Seagate 2011 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

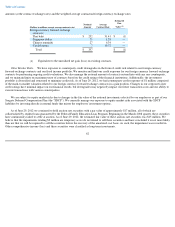

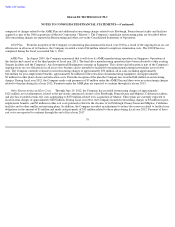

disclosing gross and net information about instruments and transactions eligible for offset and instruments and transactions subject to an

agreement similar to a master netting arrangement. The ASU is effective for the Company's first quarter of fiscal year 2014 and requires the

enhanced disclosures for all comparative periods presented. Other than requiring additional disclosures, the adoption of this new guidance will

not have a material impact on the Company's consolidated financial statements.

In June 2011, the Financial Accounting Standards Board (FASB) issued Accounting Standard Update (ASU) No. 2011-05, Comprehensive

Income (ASC Topic 220)

—Presentation of Comprehensive Income. The ASU requires companies to report comprehensive income, including

items of other comprehensive income, for all periods presented in a single continuous financial statement in the Consolidated Statements of

Operations or split between the Consolidated Statements of Operations and a separate Consolidated Statements of Other Comprehensive Income.

The ASU is effective for the Company's first quarter of fiscal year 2013. Other than requiring additional disclosures, the adoption of this new

guidance will not have a material impact on the Company's consolidated financial statements.

In May 2011, the FASB issued ASU No. 2011-04, Fair Value Measurement (ASC Topic 820)—Amendments to Achieve Common Fair

Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs. The ASU requires additional disclosures about the sensitivity to

changes in unobservable inputs for Level 3 measurements. In addition, for items that are not measured at fair value on the balance sheet but for

which the disclosure of fair values in the footnotes is required, the ASU requires disclosures of the categorization by level within the fair value

hierarchy. The ASU is effective for the Company's first quarter of fiscal year 2013. Other than requiring additional disclosures, the adoption of

this new guidance will not have a material impact on the Company's consolidated financial statements.

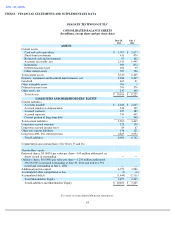

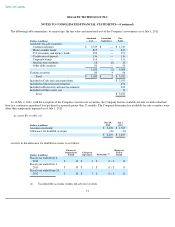

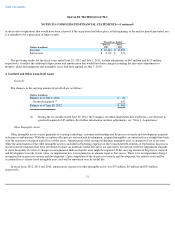

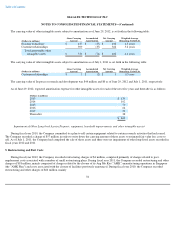

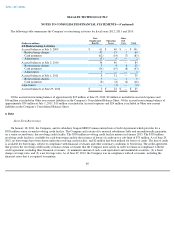

2. Balance Sheet Information

Investments

The Company's available-for-sale securities include investments in auction rate securities. Beginning in fiscal year 2008, the Company's

auction rate securities failed to settle at auction and have continued to fail through June 29, 2012. Since the Company continues to earn interest

on its auction rate securities at the maximum contractual rate, there have been no payment defaults with respect to such securities, and they are

all collateralized, the Company expects to recover the entire amortized cost basis of these auction rate securities. The Company does not intend

to sell these securities and has concluded it is not more likely than not that the Company will be required to sell the securities before the recovery

of their amortized cost basis. As such, the Company believes the impairments totaling $2 million are not other-than-temporary and therefore

have been recorded in Accumulated other comprehensive income (loss). Given the uncertainty as to when the liquidity issues associated with

these securities will improve, these securities were classified within Other assets, net in the Company's Consolidated Balance Sheets.

As of June 29, 2012, the Company's Restricted cash and investments consisted of $73 million in cash equivalents and investments held in

trust for payment of its non-qualified deferred compensation plan liabilities and $20 million in cash and investments held as collateral at banks

for various performance obligations. As of July 1, 2011, the Company's Restricted cash and investments consisted of $84 million in cash and

investments held in trust for payment of its non-qualified deferred compensation plan liabilities and $18 million in cash and investments held as

collateral at banks for various performance obligations.

71