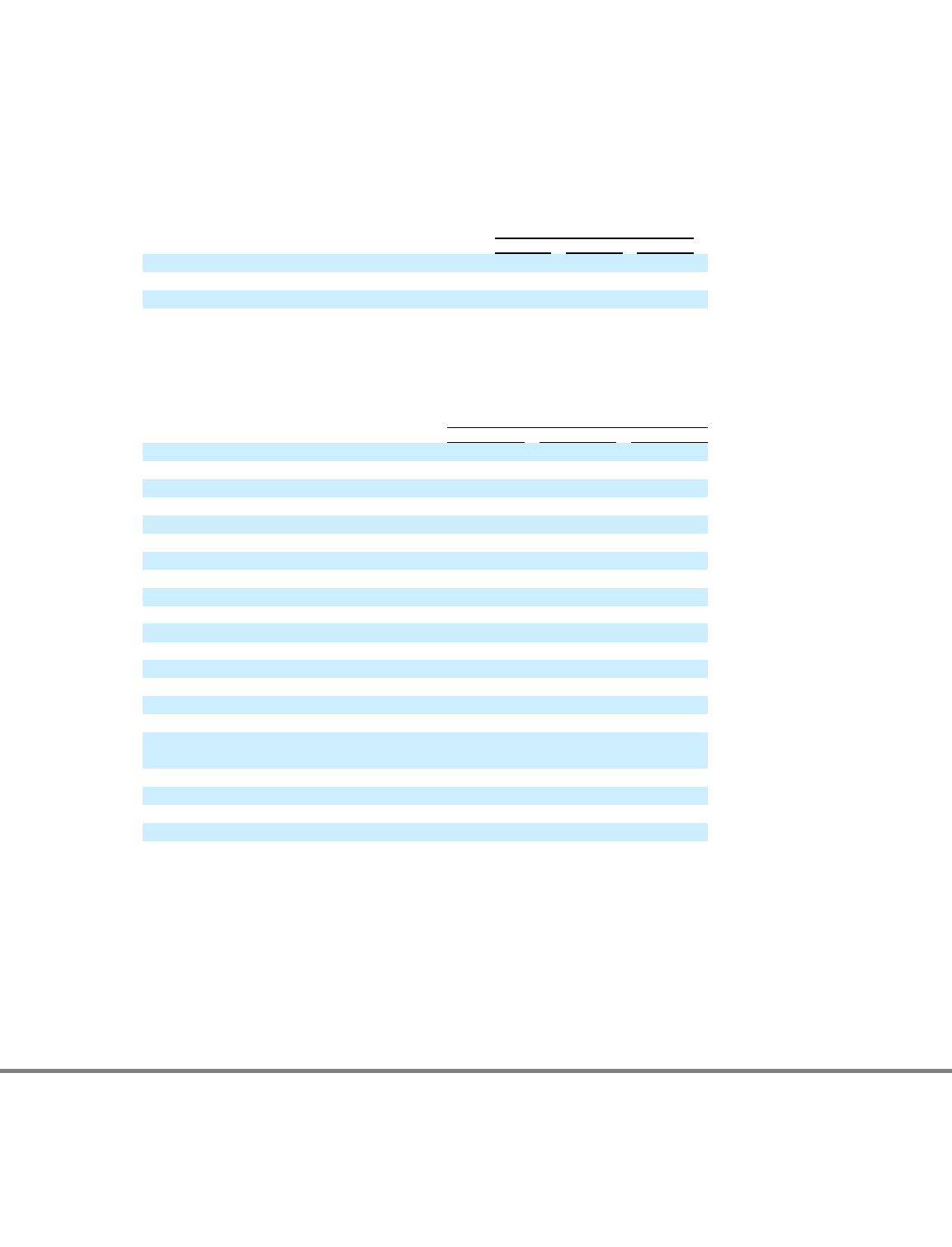

Fair Value —The fair value of the Company's nonvested awards and performance awards subject to an AEPS condition for fiscal years

2012, 2011, and 2010, is the price of the Company's shares on the grant date. The weighted average grant date fair value of awards granted are as

follows:

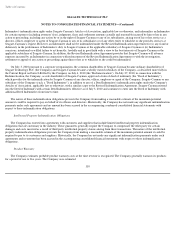

The fair value of the Company's shares related to options granted to employees, shares issued from the ESPP and performance awards

subject to TSR/ROIC conditions for fiscal years 2012, 2011, and 2010 were estimated using the following assumptions:

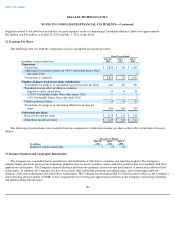

Stock Compensation Expense

The Company recorded $51 million, $51 million and $57 million of stock-based compensation during fiscal years 2012, 2011, and 2010,

respectively. Management has made an estimate of expected forfeitures and is recognizing compensation costs only for those equity awards

expected to vest. When estimating forfeitures, the Company considers voluntary termination behavior as well as analysis of actual forfeited

awards.

101

Fiscal Years

2012

2011

2010

Nonvested awards

Weighted

-

average fair value

$

13.14

$

11.61

$

15.47

Performance awards

Weighted

-

average fair value

$

11.16

$

13.63

N/A

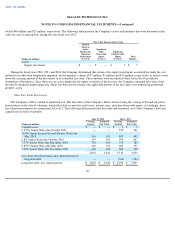

Fiscal Years

2012

2011

2010

Options

Expected term (in years)

4.2

4.2

4.2

Volatility

49

–

53%

49

–

57%

51

–

57%

Weighted

-

average volatility

50%

55%

53%

Expected dividend rate

3.8

–

6.5%

0

–

4.3%

—

%

Weighted

-

average expected dividend rate

5.89%

0.08%

—

%

Risk

-

free interest rate

0.6

–

0.9%

0.9

–

1.8%

1.7

–

2.1%

Weighted

-

average fair value

$3.61

$5.32

$6.45

ESPP

Expected term (in years)

0.5

0.5

0.5

Volatility

45

–

54%

44

–

47%

49

–

60%

Weighted

-

average volatility

49%

45%

55%

Expected dividend rate

3.9

–

5.2%

—

%

—

%

Weighted

-

average expected dividend rate

4.66%

—

%

—

%

Risk

-

free interest rate

0.1

–

0.2%

0.1

–

0.2%

0.2

–

0.3%

Weighted

-

average fair value

$4.89

$3.42

$4.19

Performance awards subject to market

condition

Expected term (in years)

2.96

2.96

N/A

Weighted

-

average volatility

65%

64%

N/A

Expected dividend rate

6.4%

—

%

N/A

Risk

-

free interest rate

0.34%

0.81%

N/A

Weighted

-

average fair value

$10.05

$12.13

N/A