Seagate 2008 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2008 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Net cash used in financing activities of approximately $1.5 billion for fiscal year 2008 was primarily attributable to the repurchases of our

common shares totaling $1.5 billion. Additionally, we paid approximately $216 million in dividends to our shareholders, repaid $34 million of

our long-term debt and received approximately $178 million in cash from employee stock option exercises and employee stock purchases.

Net cash used in financing activities of $463 million for fiscal year 2007 was primarily attributable to approximately $1.5 billion used for

the repurchases of our common shares, $416 million used in the redemption of our 8% Notes and $212 million of dividends paid to our

shareholders, largely offset by approximately $1.5 billion received from the issuance of long-term debt and $219 million cash provided by

employee stock option exercises and employee stock purchases.

Liquidity Sources, Cash Requirements and Commitments

Our primary sources of liquidity as of July 3, 2009, consisted of: (1) approximately $1.5 billion in cash, cash equivalents, and short-term

investments, (2) cash we expect to generate from operations and (3) a $350 million credit facility, which is committed until 2011, but is currently

fully drawn. We also have restricted cash and investments that include $380 million held in escrow available for the retirement of debt and

$85 million available for the payment of employee deferred compensation liabilities.

Our liquidity requirements are primarily to meet our working capital, research and development, and capital expenditure needs, and to

service our debt. Our ability to fund these requirements and comply with the financial covenants under our debt agreements will depend on our

future operations, performance and cash flow and is subject to prevailing global macroeconomic conditions and financial, business and other

factors, some of which are beyond our control. We believe that our sources of cash will be sufficient to fund our operations and meet our cash

requirements for at least the next 12 months.

