Seagate 2011 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

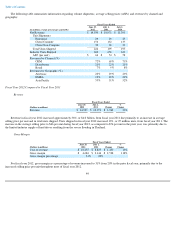

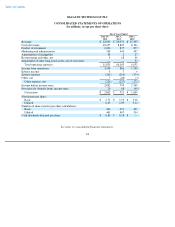

In fiscal year 2011, we used $981 million for net cash investing activities, which was primarily attributable to payments for property,

equipment and leasehold improvements of approximately $843 million.

In fiscal year 2010, we used $752 million for net cash investing activities, which was primarily attributable to payments for property,

equipment and leasehold improvements of approximately $639 million.

Cash Provided by (Used in) Financing Activities

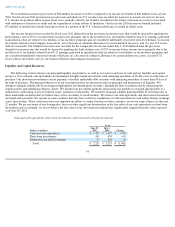

Net cash used in financing activities of $3.1 billion for fiscal year 2012 was attributable to $2.4 billion paid to repurchase 101 million of our

ordinary shares, $670 million in long term debt repayments and $372 million in dividends paid to our shareholders. This was partially offset by

$344 million in proceeds from the exercise of stock options and employee stock purchases.

Net cash provided by financing activities of $131 million for fiscal year 2011 was attributable to $1.3 billion in net proceeds from the

issuance of long-term debt partially offset by $822 million to repurchase 56.9 million of our ordinary shares and $377 million for the repayment

of our long-term debt.

Net cash used in financing activities of $344 million for fiscal year 2010 was primarily attributable to the repayment of $350 million of our

amended credit facility and the repayment and repurchases of $457 million of our long-term debt. The repayment and repurchases were paid

primarily with $379 million of restricted cash, previously held in escrow. We also paid approximately $584 million to repurchase 32.4 million of

our ordinary shares, which was partially offset by $587 million in net proceeds from the issuance of long-term debt and $86 million in proceeds

from the exercise of stock options and employee stock purchases.

Liquidity Sources

Our primary sources of liquidity as of June 29, 2012, consisted of: (1) approximately $2.1 billion in cash and cash equivalents, and short-

term investments, (2) cash we expect to generate from operations and (3) a $350 million senior secured revolving credit facility. We also had

$93 million in restricted cash and investments, of which $73 million was related to our employee deferred compensation liabilities under our

non-qualified deferred compensation plan.

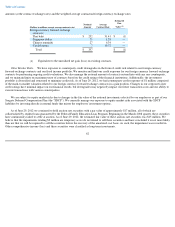

On January 18, 2011, Seagate Technology plc, and its subsidiary Seagate HDD entered into a credit agreement which provides for a

$350 million senior secured revolving credit facility. Seagate Technology plc and certain of its material subsidiaries fully and unconditionally

guarantee, on a senior secured basis, the revolving credit facility. The revolving credit facility matures in January 2015. The revolving credit

facility is available for cash borrowings and for the issuance of letters of credit up to a sub-limit of $75 million. As of June 29, 2012, no

borrowings have been drawn under the revolving credit facility, and $2 million had been utilized for letters of credit. The line of credit is

available for borrowings, subject to compliance with financial covenants and other customary conditions to borrowing.

The credit agreement that governs our revolving credit facility contains certain covenants that we must satisfy in order to remain in

compliance with the credit agreement, including three financial covenants: (1) minimum amount of cash, cash equivalents and marketable

securities; (2) a fixed charge coverage ratio; and (3) a net leverage ratio. As of June 29, 2012, we are in compliance with all covenants, including

the financial ratios that we are required to maintain.

We believe that our sources of cash will be sufficient to fund our operations and meet our cash requirements for at least the next 12 months.

56