Seagate 2011 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2011 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY PLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

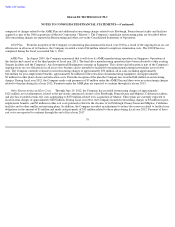

expected to improve the Company's position as a supplier of 2.5-inch products; position the Company to better address rapidly evolving

opportunities in markets including, but not limited to, mobile computing, cloud computing and solid state storage; expand the Company's

customer access in China and Southeast Asia; and accelerate time to market for new products.

The acquisition-date fair value of the consideration transferred totaled $1,140 million, which consisted of $571 million of cash, $10 million

of which was paid as a deposit upon signing the APA in the fourth quarter of fiscal year 2011, and 45.2 million ordinary shares with a fair value

of $569 million. The fair value of the ordinary shares issued was determined based on the closing market price of the Company's ordinary shares

on the acquisition date, less a 16.5% discount for lack of marketability as the shares issued are subject to a restriction that limits their trade or

transfer for approximately a one year period.

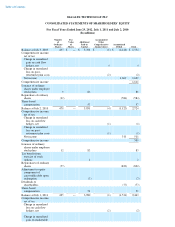

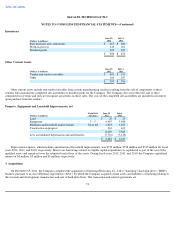

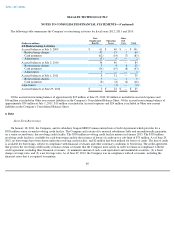

The following table summarizes the preliminary estimated fair values of the assets acquired and liabilities assumed at the acquisition date

(in millions):

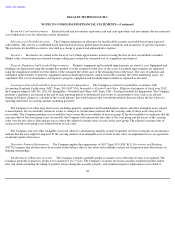

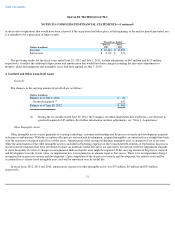

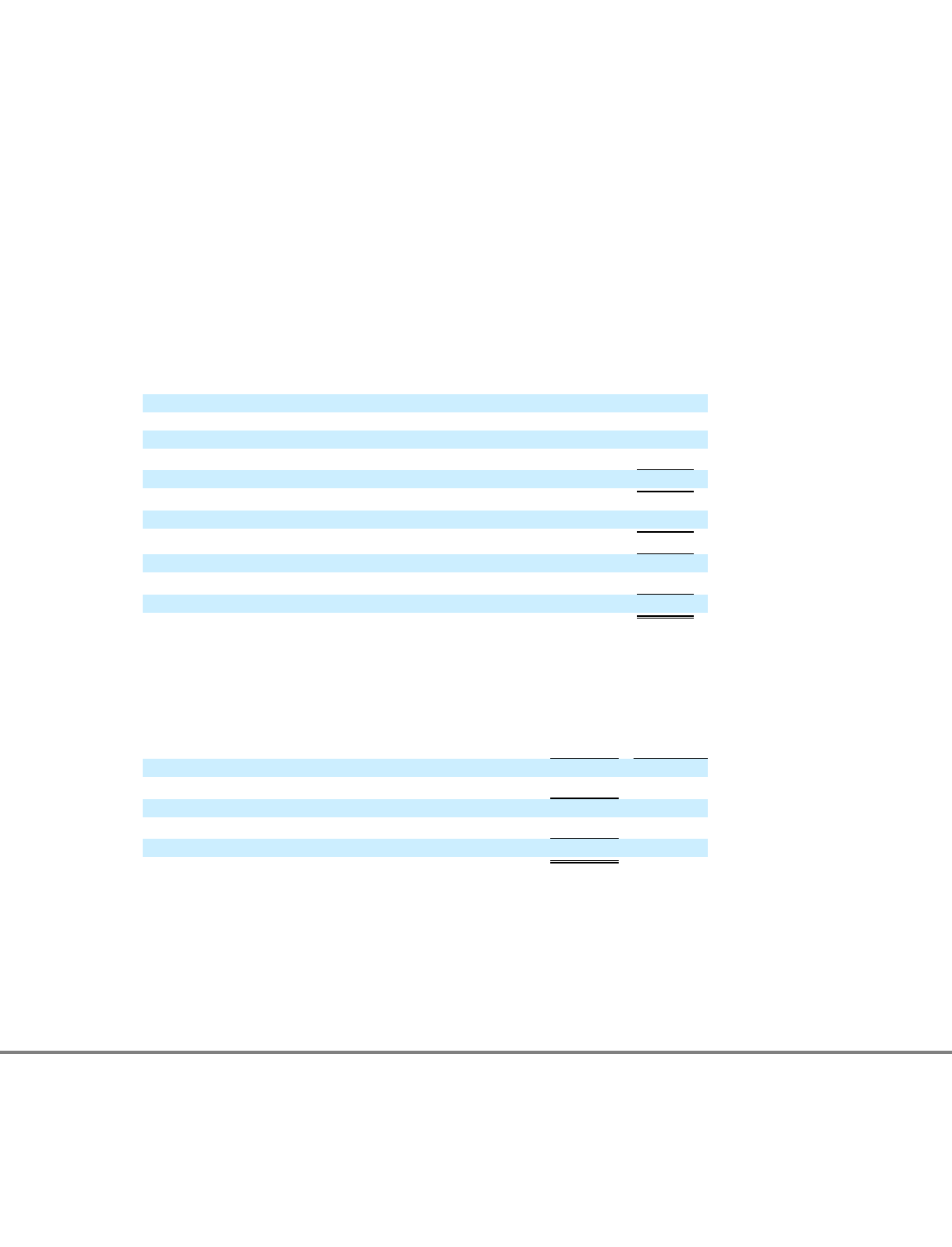

The following table shows the fair value of the separately identifiable intangible assets at the time of acquisition and the period over which

each intangible asset will be amortized:

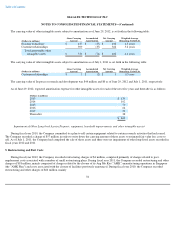

During the six months ended June 29, 2012, the Company recorded adjustments to the preliminary fair value of certain assets acquired and

liabilities assumed with the Samsung HDD business that resulted in a net decrease of $5 million to Goodwill. These adjustments included a

$7 million increase in Other assets for spare parts and a $3 million increase to Equipment, offset by a $3 million increase in Warranty liability

and a $2 million increase in Other liabilities related to certain assumed vendor obligations. These adjustments were based on information

obtained in the current period about facts and circumstances that existed at the acquisition date.

75

Inventories

$

141

Equipment

76

Intangible assets

580

Other assets

28

Total identifiable assets acquired

825

Warranty liability

(72

)

Other liabilities

(45

)

Total liabilities assumed

(117

)

Net identifiable assets acquired

708

Goodwill

432

Net assets acquired

$

1,140

(Dollars in millions)

Fair Value

Weighted

-

Average

Amortization

Period

Existing technology

$

137

2.0 years

Customer relationships

399

5.8 years

Total amortizable intangible assets acquired

536

4.8 years

In

-

process research and development

44

Total acquired identifiable intangible assets

$

580