Seagate 2008 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

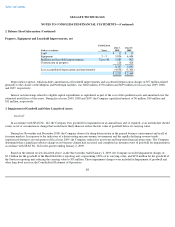

4. Restructuring and Exit Costs (Continued)

the Company's first quarter of fiscal year 2010. Under this plan, the Company recorded $65 million during the fiscal year ended July 3, 2009.

January 2009 Plan.

The January 2009 Plan included reducing worldwide headcount by approximately 4,100 employees, including a 20%

reduction in vice-president level employees. The January 2009 Plan is expected to result in total restructuring charges of approximately

$103 million and is expected to be largely complete by the end of the Company's first quarter of fiscal year 2010. Under this plan, the Company

recorded $100 million during the fiscal year ended July 3, 2009.

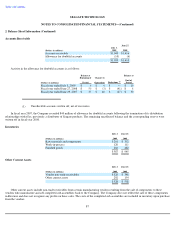

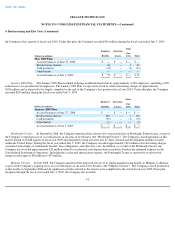

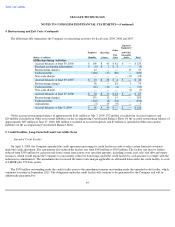

Pittsburgh Closure.

In September 2008, the Company announced the closure of its research facility in Pittsburgh, Pennsylvania, as part of

the Company's ongoing focus on cost efficiencies in all areas of its business (the "Pittsburgh Closure"). The Company ceased operations at this

facility during its fourth quarter of fiscal year 2009 and integrated certain activities into its other research and development facilities located

within the United States. During the fiscal year ended July 3, 2009, the Company recorded approximately $13 million of restructuring charges

associated with employee termination benefits, lease obligations, and other exit costs. In addition, as a result of the Pittsburgh Closure, the

Company has recorded approximately $26 million related to accelerated asset depreciation recorded as Product development expense on the

Consolidated Statement of Operations. Including the accelerated depreciation expense, the Pittsburgh Closure is expected to result in total

charges in the range of $50 million to $55 million.

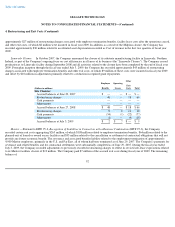

Milpitas Closure. In July 2008, the Company announced the proposed closure of its media manufacturing facility in Milpitas, California,

as part of the Company's ongoing focus on cost efficiencies in all areas of its business (the "Milpitas Closure"). The Company ceased production

at this facility in September 2008 and all significant activities related to the closure were completed by the end of fiscal year 2009. From plan

inception through the fiscal year ended July 3, 2009, the Company has recorded

91

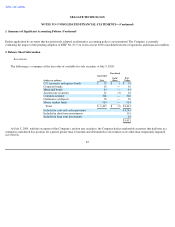

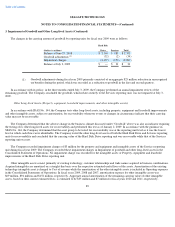

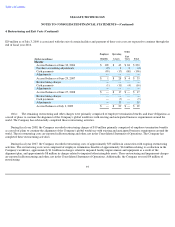

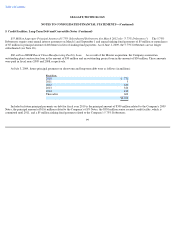

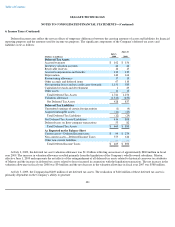

(Dollars in millions)

Employee

Benefits

Operating

Leases

Other

Exit

Costs

Total

May 2009 Plan

Accrual balances at June 27, 2008

$

—

$

—

$

—

$

—

Restructuring charges

64

—

1

65

Cash payments

(12

)

—

(

1

)

(13

)

