Seagate 2011 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

of the results of operations that would have been achieved if the acquisition had taken place at the beginning of the earliest period presented, nor

is it intended to be a projection of future results.

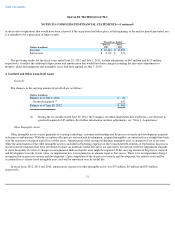

The pro forma results for the fiscal years ended June 29, 2012 and July 1, 2011, include adjustments of $65 million and $115 million,

respectively, to reflect the additional depreciation and amortization that would have been charged assuming the fair value adjustments to

property, plant and equipment and intangible assets had been applied on July 3, 2010.

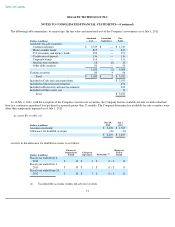

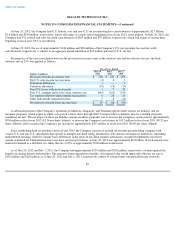

4. Goodwill and Other Long-lived Assets

Goodwill

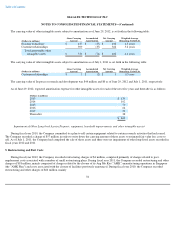

The changes in the carrying amount of goodwill are as follows:

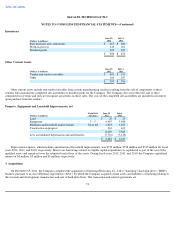

Other Intangible Assets

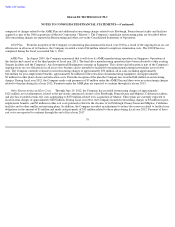

Other intangible assets consist primarily of existing technology, customer relationships and In-process research and development acquired

in business combinations. With the exception of In-process research and development, acquired intangibles are amortized on a straight-line basis

over the respective estimated useful lives of the assets. Amortization of the existing technology intangible asset is charged to Cost of revenue

while the amortization of the other intangible assets is included in Operating expenses in the Consolidated Statements of Operations. In-process

research and development has been determined to have an indefinite useful life and is not amortized, but instead tested for impairment annually

or more frequently if events or changes in circumstance indicate that the asset might be impaired. If the carrying amount of In-process research

and development exceeds its fair value, an impairment loss is recognized in an amount equal to that excess. There were no impairment charges

recognized for in-process research and development. Upon completion of the in-process research and development, the related assets will be

accounted for as a finite-lived intangible asset, and will be amortized over its useful life.

In fiscal years 2012, 2011 and 2010, amortization expense for other intangible assets was $75 million, $6 million and $35 million,

respectively.

77

Fiscal Years Ended

(Dollars in millions)

June 29,

2012 July 1,

2011

Revenue

$

16,113

$

13,853

Net income

$

2,761

$

370

(Dollars in millions)

Balance as of July 1, 2011

$

31

Goodwill acquired

(1)

432

Balance as of June 29, 2012

$

463

(1)

During the six months ended June 29, 2012, the Company recorded adjustments that resulted in a net decrease in

goodwill acquired of $5 million. For further information on these adjustments, see "Note 3. Acquisitions."