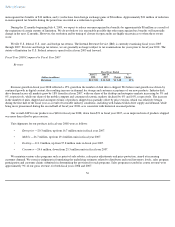

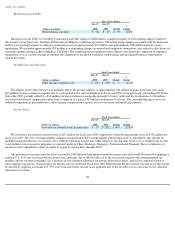

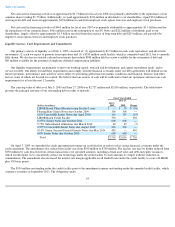

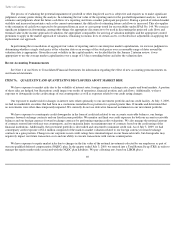

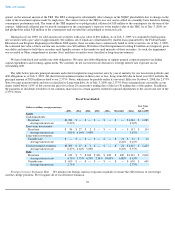

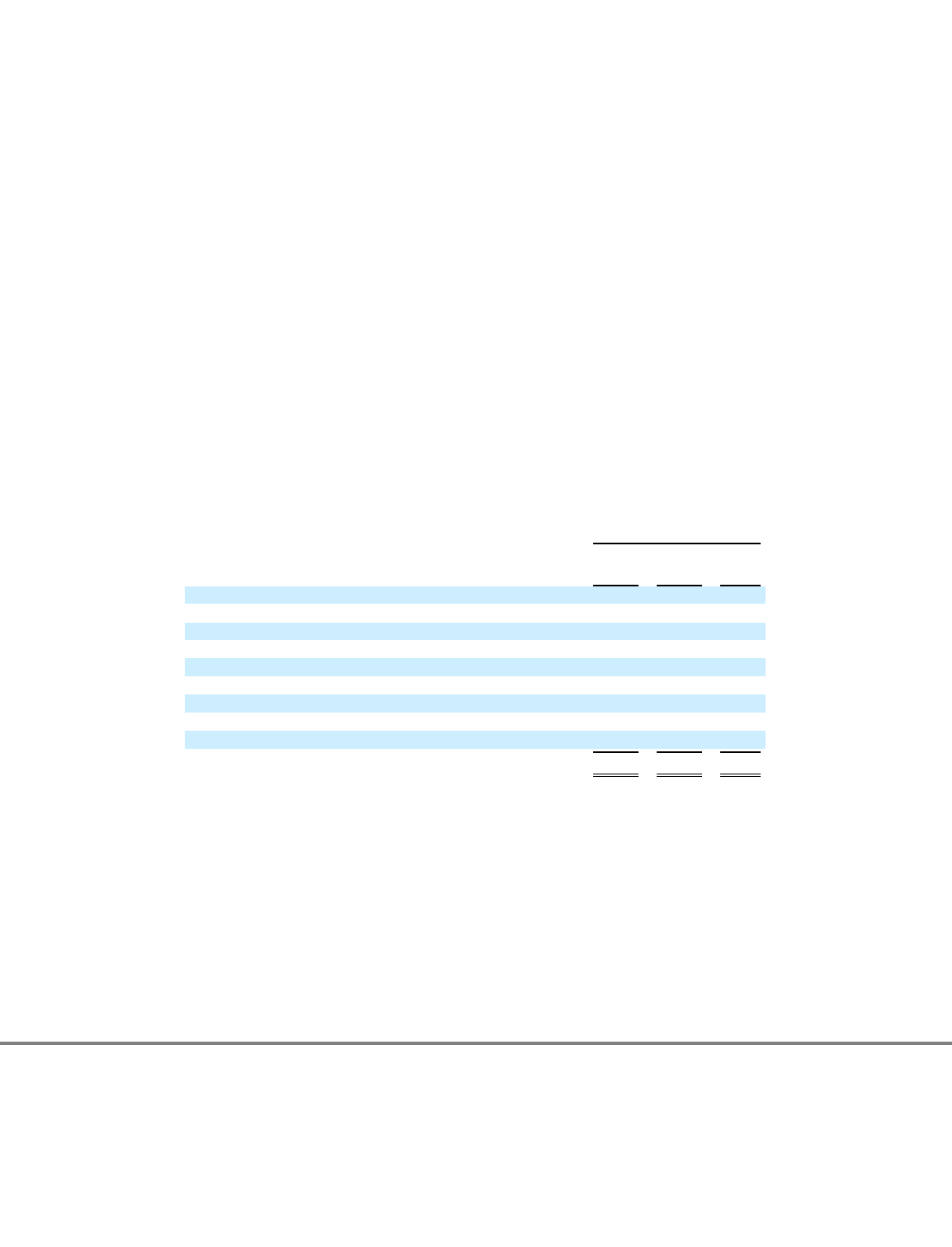

The carrying value of debt as of July 3, 2009 and June 27, 2008 was $2,727 million and $2,030 million, respectively. The table below

presents the principal amounts of our outstanding debt in order of maturity:

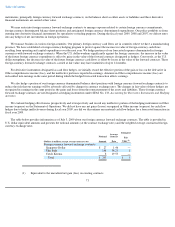

On April 3, 2009, we amended the credit agreement governing our credit facility in order to relax certain financial covenants under the

credit agreement. The amendment also reduced the facility size from $500 million to $350 million. The facility size may be further reduced from

$350 million by cash proceeds from certain transactions over specified amounts, including certain asset sales and debt and equity issuances,

which would require us to concurrently reduce our borrowings under the credit facility by such amounts to comply with the reduction in

commitments. The amendment also increased the interest rate margin applicable on all funded loans under the credit facility to a rate of LIBOR

plus 350 basis points.

The $350 million outstanding under the credit facility prior to the amendment remains outstanding under the amended credit facility, which

continues to mature in September 2011. The obligations under

63

Fiscal Years Ended

(Dollars in millions)

July 3,

2009

June 27,

2008

Change

LIBOR Based China Manufacturing Facility Loans

$

—

$

30

$

(30

)

Floating Rate Senior Notes due October 2009

300

300

—

6.8% Convertible Senior Notes due April 2010

116

135

(19

)

LIBOR Based Credit Facility

350

—

350

6.375% Senior Notes due October 2011

600

600

—

5.75% Subordinated debentures due March 2012

40

45

(5

)

2.375% Convertible Senior Notes due August 2012

326

326

—

10.0% Senior Secured Second

-

Priority Notes due May 2014

430

—

430

6.8% Senior Notes due October 2016

600

600

—

Total

$

2,762

$

2,036

$

726