Adjustments

—

—

—

—

Accrual balances at July 3, 2009

$

52

$

—

$

—

$

52

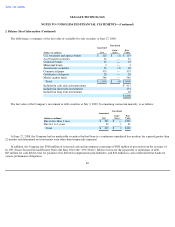

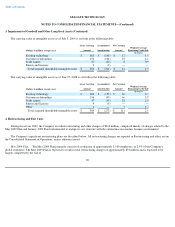

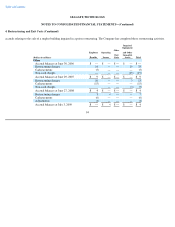

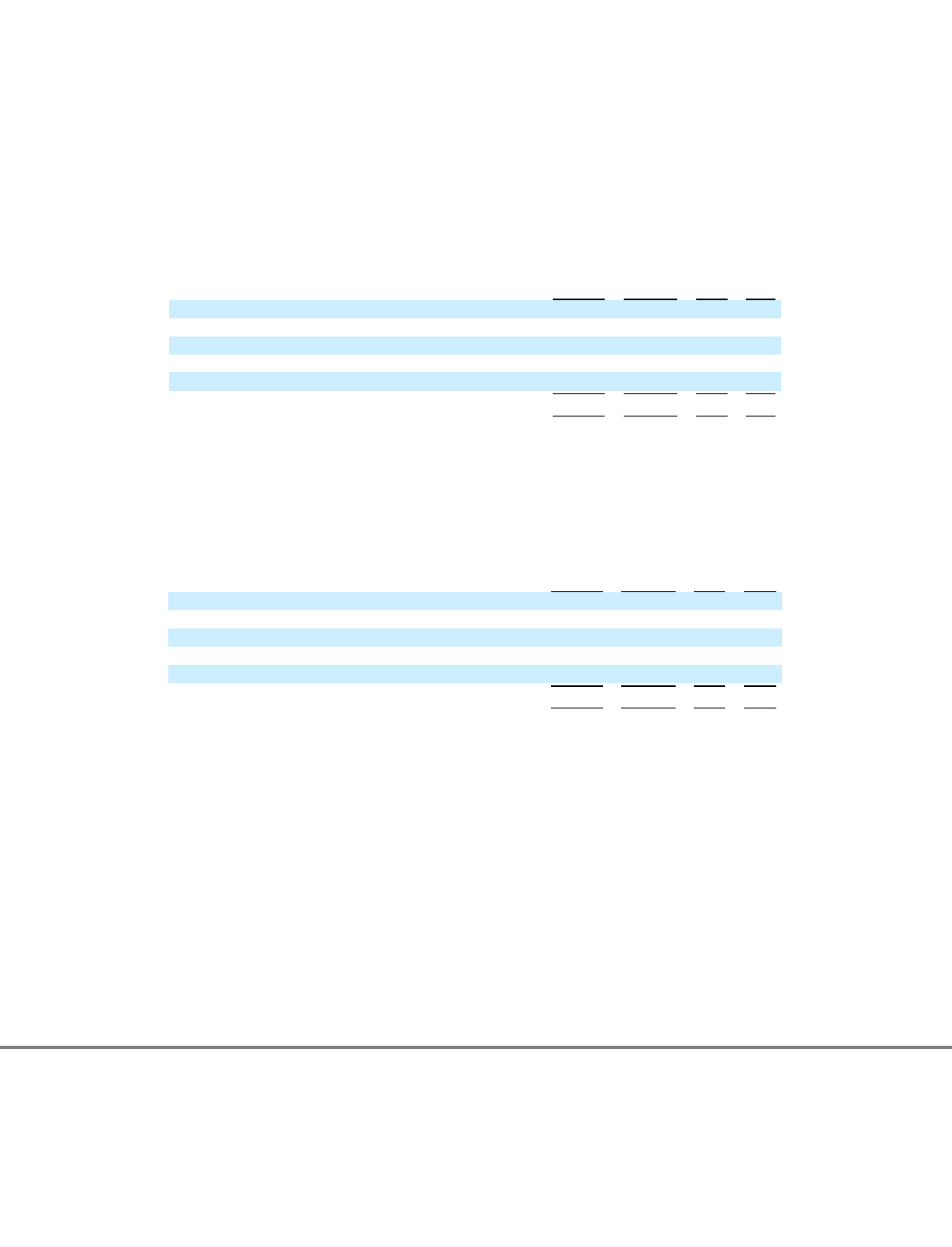

(Dollars in millions)

Employee

Benefits

Operating

Leases

Other

Exit

Costs

Total

January 2009 Plan

Accrual balances at June 27, 2008

$

—

$

—

$

—

$

—

Restructuring charges

100

—

1

101

Cash payments

(92

)

—

(

1

)

(93

)

Adjustments

(1

)

—

—

(

1

)

Accrual balances at July 3, 2009

$

7

$

—

$

—

$

7