Seagate 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The amount noted above for warranty is provisional, being an estimate calculated on the basis of projected product failure rates and timing

of product returns during the warranty period. Seagate assumed product warranty obligations from Samsung on products sold prior to the

acquisition. These products are warranted for up to three years from the original shipment date. The estimate of the warranty liability is subject

to a significant degree of subjectivity since the Company has limited experience with Samsung products. If actual return rates differ materially

from the Company's estimate, or if there is an epidemic failure of drives for which Seagate assumed warranty obligations, the fair value of the

warranty liability may need to be reestimated during the measurement period, which may be up to one year following the acquisition date.

The Company received a patent portfolio that may have value apart from being an enabling technology that is included within the fair value

of Intangible assets—Existing technology. However, the Company has not received all information regarding these patents that is necessary for

the completion of a review to determine the extent of encumbrances and the scope of their application. Therefore, provisionally, no separately

identifiable value has been recognized for the patent portfolio.

As part of the acquisition, the Company assumed certain vendor-

related and other obligations and contingent liabilities. Due to the nature of

these obligations and contingent liabilities, except for the adjustment noted above relating to certain assumed vendor liabilities, the Company has

not received sufficient information needed to determine the fair value of these obligations.

The $432 million of goodwill recognized is attributable primarily to the benefits the Company expects to derive from enhanced scale and

efficiency to better serve its markets and expanded customer presence in China and Southeast Asia. Except for approximately $4 million of

goodwill relating to assembled workforce in Korea, none of the goodwill is expected to be deductible for income tax purposes.

The Company incurred a total of $22 million of expenses related to the acquisition of Samsung in fiscal year 2012, which are included

within Marketing and administrative expense on the Consolidated Statement of Operations.

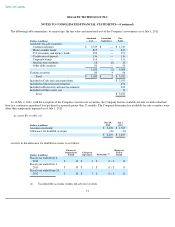

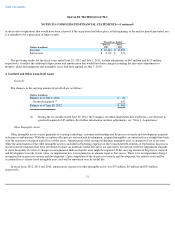

The amounts of revenue and earnings of the acquired assets of Samsung's HDD business included in the Company's Consolidated Statement

of Operations from the acquisition date to the period ended June 29, 2012, were as follows:

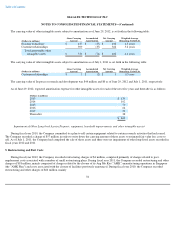

The unaudited pro forma financial results presented below for fiscal years ended June 29, 2012 and July 1, 2011, include the effects of pro

forma adjustments as if the acquisition date occurred as of the beginning of the prior fiscal year on July 3, 2010. The pro forma results combine

the historical results of the Company for the fiscal years ended June 29, 2012 and July 1, 2011, respectively, and the historical results of the

acquired assets and liabilities of Samsung's HDD business, and include the effects of certain fair value adjustments and the elimination of certain

activities excluded from the transaction. The pro forma financial information is presented for informational purposes only and is not necessarily

indicative

76

(Dollars in millions)

Revenue

$

970

Net income

$

104