Seagate 2008 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

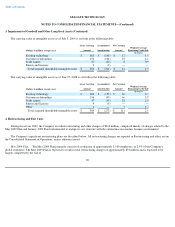

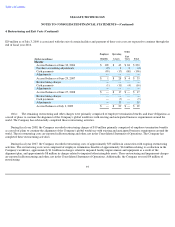

5. Credit Facilities, Long-Term Debt and Convertible Notes (Continued)

certain of its material subsidiaries and secured by a lien on substantially all of the Company's tangible and intangible assets.

The credit facility has various limitations on certain transactions that may occur, including limitations on: asset sales, liens, incurrence of

additional debt, issuance of preferred stock, redemption and repurchases of debt or stock, and payment of dividends.

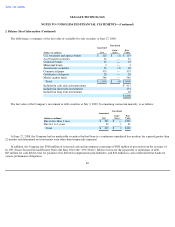

The amended credit facility also contains three financial covenants:

• Minimum liquidity: Prior to January 1, 2010, the Company must maintain a minimum amount of liquidity in the form of cash,

cash equivalents and short-term investments of $600 million, including any cash drawn under the credit facility. After January 1,

2010, the Company must maintain a minimum amount of liquidity in the form of cash, cash equivalents and short term

investments of $500 million, excluding any cash drawn under the credit facility.

•

Fixed charge coverage ratio:

The Company must maintain a fixed charge ratio of at least 1.50.

•

Net leverage ratio:

The Company must not exceed a net leverage ratio of 1.80x for the quarter ended July 3, 2009, 2.65x for the

quarter ended October 2, 2009, 1.80x for the quarter ended January 1, 2010 and 1.50x for any subsequent quarter. By holding

proceeds of the Company's 10% Notes in escrow until no later than November 1, 2009, the notes are considered refinancing of

existing debt, as opposed to incremental debt, for the purpose of calculating its net leverage ratio.

As of July 3, 2009, the Company was in compliance with all of the covenants under its credit facility.

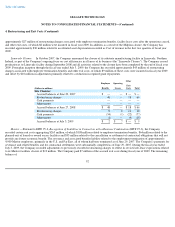

As amended, the senior secured credit facility bears interest per annum at a variable rate, at the Company's option, of LIBOR plus 350 basis

points or the Alternate Base Rate plus 250 basis points. The "Alternate Base Rate" is equal to the greatest of (i) the administrative agent's Prime

Rate, (ii) the Federal Funds effective rate plus 50 basis points and (iii) LIBOR for a one-month interest period plus 100 basis points. Borrowings

under the senior secured credit facility will continue to be prepayable at any time prior to maturity without penalty, other than customary

breakage costs. Current borrowings under the senior secured credit facility bear interest at LIBOR plus 350 basis points. As of July 3, 2009, the

senior secured credit facility was fully drawn.

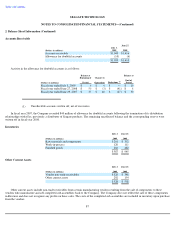

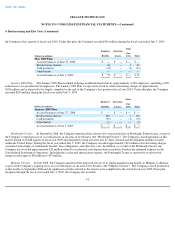

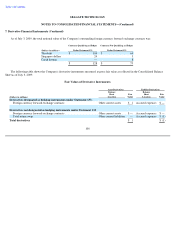

Long-Term Debt

$430 Million Aggregate Principal Amount of 10% Senior Secured Second-Priority Notes due May 2014 (the "10% Notes"). On May 1,

2009, the Company's subsidiary, Seagate Technology International, completed the sale of $430 million aggregate principal amount of 10%

Senior Secured Second-Priority Notes Due May 2014, in a private placement exempt from the registration requirements of the Securities Act of

1933, as amended. The obligations under the 10% Notes are unconditionally guaranteed by the Company and certain of its material subsidiaries.

In addition, the obligations under the 10% Notes are secured by a second-priority lien on substantially all of the Company's tangible and

intangible assets. The indenture of the 10% Notes contains covenants that limit the Company's ability, and the ability of certain of its

subsidiaries, (subject to certain exceptions) to: incur additional debt or issue certain preferred stock, create liens, pay dividends, redeem or

repurchase debt or stock, sell certain assets, issue or sell capital stock of certain subsidiaries and enter into certain transactions with the

Company's stockholders or affiliates. The net proceeds from the offering of the 10% Notes were approximately $399 million, of which

96